Weekly market wrap

Post-Inauguration update: Four key areas of focus and market/economic implications

Key Takeaways:

- On his first day in office, President Trump signed a record 26 executive orders, more than any other administration in history. From a macroeconomic perspective, these new orders focused on four key areas – energy, immigration reform, tariffs and technology.

- While the new policy proposals were in many cases more measured than anticipated – which was welcome by stock markets – we would expect bouts of market volatility ahead as new policy updates are released.

- The next set of policy proposals will likely focus on both tariff implementation as well as the administration's pro-growth agenda, including deregulation and tax cuts.

- Overall, as we get through the first 100 days of the new administration and beyond, investors should remember to "not play politics with their portfolios." We continue to see a solid fundamental backdrop in place as we kick off 2025, supported by a healthy consumer and positive economic and earnings growth. This should continue even as new policies are rolled out, and may even improve, as some of the uncertainty is behind us.

President Trump's first week in office was marked by a slew of new executive orders and action. Below we highlight four key focus areas of these policy moves – energy, immigration, technology and tariffs – as well as the key implications.

1) Energy reform: Will the oil companies be onboard?

The first area that the new administration seemed to focus on was energy reform. Specifically, President Trump followed through on his campaign promise to “drill, baby, drill” with several executive actions that support oil and gas production in the U.S.

These included declaring a national energy emergency to reduce restrictions on fossil-fuel production and refining, as well as expedite new energy infrastructure projects. The administration also dialed back climate-change initiatives and withdrew the U.S. from the Paris Climate Agreement, which aims to cut greenhouse gas emissions. The energy orders also focused on targeting Alaska for natural gas production.

Our take: While the new administration may be eager for oil companies to increase fossil-fuel production, the oil and gas companies (and OPEC nations) may not be as keen to do so. Increasing the supply of oil and gas would ultimately lower energy prices, and in fact put downward pressure on revenue growth and earnings for major energy producers. Lower energy and gas prices would, however, be a positive for containing inflation.

Even if U.S. companies were to drill and produce more oil, the logistics of refining may be a headwind as well. Refineries will not only need to access the drilled oil, but they may need to retool their facilities to be able to process U.S. oil.

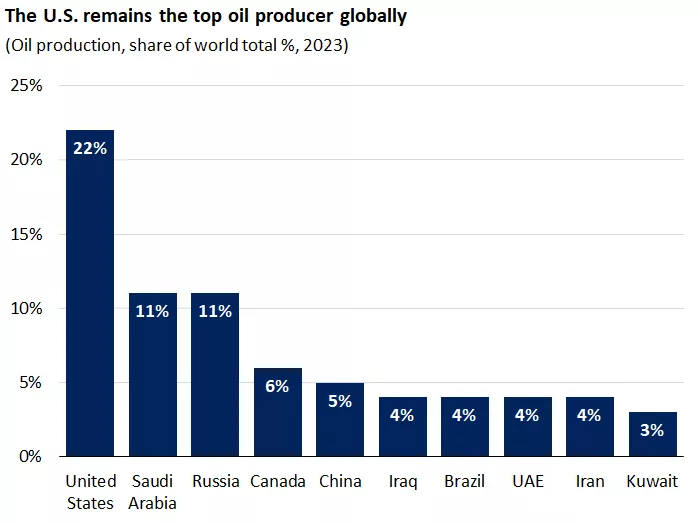

Keep in mind that the U.S. is already a top oil producer globally, but trying to expand this lead further could bring challenges from both oil companies and refiners globally. Nonetheless, oil and energy prices have responded thus far, with WTI oil down about 5% since Inauguration Day.

This chart shows that the U.S. was the top producer of oil worldwide in 2023.

This chart shows that the U.S. was the top producer of oil worldwide in 2023.

2) Immigration reform: A phased approach

The second key focus area from the Week 1 executive orders are around immigration reform. These set of actions around immigration focused largely on securing the southern border and preventing illegal immigration. They included declaring a national emergency at the border, naming illegal foreign drug cartels as terrorists, and ending public benefits for unauthorized immigrants. While the campaign proposals around mass deportations have not yet materialized, there has been an increase of troops to support border security.

