Future you will thank you

To have the best chance of finding financial freedom down the road, you’ve got to make some smart money moves today. But knowing where to start can feel overwhelming, so we’re here to help.

Start laying your financial foundation today:

Emergency Savings

Budgeting Basics

Debt Details

Emergency Savings

Creating a rainy day fund

Car problems? Broken laptop? Whatever the unexpected situation, having an emergency fund can help you keep your cool and stay on track. It can also give you more freedom to live the life you want.

The amount you need in an emergency fund depends on lots of factors, and that can change over time. But even though every individual has unique needs and goals, there are a few helpful milestones you can reach for to start filling out that rainy day fund.

How to read this chart: This chart illustrates the recommended amount to have saved in an emergency fund based on each of three financial milestones. In the first milestone, $500 to one month of expenses should be saved as you begin building a financial foundation. In the second milestone, one to two months of expenses should be saved as you become more stable in your financial life. The optimal emergency fund is represented in the third milestone, with three to six months of expenses saved.

How to read this chart: This chart illustrates the recommended amount to have saved in an emergency fund based on each of three financial milestones. In the first milestone, $500 to one month of expenses should be saved as you begin building a financial foundation. In the second milestone, one to two months of expenses should be saved as you become more stable in your financial life. The optimal emergency fund is represented in the third milestone, with three to six months of expenses saved.

How do I start building my emergency fund?

As much as we'd like to avoid thinking about them, emergencies do happen. But building an emergency fund can help you better weather the storms.

How much should I save for emergencies?

An emergency fund can help you prepare for the unexpected, giving you more confidence and flexibility to accomplish your goals.

Budgeting Basics

Budget Building 101

Creating (and sticking with) a budget is one way to help you stay on track financially. To clearly see your entire financial picture, you'll want to identify all your "money in" and "money out" as a starting point.

