Average hourly earnings (as a year-over-year percentage) have outpaced Consumer Price Index (CPI) inflation (also as a year-over-year percentage) since mid-2023.

Average hourly earnings (as a year-over-year percentage) have outpaced Consumer Price Index (CPI) inflation (also as a year-over-year percentage) since mid-2023.

Looking ahead to 2025, we believe the U.S. economy will continue to see positive economic momentum. Consumption in the U.S. held up well in 2024, despite inflation rates above the Fed’s target and elevated borrowing costs.

We expect conditions for U.S. households to improve somewhat in the year ahead as the Fed continues to cut rates (albeit perhaps just two or three times in 2025) and inflation continues to moderate and remain contained. Wage growth should also remain above inflation rates, which means consumers can continue to benefit from positive real wages.

While economic growth could cool a bit in the first half of the year, perhaps to 1.5%–2%, we do not expect a downturn or recession. The U.S. manufacturing sector, which remained in contraction for much of 2024, may stabilize and expand in the year ahead. However, the services sector, which makes up about 77% of the U.S. economy, may moderate as consumers — particularly those in lower income brackets — pull back spending in leisure, hospitality and food services.

However, we see the potential for U.S. GDP growth to reaccelerate toward the back half of 2025, perhaps driven by two key reasons:

The lower federal funds rate, even if marginally below current levels, should flow through to the real economy by the end of 2025, supporting household and corporate consumption.

Proposed pro-growth policies, including deregulation and tax cuts, should start to take shape by year-end and could drive consumption as well as positive sentiment in financial markets.

These may be offset by uncertainty around tariffs and trade wars, but we see this risk contained more to specific industries and global peers. It should not outweigh the broader pro-growth impulses we may see by year-end 2025.

The U.S. quits rate, Labor Market Conditions Index and number of job openings all fell in 2024

The U.S. quits rate, Labor Market Conditions Index and number of job openings all fell in 2024

Perhaps a key source of strength for the U.S. economy has been its resilient labor market. Generally, when consumers are secure in their employment, they feel more confident in spending — and consumer spending makes up about 70% of U.S. GDP.

In 2024, the labor market moderated but remained healthy versus historical levels. For example, the U.S. unemployment rate has risen from a post-pandemic low of 3.4% to around 4.1%. Nonetheless, even at 4.1%, the unemployment rate remains well below long-term averages of closer to 5.7% in the U.S.

In our view, the U.S. labor market appears to be normalizing after a period of outsized strength following the pandemic. The labor supply has steadily moved higher, with more new entrants to the labor market and better labor force participation rates.

Meanwhile, the demand for labor seems to be cooling, as job openings across industries have moved lower. This better supply and demand of labor has helped cool a potentially overheated labor market in recent years.

We believe leading indicators of the labor market all point to further modest cooling ahead. These include job openings and quits rates (the percentage of workers who voluntarily quit their jobs), as well as broader metrics such as the Fed’s Labor Market Conditions Index.

In our view, the monthly nonfarm jobs figure could moderate toward long-term average levels, while the U.S. unemployment rate may rise modestly. Even so, it should remain generally contained below 4.5%.

As with economic growth, we may see a reacceleration of the labor market toward the end of 2025. In our view, lower borrowing costs, growing use cases in artificial intelligence (AI), and potential pro-growth policies could spark incremental hiring activity.

Perhaps the wild card in the labor market outlook is a proposed new immigration policy. If we see an outsized reduction in the U.S. labor force, this could create a supply shock. This in turn may force employers to push wages higher, especially in low-cost labor industries such as restaurants, manufacturing and hospitality.

This could raise inflation further, particularly in the services sector. If more extreme policy proposals are avoided, however, the U.S. labor market should be able to absorb a modestly lower labor supply with minimal disruptions.

This chart shows the path of core goods, core services and core CPI since 2020

This chart shows the path of core goods, core services and core CPI since 2020

Overall, we expect the trend for inflation rates to remain downward, potentially approaching 2% in 2025. However, the path may be bumpy, and inflation could settle in the 2%–3% range rather than hitting the Fed’s target and staying there.