Our take: For now, the administration seems focused on containing illegal immigration, particularly targeting those engaged in criminal activity. Investors will be watching to see if the next phase includes broader deportation activity, which could be more disruptive to labor supply and markets.

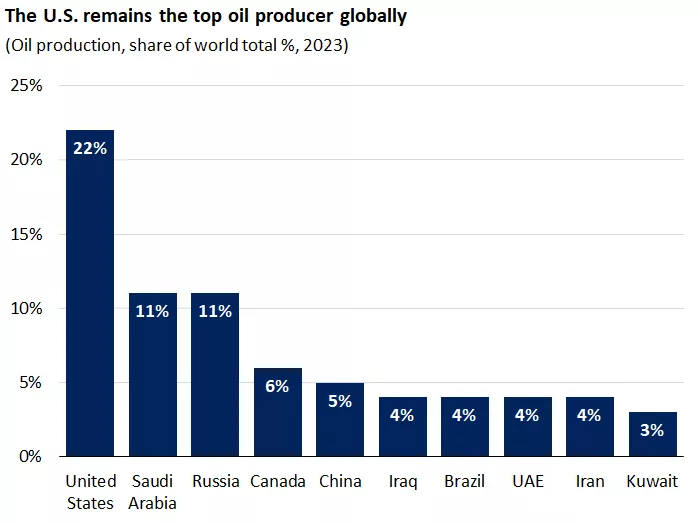

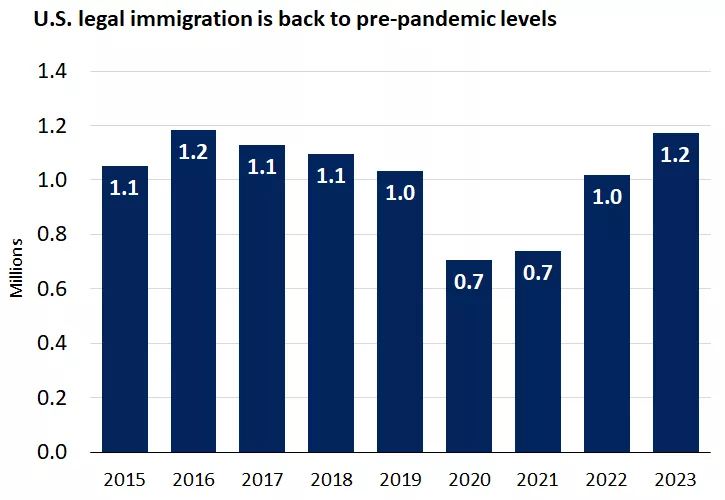

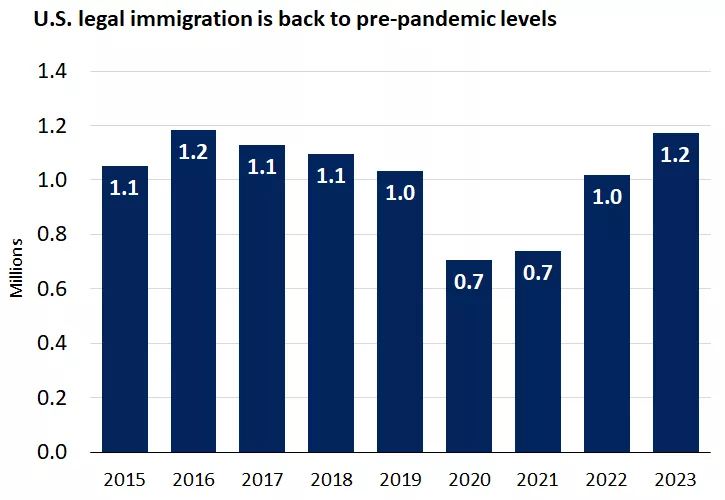

From an economic perspective, the key risk remains that legal immigration declines over time, and this could weigh on the U.S. labor supply. A smaller labor force could mean not only softer growth in the U.S., but it may also cause employers to pay higher wages to attract workers, which could lead to price increases and renewed inflationary pressure. Perhaps the good news is that President Trump has acknowledged the need for legal immigration into the U.S., especially in areas like technology that need skilled workers to fill shortages.

This chart shows the number of new lawful permanent residents by year in the United States.