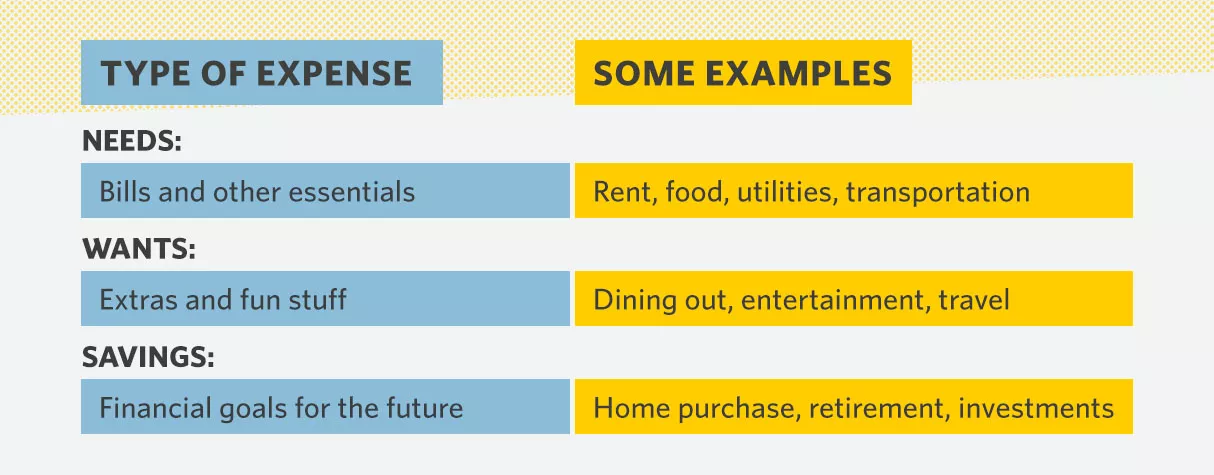

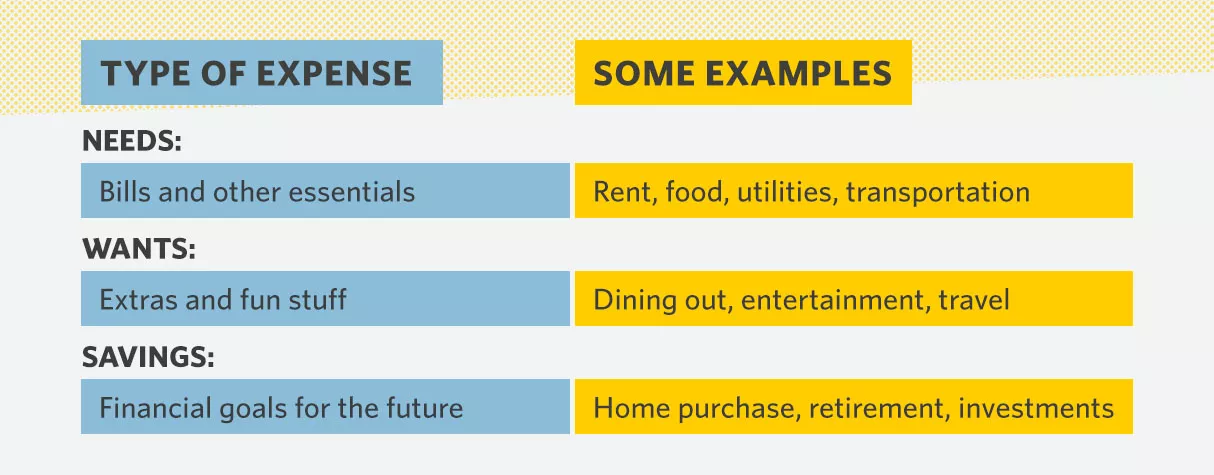

There are many different strategies for creating a budget that’s right for you, but no matter which method you choose, you’ve got to start by splitting up your money into needs, wants, and wishes.

How to read this chart: This chart illustrates three different types of expenses as well as several examples of each. The "Needs" category represents essential expenses, like paying rent and utilities, buying food and paying for transportation. The "Wants" category represents items you might like to buy but aren't absolutely necessary, like dining out, entertainment and travel. The third category represents money allocated for savings goals, like investing, planning for retirement or buying a home.

How to read this chart: This chart illustrates three different types of expenses as well as several examples of each. The "Needs" category represents essential expenses, like paying rent and utilities, buying food and paying for transportation. The "Wants" category represents items you might like to buy but aren't absolutely necessary, like dining out, entertainment and travel. The third category represents money allocated for savings goals, like investing, planning for retirement or buying a home.

Creating a budget

Ever run out of money before the end of the month? Create a budget so you know where your money is going instead of wondering where it went.

Build a budget that works

By using a budget, you can get a clearer picture of your spending and how much progress you're making toward your goals.