Core inflation, which excludes food and energy, has been cut in half since it peaked at 6.6% in 2022. While further progress was made in 2024, the pace of disinflation has slowed, and the push to remain consistently at the Fed’s 2% target may be harder to achieve.

Goods prices have been a key deflationary force, posting monthly declines throughout 2024. In contrast, services inflation remains stubborn, moderating at a slow pace. A further moderation in housing costs, as suggested by market-rent measures, and cooling wage growth should help apply downward pressure to inflation. Additionally, a sustained rise in productivity could support solid economic growth without stoking inflation.

However, the potential for loose fiscal policy, higher tariffs and immigration restrictions poses upside risks for inflation. Goods inflation may see a modest one-off increase in prices if universal tariffs are implemented, but this is unlikely to be an ongoing source of inflation that would force the Fed to resume rate hikes. Ultimately, services inflation, which accounts for 74% of the core CPI weight (versus 26% for goods), will be the key driver of inflation trends in 2025.

Perhaps the good news for investors is that we expect inflation rates to remain contained and do not see a return to the above-4% figures we saw during the post-pandemic period.

This chart shows the path of the federal funds rate since 2022, along with Fed projections and the market-implied path for the rate for 2025.

This chart shows the path of the federal funds rate since 2022, along with Fed projections and the market-implied path for the rate for 2025.

We see the Fed continuing its rate-cutting cycle in 2025 to gradually remove its restriction on the economy. With the fed funds rate now around 4.5% and core personal consumption expenditure (PCE) inflation around 2.8%, we believe there is room to bring rates down to a less restrictive policy stance, perhaps settling in the 3.5% to 4% range.

This recalibration by the Fed is backed by improvement in inflation rather than an economic downturn, which is expected to continue supporting the expansion, likely keeping the economy on track for a soft landing. In general, a neutral fed funds rate tends to be about 1% above inflation rates, which we see settling in the 2% to 3% range. This implies perhaps a relatively shallow set of rate cuts ahead.

The Fed began cutting interest rates in 2024 as its employment and price mandates returned to better balance, with the labor market normalizing and inflation gradually moderating. However, the Fed’s preferred core PCE inflation gauge remains above the 2% target, and the pace of disinflation has slowed.

Additionally, pro-growth policies could drive some resurgence in economic growth, potentially spurring more hiring, while immigration reform could reduce the number of available workers. Any tightening in labor markets or rise in inflation would reduce the need for rate cuts, while a deterioration in the growth outlook could cause the Fed to cut rates more than currently expected.

This chart shows the average three-year path of the past 10 bull markets since 1949 versus the path of the current bull market.

This chart shows the average three-year path of the past 10 bull markets since 1949 versus the path of the current bull market.

