3 ways to strengthen your portfolio in 2024

Tom Larm, CFA®, CFP®

Portfolio Strategist

In 2023, interest rates drove the markets. Central banks tightened monetary policy to bring down inflation amid surprisingly resilient economic growth. These dynamics helped send yields to levels not seen in more than 15 years.

As interest rates rose from their 2020 lows, they pressured portfolios. However, now that interest rates are higher, we believe the future looks brighter.

Moderating inflation and an end to central bank rate hikes, with a possible pivot lower, are likely to provide long-awaited relief for markets — and portfolios — this year.

With our outlook for 2024 in mind, discussing these three considerations with your financial advisor may help strengthen your portfolio and start the year off on the right foot — with your goals in focus.

1. The starting point of your portfolio’s design

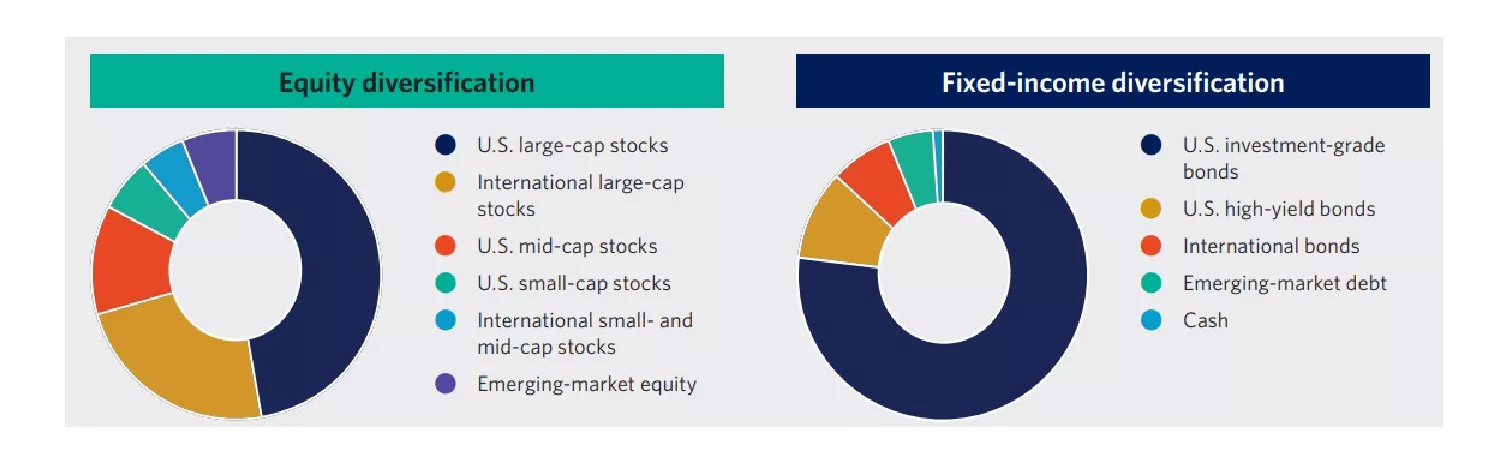

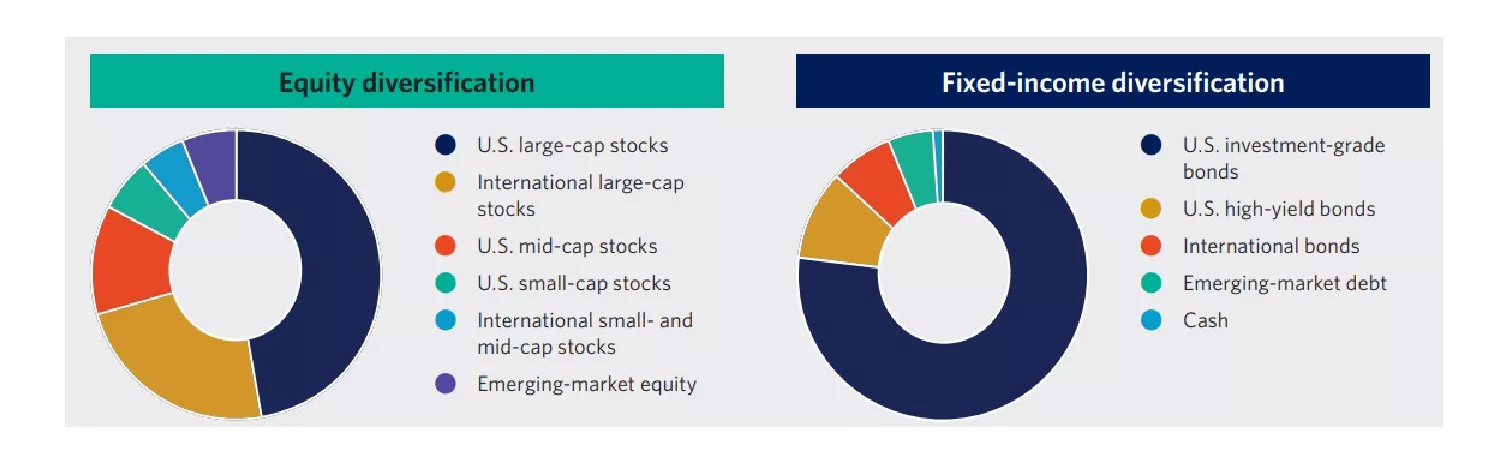

The key to building a quality portfolio is an investment strategy that balances your comfort with risk, time horizon and financial goals. It should also incorporate the value of diversification.

Talking through this with your financial advisor can help you determine:

- Strategic stock and bond allocations most appropriate for you

- Realistic expectations for returns, including how much your portfolio may fluctuate

In today’s environment, we recommend closely aligning your portfolio with your investment strategy, which we consider a neutral starting point. We expect markets to remain sensitive to economic trends as growth softens in the coming months. Aligning with long-term target allocations can help you navigate market volatility while staying positioned to take advantage of additional timely market opportunities as they appear.

Our strategic asset allocation guidance, seen here, can help you design a portfolio to deliver on your risk and return objectives. It represents our view of balanced diversification across a variety of asset classes, based on our long-term global outlook.

Strategic asset allocation guidance

2. The value of lagging investments

In a diversified portfolio, some allocations will lag in performance, possibly over an extended period. For example, excitement about artificial intelligence (AI) drove mega-cap tech stocks significantly higher in 2023. At the same time, small-cap stocks faced challenges from tighter financial conditions and the potential for economic softness, driving their underperformance.