This chart shows the number of new lawful permanent residents by year in the United States.

3) Tariffs: No action yet

While tariffs were a big concern for markets heading into Inauguration Day, thus far the new administration has only hinted at tariff policy – but has not acted yet. President Trump has alluded to some specifics, including a 25% tariff on Mexico and Canada on February 1, citing unauthorized immigrants and drug trafficking as key reasons behind the tariffs. He has also spoken about a potential for 10% tariffs against China and levying tariffs on the European Union, but no action has been taken here either.

In fact, the Trump administration has asked federal agencies to evaluate U.S. trade policy and provide recommendations by April 1. This includes a review of potentially unfair trade practices and causes of the U.S. trade deficit, as well as an order for recommendations and potential remedies.

Our take: While we certainly expect tariffs are coming (and could spark bouts of volatility), the administration for now appears to be taking more of a deliberate and research-based approach. In our view, there is increasing likelihood that tariffs may be targeted to specific sectors and even companies and used more for negotiating leverage rather than to incite global trade battles. An example of this is President Trump potentially increasing tariffs against China if it is not willing to make a deal around the social media giant Tik Tok.

Keep in mind that fighting inflation was a central theme of the Trump campaign. The administration is likely more sensitive to enacting tariffs that could increase consumer prices and be inflationary or even perceived to be inflationary. The focus on containing prices in this second Trump term may thus also support keeping more extreme trade and tariff impulses contained.