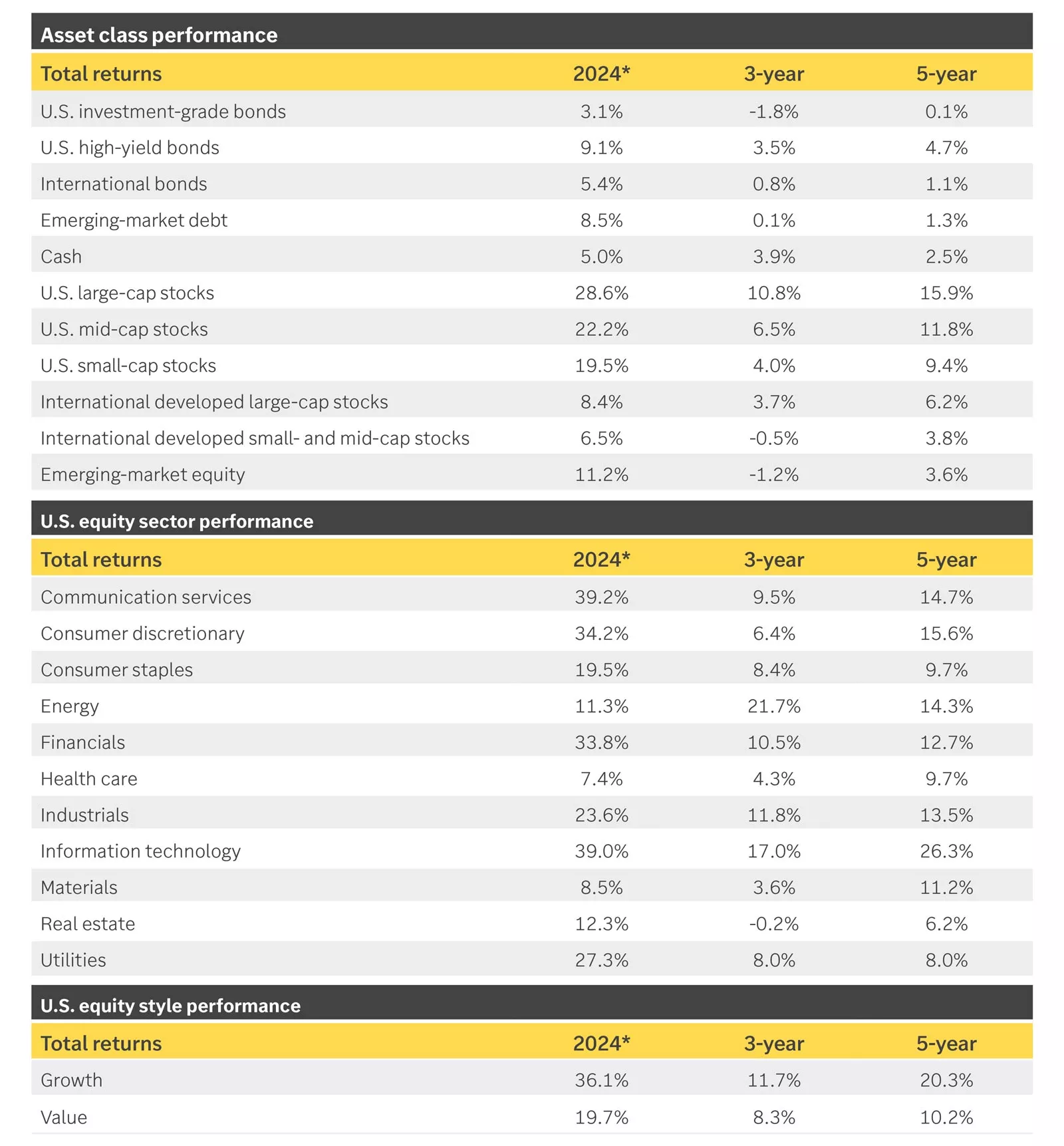

In 2024, U.S. large-cap stocks delivered their second consecutive year of more than 20% gains for the first time since 1998. This strength has been underpinned by a resilient consumer, rising corporate profits and Fed easing, conditions that we expect will likely persist in 2025. Returns are likely to moderate and volatility to pick up, but we think the rise in stocks will continue into its third year.

Historically, a recession, Fed interest rate hikes or an external shock ends bull markets. While the latter is tough to handicap, we don’t see an economic downturn or the resumption of Fed tightening on the horizon.

The consumer remains supported by a healthy labor market, lending standards are easing, and the manufacturing sector may stage a recovery in 2025. This is all with the backdrop of the Fed looking to gradually remove its restriction on the economy and shift to a neutral stance.

Despite solid fundamentals, year 3 of this bull market may not be as smooth of a ride. Policy uncertainty around trade, immigration and tariffs is high, as are expectations for pro-growth initiatives. Worries about inflation or growth may trigger pullbacks, which we would view opportunistically as the longer-term trend remains intact.

Overall, earnings growth will have to do the heavy lifting for market returns instead of further valuation expansion, implying slower gains but still positive returns. We expect S&P 500 profits to grow 10%–15%, with the low end of the range as our base case expectation and the high end as a possibility if policies such as corporate tax cuts are delivered.

This chart shows that earnings growth in growth-style stocks (as represented by the Russell 1000 Growth Index) has outpaced earnings growth in value value-style stocks (as represented by the Russell 1000 Value Index) since the beginning of 2023, but the difference between them is expected to narrow in 2025.

This chart shows that earnings growth in growth-style stocks (as represented by the Russell 1000 Growth Index) has outpaced earnings growth in value value-style stocks (as represented by the Russell 1000 Value Index) since the beginning of 2023, but the difference between them is expected to narrow in 2025.