While it may seem counterintuitive to buy investments that have underperformed, selecting the right ones could add value to your portfolio. Lagging markets could cause underweight allocations in your portfolio, potentially creating unintentional risks. Additionally, you may be able to add quality investments at more attractive prices in segments of the market that are down in value.

It’s important to remember that each investment plays a specific role in your portfolio, such as managing risk through diversification. Throughout 2024, new leaders may emerge, and we expect to head toward a more broad-based, sustained move higher.

Talk with your financial advisor about the “why” behind your allocations. Together, you can decide whether you should rebalance by leaning into the laggards.

3. The benefits of diversified bond allocations

Interest rates moved sharply higher in 2023, continuing a three-year upward trend in yields. For instance, the 10-year Treasury yield was below 1% in 2020 but rose to over 5% in 2023.

With rates rising significantly over a relatively short period, the decline in bond prices has been painful and unprecedented. Not all segments of the bond market have been impacted the same, though. This highlights the value of diversifying your fixed-income investments.

The best single predictor of future returns for high-quality bonds is their starting yield. Because of this, the future looks brighter than what we’ve experienced over the past three years. Additionally, we believe the potential upside for interest rates is limited, given the road we’ve already traveled and our outlook for 2024.

If economic growth and inflation cool in the coming months, as we expect, yields are likely to drift lower. The potential for higher bond prices could provide an additional lift for bond portfolios and help offset potential equity market volatility.

We recommend reducing overweight allocations to cash and short-term bond investments, which can help lower reinvestment risk. Ensure your portfolio has appropriate allocations to quality long-term bonds if they’re part of your investment strategy. This could help you lock in the benefits of today’s higher yields.

Stay disciplined in 2024 and beyond

Over the long term, a quality investment strategy focused on your goals can help you stay disciplined as market conditions evolve. This also highlights the importance of talking through your goals with your financial advisor. We believe reviewing your investments in the context of your goals and our outlook can help kick-start your portfolio in the new year, helping you make progress toward what matters most.

Important Information:

Investing in equities involves risks. The value of your shares will fluctuate, and you may lose principal.

Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Diversification does not ensure a profit or protect against loss in a declining market.