Don’t play politics with your portfolio

Like many Americans, you may wonder how election outcomes affect financial markets. You may also wonder whether you should change your strategy based on election results.

Although changes in government policies can have a sizable effect on investment returns, they’re much harder to predict than you might think, and the consequences of policy changes are usually not as expected. We think it’s better to follow time-tested investment principles and avoid letting politics influence your long-term strategy.

What history tells us

To help you better understand how financial markets have performed under various political parties in power, review these charts.

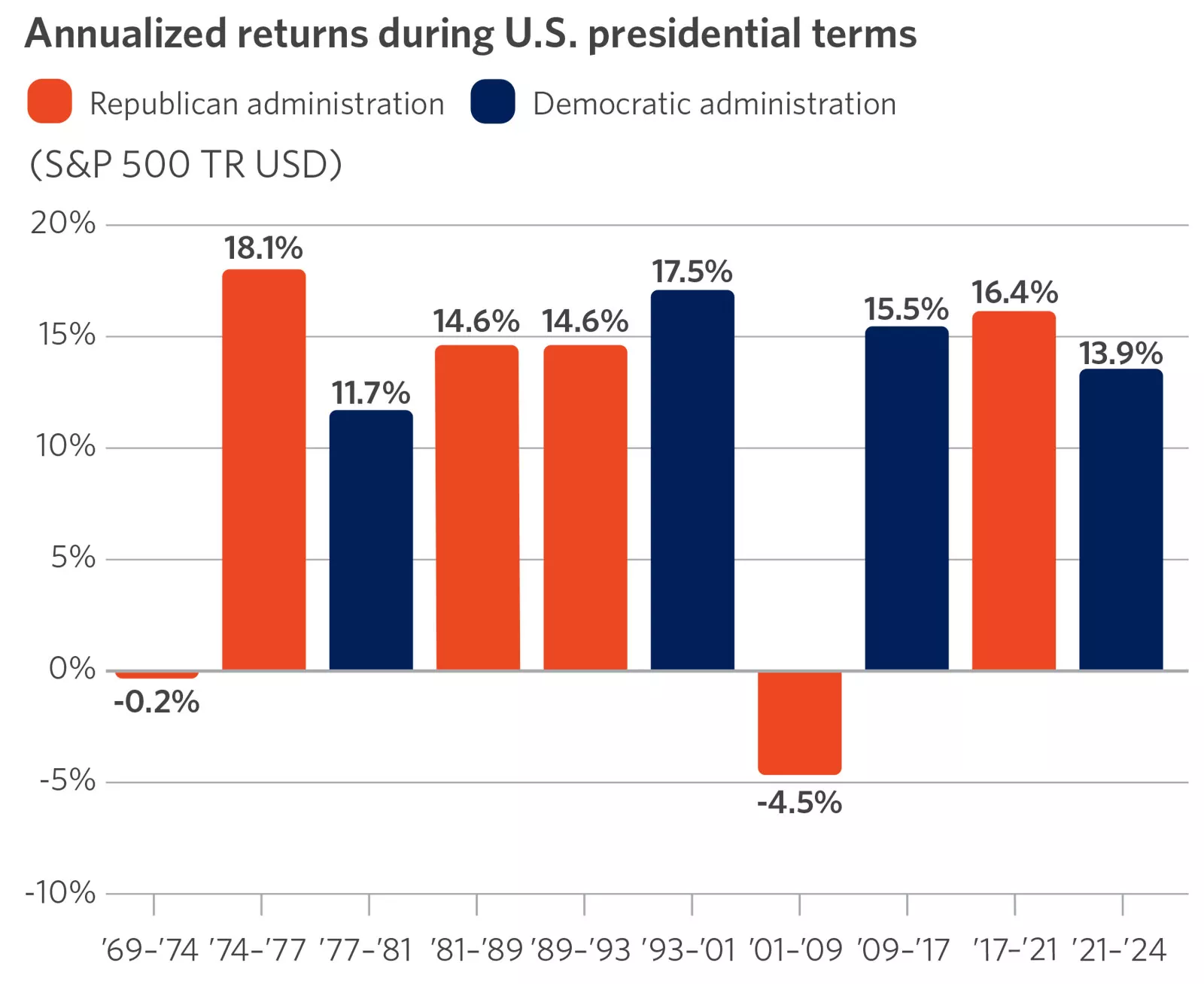

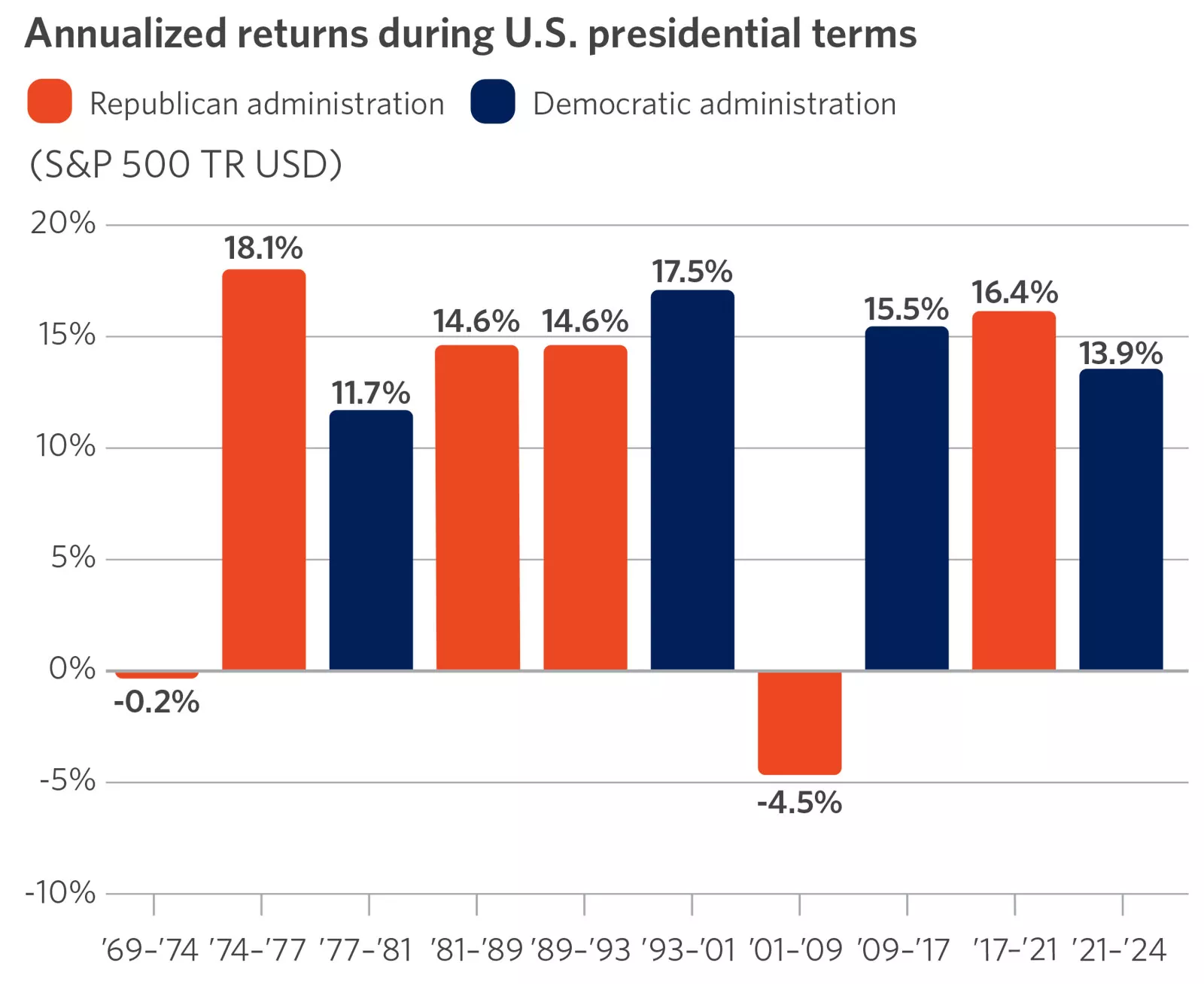

This chart shows that, going back to 1969, annualized returns for the S&P 500 have been mostly positive during U.S. presidential terms regardless of party.

This chart shows that, going back to 1969, annualized returns for the S&P 500 have been mostly positive during U.S. presidential terms regardless of party.