We see market leadership continue to broaden beyond U.S. mega-cap technology stocks in 2025, as investors look to investments with more domestic exposure and potential for earnings growth and valuation expansion. We expect balanced performance between value- and growth-style stocks, strengthening the case for portfolio diversification.

U.S. mega-cap tech stocks have seen strong performance over the past two years, driven by enthusiasm around the growth potential of AI. But optimism alone isn’t the sole performance driver — these companies have experienced robust profit growth, compared with relatively lackluster earnings growth in other areas of the market.

Looking ahead to 2025, we believe opportunities are emerging in cyclical and value-style investments that could lead to broader leadership in the year ahead for a few key reasons:

Profit growth is expected to be strong not only in mega-cap tech, but in cyclical and value-style stocks as well.

Value-style stocks typically generate nearly 70% of their revenue domestically versus around 50% for growth-style stocks. A higher share of revenue from domestic sources could make value stocks less sensitive to trade policy uncertainty.

Cyclical sectors such as financials and industrials — which together make up nearly 40% of the value index — could stand to benefit from deregulation and pro-growth policies from the incoming administration.

In our view, this creates a favorable backdrop for broad participation in equity markets over the coming year, potentially rewarding those with well-balanced portfolios.

Diversification does not ensure a profit or protect against loss in a declining market.

This chart shows the path of cash and U.S. investment-grade bonds yields since 2020, with bonds regaining the advantage in late 2024.

This chart shows the path of cash and U.S. investment-grade bonds yields since 2020, with bonds regaining the advantage in late 2024.

In 2024, cash outperformed U.S. investment-grade bonds for the third time in the past four years, benefiting from a yield advantage. We see this trend reversing in 2025 as Fed rate cuts have driven cash yields below bond yields. Since yield is a key driver of fixed-income returns, this sets the stage for bonds to outperform cash in the year ahead as they have in 31 years since 1981.

Further Fed rate cuts could cause cash yields to fall more than intermediate- and long-term bond yields, likely steepening the yield curve.

Over the past few years, many investors have gravitated toward cash and cash-like instruments over the past year, such as money market funds and CDs, as these investments offered favorable yields. However, while cash can provide important benefits, holding too much in cash or cash-like investments can present risks, such as the potential for lower returns over the long term. For perspective, since 1981, cash has generated annualized returns of 4.1%, compared with 6.8% for U.S. investment-grade bonds.

Within investment-grade bonds, we see particular value in intermediate-term bonds and bond funds, which can lock in higher yields for longer. Bond prices typically rise in value when interest rates fall, and vice versa, providing the opportunity for higher values as the Fed continues cutting rates. Intermediate-term bonds should also be less susceptible than long-term bonds to concerns around widening deficits and rising government debt.

On the credit side, credit spreads — which reflect the excess yield above Treasury bonds to compensate for default risk — have tightened well below their historical averages. We see little opportunity for credit spreads to narrow further, and any potential widening could drive yields higher and bond prices lower.

Resilient growth could provide a stable backdrop for credit conditions, allowing investment-grade credit spreads to remain relatively contained. High-yield bond spreads, however, may be more volatile as they are closer to historical lows and tend to be more sensitive to any weakening in credit conditions.

This chart shows the path of the 10-year Treasury yield since 2004.

This chart shows the path of the 10-year Treasury yield since 2004.

With the fed funds rate likely heading toward 3.5% to 4%, a positive yield curve should keep intermediate-term Treasury yields above this range. The Fed’s balance sheet reduction program, known as quantitative tightening, is expected to end soon, allowing the Fed to participate more actively in Treasury auctions to replace maturing bonds. This additional demand should support bond prices, in turn helping to keep yields relatively contained to the upside.

While 10-year yields could temporarily move outside the 4% to 4.5% range, we believe there are guardrails on both sides. Additional Fed rate cuts and bond purchases should help keep yields from rising meaningfully. On the other hand, resilient growth, widening deficits and uncertainty around inflation could prevent yields from sustainably falling much further, in our view.