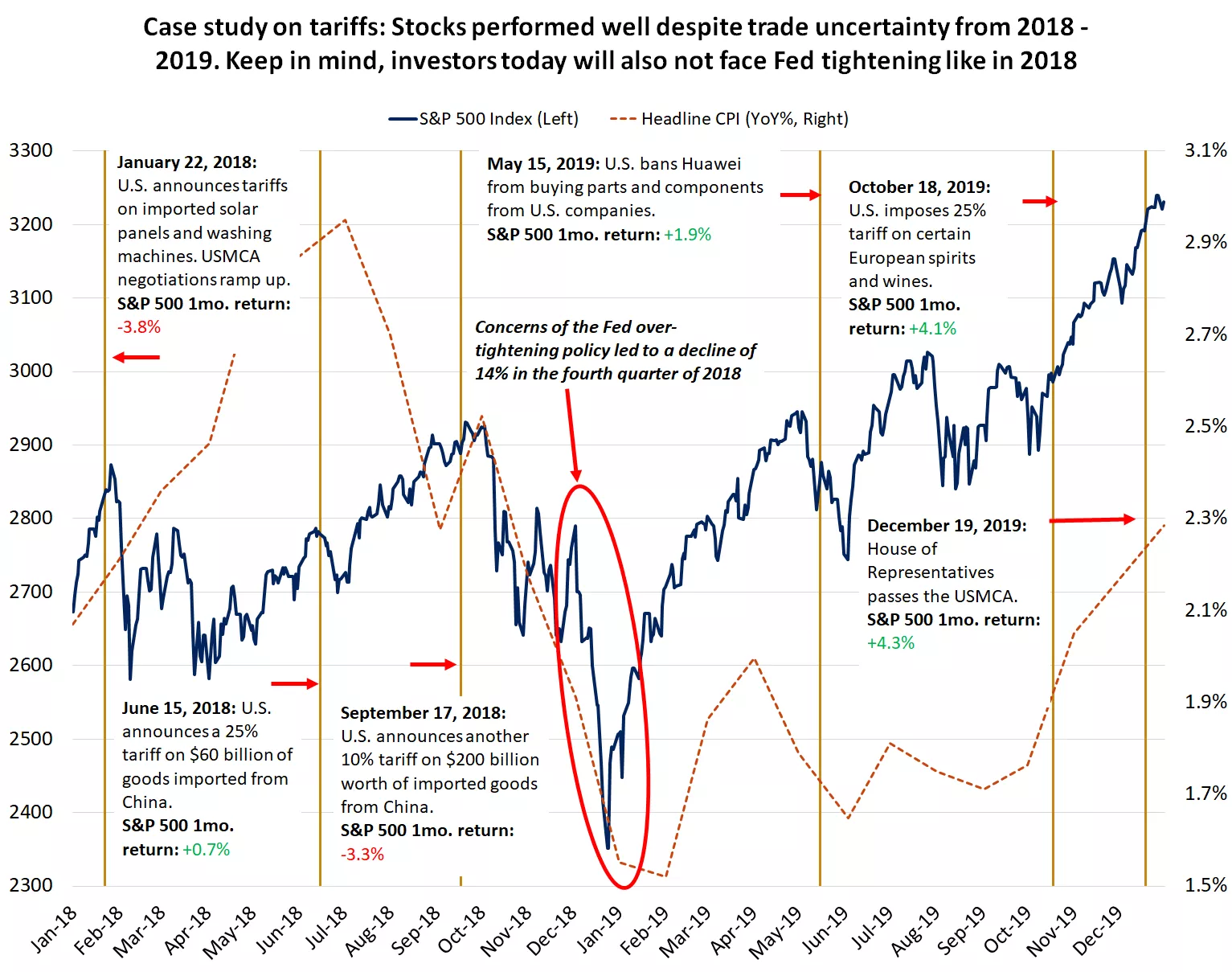

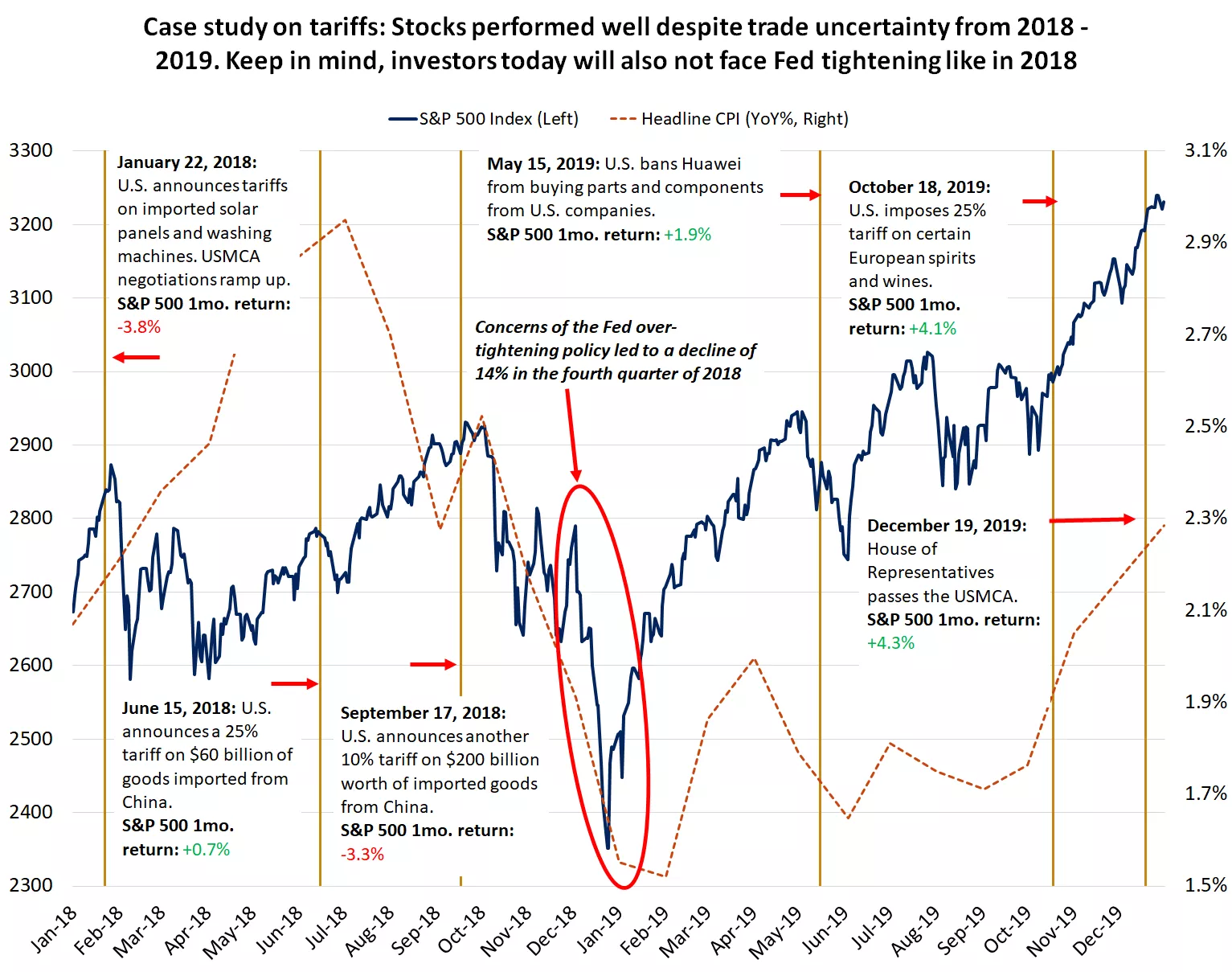

This chart shows how the S&P 500 Index performed from 2018 – 2019 when various tariffs were implemented on imported goods by the U.S. It also shows the year-over-year change in U.S. headline CPI during this time. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows how the S&P 500 Index performed from 2018 – 2019 when various tariffs were implemented on imported goods by the U.S. It also shows the year-over-year change in U.S. headline CPI during this time. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

4) Technology investment: Forward-looking bets on AI

Investing in technology and specifically artificial intelligence (AI) also seemed to be front and center in the early days of the Trump administration. This showed up not only in the number of technology CEOs attending the inauguration, but also in executive orders and an announcement of a new AI technology initiative.

President Trump signed an executive order to "make America the world capital in artificial intelligence." The order calls for agencies to craft policy to ensure U.S. dominance in AI. In addition, the new administration has proposed backing a private-sector investment of up to $500 billion to fund infrastructure for AI. The new venture, called Stargate, aims to build data centers – a huge need to support AI computing power – and potentially create up to 100,000 jobs.

Our take: In our view, the focus on technology investment is a step in the right direction for the new administration. The U.S. has already been a leader in AI, with many of the "Magnificent 7" AI infrastructure companies based in the United States. The investments in data centers and electricity are critical for the U.S. to maintain leadership and be a driver for AI technology and applications. The government investment in technology infrastructure, we believe, will pay dividends in the form of enhanced innovation and productivity in the future.