Debt Details

When borrowing dollars makes sense

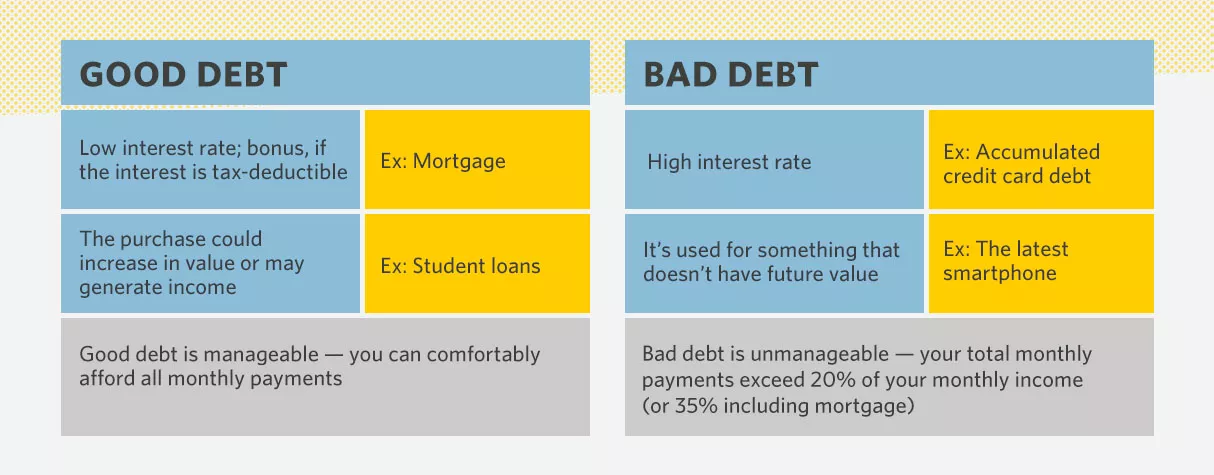

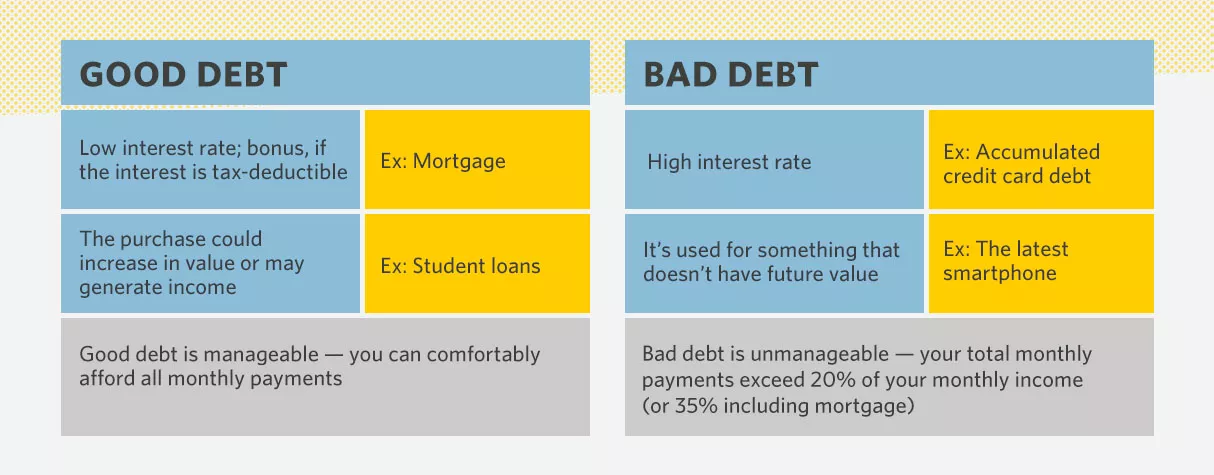

Being crystal clear on how much debt you have, and what kind it is, can help you create a roadmap to pay it down and ultimately pay it off. Mindfully managing your debt can help to increase your credit score and free up more money, and more financial freedom.

But wait, isn’t all debt bad? No! Certain types of debts can actually help you achieve more future goals, while other debts tend to drag you down and may limit what you’re able to do down the road. Here are a few things to consider.

How to read this chart: This chart illustrates the difference between good and bad debt, how these two types are defined, and examples of each. Good debt is defined as debt with a low interest rate, like a mortgage; a purchase that may increase in value or generate income, like student loans that support an education; and debt that you can comfortably afford to pay off. Bad debt is defined as debt with a high interest rate, like accumulated credit card debt; a purchase that doesn't have future value, like the latest smartphone; or a case in which payments exceed 20% of your monthly income (or 35% including a mortgage).

How to read this chart: This chart illustrates the difference between good and bad debt, how these two types are defined, and examples of each. Good debt is defined as debt with a low interest rate, like a mortgage; a purchase that may increase in value or generate income, like student loans that support an education; and debt that you can comfortably afford to pay off. Bad debt is defined as debt with a high interest rate, like accumulated credit card debt; a purchase that doesn't have future value, like the latest smartphone; or a case in which payments exceed 20% of your monthly income (or 35% including a mortgage).

Dealing with debt

Debt, when it's wisely managed, can help to strengthen your credit score and open more doors in the future.

Strategies to pay down debt

Which is more important: paying off debt or saving for the future? Learn some tricks to help set yourself up for a financially sound future.

The road to financial freedom starts now.

Once you’ve armed yourself with a few key bits of financial wisdom, you’re better able to set your course for future financial stability with clarity and confidence. And as major life changes come up over time, you’ll have the tools and training you need to keep on rolling.

For those times when you could use a little extra guidance, we’re here to help. We’ll do our best to get to know you, your unique situation, and your goals so we can help you achieve financial freedom throughout your life.

Ready to get started?

Find a Financial Advisor

While financial goals aren't achieved overnight, moving in the right direction can help. At Edward Jones, becoming a client starts with choosing a financial advisor.

Find Financial Advisor Search Tools

Get Matched with Advisors Near You

Take two minutes to help us understand your needs and goals and match with financial advisors personalized for you.

Search By Location

Edward Jones has offices in communities across the country. Find financial advisors near you or explore financial advisors by state.

Search By Name

Looking for a specific financial advisor? Browse by name - first, last or both.

Not sure how to work with a financial advisor? Get a better understanding of your different financial goals and how a financial advisor can work with you to meet them with our Starting Point Quiz.