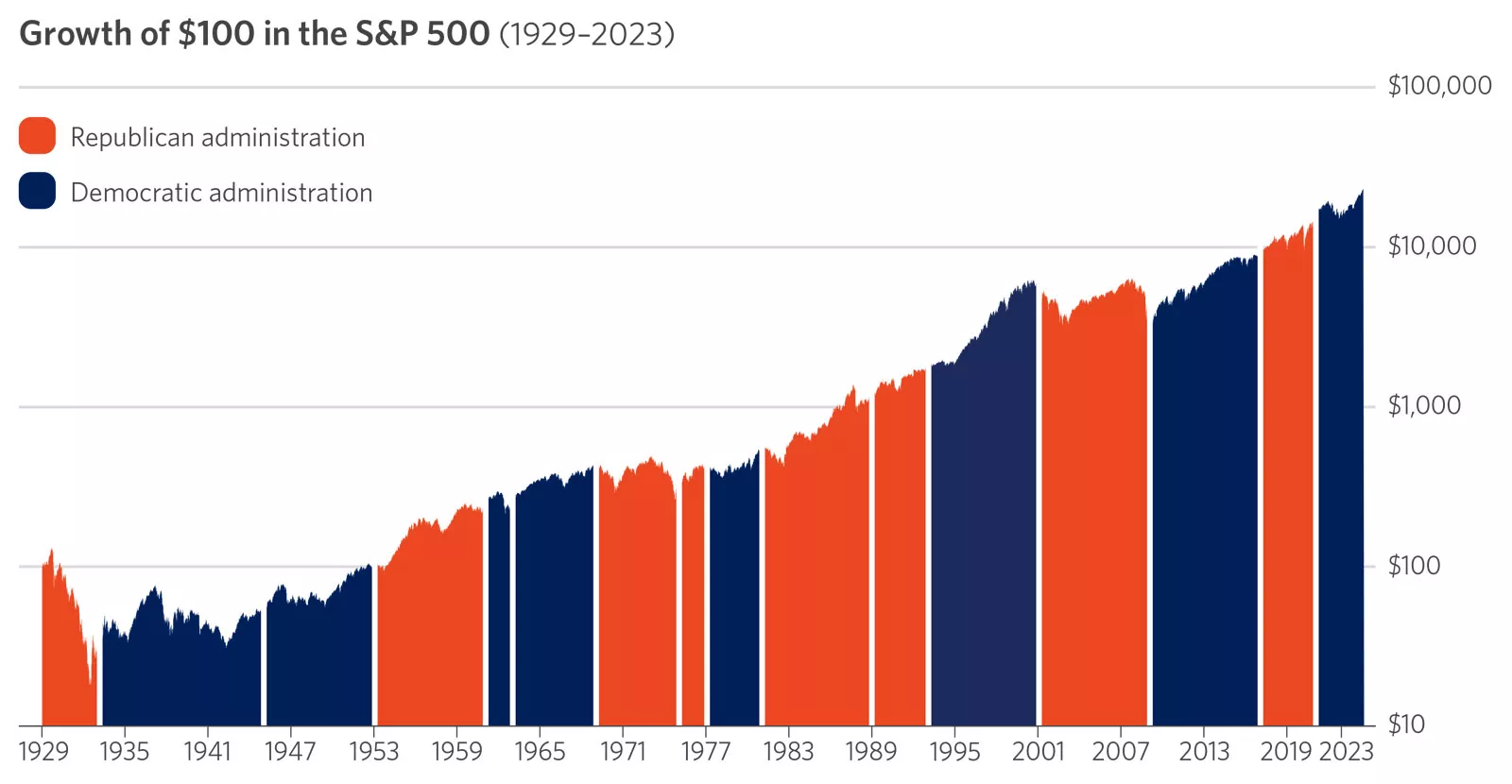

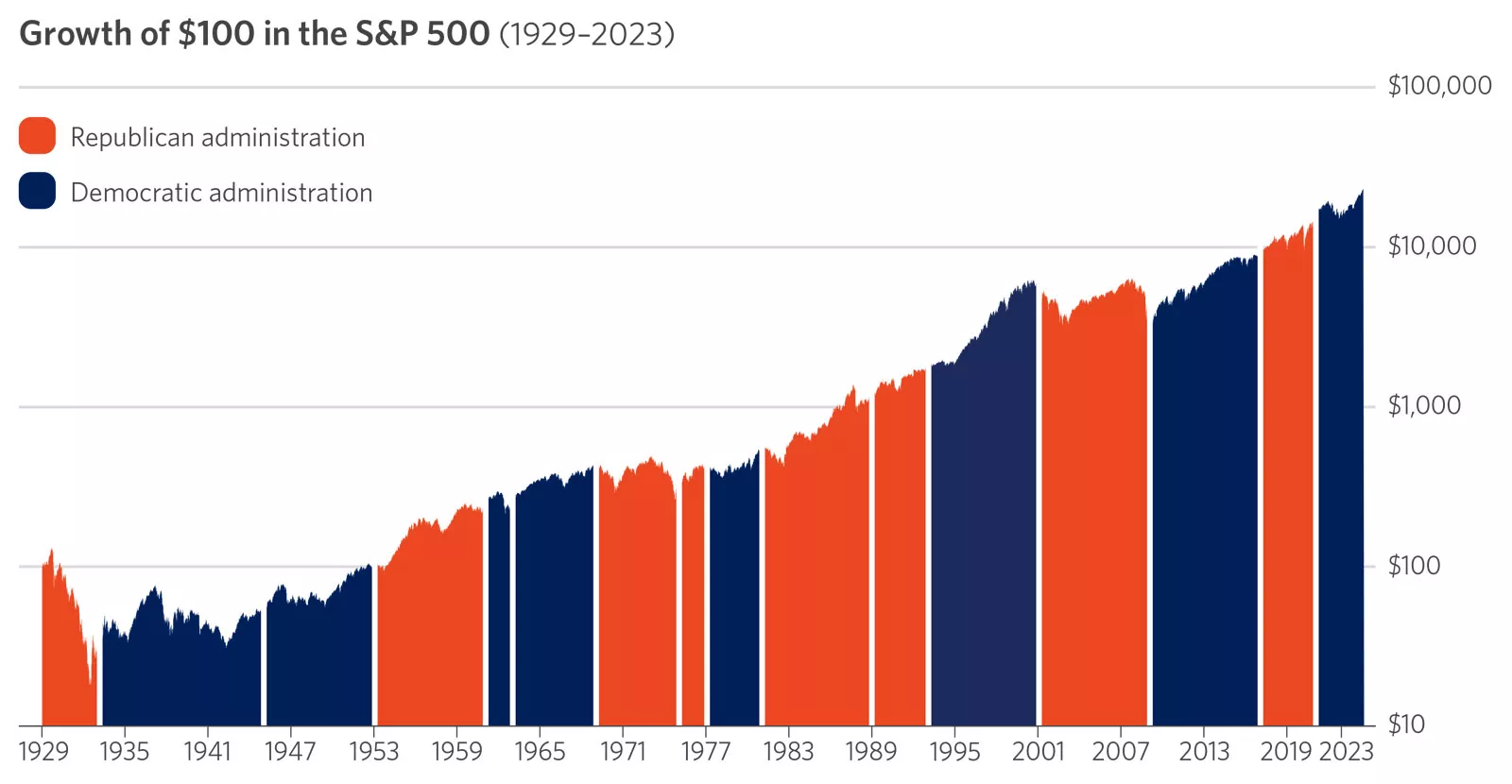

This chart shows the path of a $100 investment in the S&P 500 in 1929, with Republican and Democratic administrations highlighted. Keep in mind that you cannot invest directly into the S&P 500.

This chart shows the path of a $100 investment in the S&P 500 in 1929, with Republican and Democratic administrations highlighted. Keep in mind that you cannot invest directly into the S&P 500.

You may be surprised to learn that the stock market has increased under every political combination in Washington, providing an average annual return of over 11% per year since 1970.* And the economy has grown regardless of which party controls the White House and Congress.

As the above charts indicate, although there has been volatility over the years, the stock market has tended to rise regardless of who runs the White House. These long-term results should serve to give you confidence in the market despite individual election results.

While political leaders may enact laws and regulations in hopes of influencing economic growth, the results are not nearly as predictable as they might imagine. Economic indicators such as jobs, interest rates and inflation can sometimes run counter to prevailing policies.

While some changes may seem to have gone too far, the next election tends to move in the opposite direction. One of the strengths of the U.S. political system is that the pendulum tends to swing back toward the center over time.

The market is more powerful than politics

During election years, politicians make many promises that go unfulfilled. That’s partly due to our government’s system of checks and balances.

However, we believe market forces are more powerful than political forces over the long term. What sounds promising during election campaigns often may not work in reality.

What about other factors that affect the prices of stocks and bonds? Again, it’s not about the politics but rather market forces.