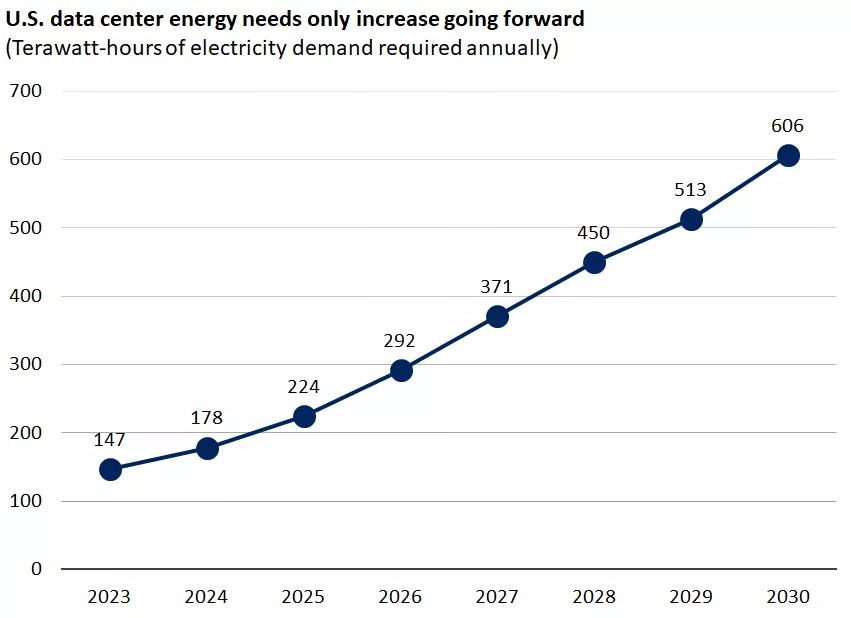

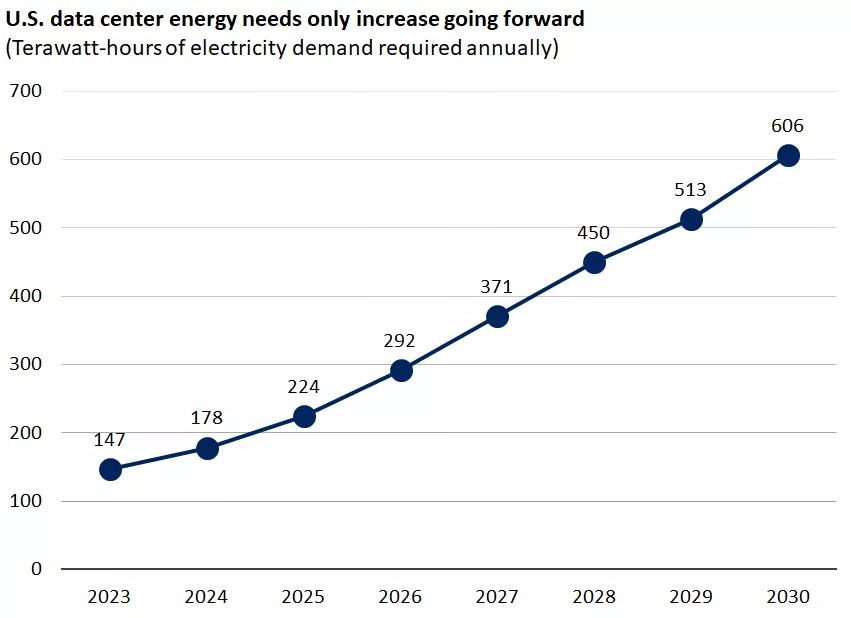

This chart shows the energy requirements measured in terawatt hours for U.S. data centers is expected to rise over the coming years.

This chart shows the energy requirements measured in terawatt hours for U.S. data centers is expected to rise over the coming years.

What could be next on the agenda? Lower taxes and deregulation

Although the focus up front has been on executive orders around energy and immigration, as well as laying out a tariff and technology agenda, we believe the new administration will start working towards pro-growth policies in the weeks ahead as well. The two areas of focus here will likely be deregulation, especially in the financial services sector, and lower taxes.

The process to come up with policy around deregulation and lower taxes will go beyond executive orders and require cooperation from Congress. To address lower taxes and the expiring Tax Cuts and Jobs Act (TCJA), for example, Republicans must come up with a proposal as well as ways to ensure deficit neutrality for a certain period, and then pass it through both the House and Senate. Similarly, to implement deregulation, the new administration must work closely with regulatory bodies and their leadership to make changes to or eliminate restrictions altogether.