Despite pulling back from their recent peak, 10-year yields remain attractive, near the high end of their range over the past two decades. Since Treasury bonds serve as the benchmark for most U.S. investment-grade bonds, higher yields should provide the foundation for solid returns ahead, with most of the contribution coming from income rather than price appreciation.

Finally, there is a case to be made for favoring the intermediate part of the Treasury yield curve versus the long end. The proposed extension of the 2017 Tax Cuts and Jobs Act could widen government deficits if lost revenue is not offset by spending cuts or economic growth. Because deficits lead to higher debt over time, long-term bonds are typically considered to be riskier, as government debt levels will be higher when these bonds mature. Concerns over rising deficits and debt could lead to higher yields for long-term bonds relative to intermediate bonds to compensate for this risk.

This chart shows the average 12-month performance of U.S. versus international and emerging-market stocks during months of a stronger and weaker U.S. dollar.

This chart shows the average 12-month performance of U.S. versus international and emerging-market stocks during months of a stronger and weaker U.S. dollar.

We expect 2025 to be another positive year for international economies and markets. However, momentum may continue to lag the U.S., based on stronger domestic trends in consumer spending, productivity and corporate profits.

While the timing and scope of potential tariffs from the new U.S. administration remain unknown, trade policy uncertainty creates another headwind that is likely to weigh on sentiment and valuations for international equities.

President Trump's campaign focused on imposing 10%–20% universal tariffs and 60% tariffs on imports from China. Exports of countries with a large trade deficit with the U.S., such as China, Vietnam, Mexico, Germany and Japan, might be impacted, as tariffs will make their products pricier. While currency depreciation might partially offset these costs, trade disruption could also lead foreign firms to slow investment and hiring, weighing on economic growth.

We expect the new administration to take a targeted approach to tariffs at least initially, to gain concessions from other countries. China is most at risk for full implementation of tariffs, although policymakers there may stimulate the economy in response.

The threat of slowing exports may prompt other central banks to cut interest rates more aggressively than the Fed. The possible economic growth and central bank divergence may impact interest rate differentials, supporting a stronger U.S. dollar. Historically, international equities tend to underperform during periods of a strengthening dollar.

We continue to believe international stocks play an important role in diversifying portfolios, especially when considering the heavily discounted valuations and attractive dividend yields. However, the range of outcomes is wide. Trade and currency headwinds keep us cautious in the short term, expecting relative momentum to continue to favor U.S. equity asset classes in 2025.

This chart shows the path of the U.S. Import Price Index from China between 2017 and 2020.

This chart shows the path of the U.S. Import Price Index from China between 2017 and 2020.

Just as any successful baseball pitcher keeps hitters off balance by mixing in the occasional curveball, we expect markets will also keep investors on their toes in 2025, particularly as we transition to a new U.S. presidential administration with new policy proposals in play.

We expect trade policy and the potential implementation of tariffs will likely dominate headlines and drive bouts of volatility in markets. In theory, tariffs create a one-time price increase on goods imported from other countries and could impact inflation, albeit temporarily.

In practice, however, there are a number of potentially offsetting factors, such as currency depreciation or foreign exporters reducing prices, to mitigate the impact of tariffs. Both were on display in 2018 when the Trump administration levied tariffs on goods imported from China, helping offset the inflationary impact of the tariffs.

With many of the incoming administration’s proposed policies viewed as adding to the U.S. budget deficit, concerns over the sustainability of the U.S. fiscal situation could surface throughout 2025, perhaps in the form of bond market volatility. While we believe the U.S.’ current fiscal path is a risk and potential headwind longer term, it does not pose a significant threat to our near-term outlook for an ongoing economic expansion.

We also expect geopolitical tensions to continue to be a source of market volatility. In recent history, this volatility has been short-lived, manifesting mainly in temporary spikes in oil and commodity prices, as well as some flight to safe-haven assets such as U.S. Treasuries and gold. Barring any major escalation, we would expect these trends to continue in 2025, and we continue to monitor potential geopolitical unrest.

As we’ve outlined, we remain optimistic about the path of the economy and markets over the coming year, despite likely bumps along the way. Just as staying on balance is key for any hitter in baseball to square up a curveball, we believe maintaining a well-balanced portfolio will be key to successful investing in 2025.