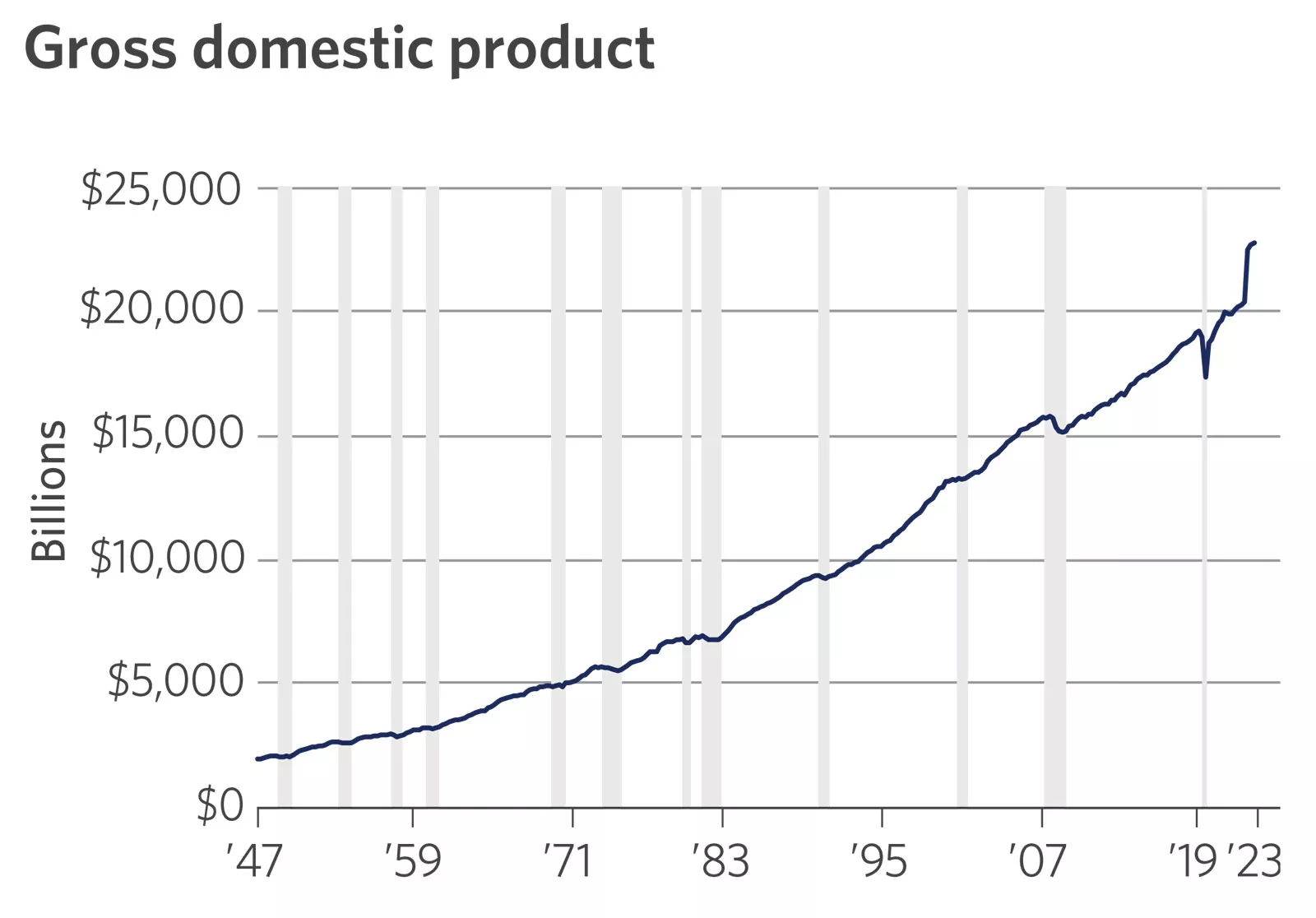

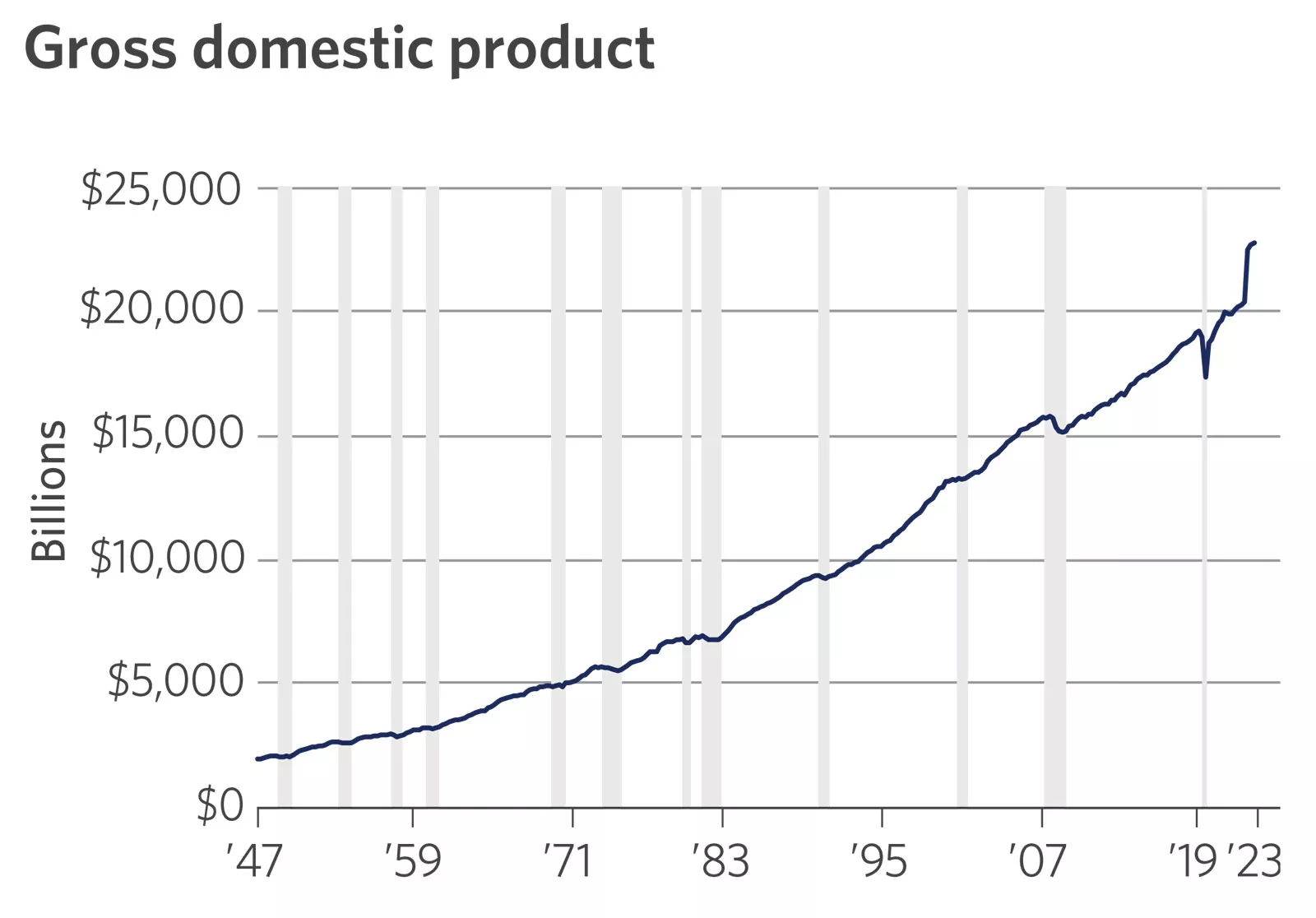

The following chart shows the U.S. economy’s long-term trend, which depicts a fairly good record over a variety of political environments. Keep in mind that, historically, there have been seven months of growth for every month of recession since 1947.

This chart shows the path of U.S. real gross domestic product, or real GDP, since 1947.

This chart shows the path of U.S. real gross domestic product, or real GDP, since 1947.

Look past the short term

There’s almost always uncertainty about the short‑term outlook. Campaign tactics deliberately raise many questions with few easy answers.

If you’re feeling uncomfortable, remember this: The mix of investments you own makes more difference to your long-term “victory” or “defeat” as an investor than any election results.

We believe equity market volatility related to political uncertainty can create attractive buying opportunities for long-term investors. It’s also important to ensure you have an appropriate type and amount of fixed-income investments. By maintaining an investment mix tailored to your situation, we think you’ll find it easier to look past short-term political and market uncertainties.

Stick with a long-term strategy

The success, growth and resiliency of the U.S. don’t change with each election, and neither should your investment strategy.

We believe you should focus beyond the election outcome and “vote” for sound investment principles, such as buying quality investments in a well-diversified portfolio and holding them for the long term.

*Source: Morningstar Direct. S&P 500 Total Return Index 2/1/1970–7/16/2024. The S&P 500 is an unmanaged index, cannot be invested in directly and is not meant to depict an actual investment. Past performance is not a guarantee of future results.

Diversification does not guarantee a profit or protect against loss in a declining market.

Past performance is not a guarantee of future results.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates, and investors can lose some or all of their principal.