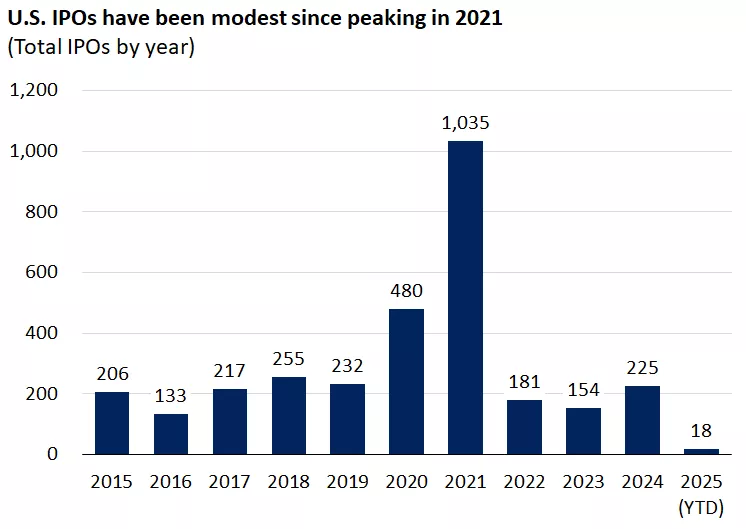

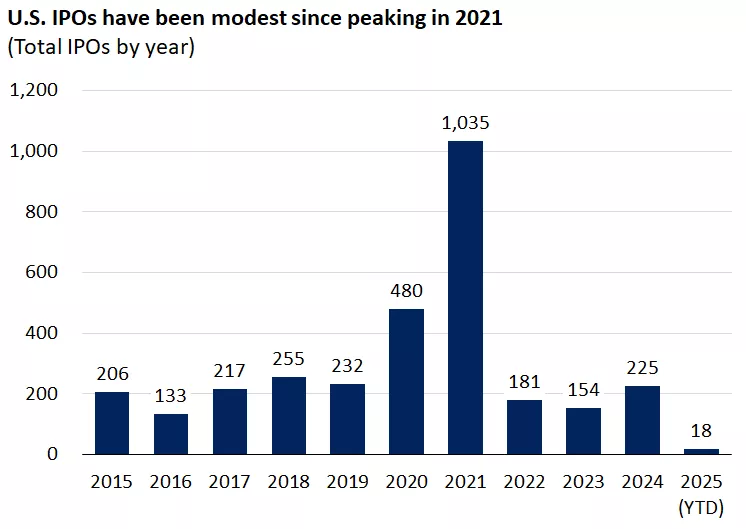

While both pro-growth efforts will likely be welcome by financial markets and investors, they will take time to implement and perhaps come with heated debate among both Republicans and Democrats on the best path forward. If, however, the administration can push forward either or both agenda items, investors may benefit from not only better market sentiment, but also more capital-markets activity, including an increase in areas like IPOs and mergers and acquisitions.

This chart shows the number of initial public offerings (IPO's) in the U.S. by year since 2015.

This chart shows the number of initial public offerings (IPO's) in the U.S. by year since 2015.

Reminder: Don’t play politics with your portfolios

Overall, there has been a flurry of policy shifts in the first week of the new Trump administration. Although the first set of business centered around energy, immigration, tariffs and technology, there will most certainly be many more to come in the weeks ahead.

While these policy shifts may spark headlines and some uncertainty, we know that enacting real policy change takes time. And there are still questions in many cases on what the final policy proposals will look like and what the impact from each of these will be on markets and the economy.

Nonetheless, for long-term investors, we recommend stepping back and taking a more fundamental view of the investing backdrop. We know over time markets are driven by key fundamental factors, including earnings and economic growth, productivity and innovation, and inflation and interest rates.

In our view, the U.S. economy continues to remain robust. We see healthy consumption rates, supported by relatively low unemployment. In fact, the Atlanta Fed GDP-now tracker points to 3.0% U.S. GDP growth in the fourth quarter, well above trend levels of 1.5% - 2.0%. Earnings season is also underway, and fourth-quarter earnings growth is on track to be up by 12.5% year-over-year, the highest growth rate since 2021.*

Thus, we believe the fundamental factors remain strong heading into 2025, which should also support the ongoing market expansion. We recommend investors work with their financial advisors to use bouts of market volatility – perhaps driven by policy uncertainty – as opportunities to diversify, rebalance, and add quality investments across sectors to portfolios. (And for those looking for a good reminder, please refer to Don't Play Politics With Your Portfolio)

Mona Mahajan

Investment Strategist

Source: *FactSet

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 44,424 | 2.2% | 4.4% |

| S&P 500 Index | 6,101 | 1.7% | 3.7% |

| NASDAQ | 19,954 | 1.7% | 3.3% |

| MSCI EAFE* | 2,360.81 | 3.2% | 4.4% |

| 10-yr Treasury Yield | 4.62% | 0.0% | 0.7% |

| Oil ($/bbl) | $74.61 | -3.6% | 4.0% |

| Bonds | $97.01 | 0.1% | -0.1% |

Source: FactSet, 1/24/2025. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *Morningstar Direct 1/26/2025.

The week ahead

Important economic releases this week include the FOMC meeting and the first preliminary estimate for fourth quarter GDP.

Review last week's weekly market update.

Mona Mahajan

Mona Mahajan is responsible for developing and communicating the firm's macroeconomic and financial market views. Her background includes equity and fixed income analysis, global investment strategy and portfolio management.

She regularly appears on CNBC and Bloomberg TV, and in The Wall Street Journal and Barron’s.

Mona has a master’s in business administration from Harvard Business School and bachelor's degrees in finance and computer science from the Wharton School and the School of Engineering at the University of Pennsylvania.

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.