Making financial resolutions for 2025

Data reveals how resolutions could translate to financial habits in the new year.

The new year is a popular time to make resolutions for life, health, relationships and finances, although it can be challenging to stick to them. Recent Edward Jones research about Americans’ financial resolution habits revealed that more than half (56%) of people surveyed who made a financial resolution in 2024 gave up on it because they prioritized needs-based spending due to inflation.

Setting the scene

According to the research, people who are setting goals for 2025 are optimistic about sticking to them. In fact, 81% said they feel confident in their ability to keep their financial resolutions. Their top three financial resolutions include:

- Building a savings account (16%)

- Paying off credit card debt (14%)

- Increasing their income (14%)

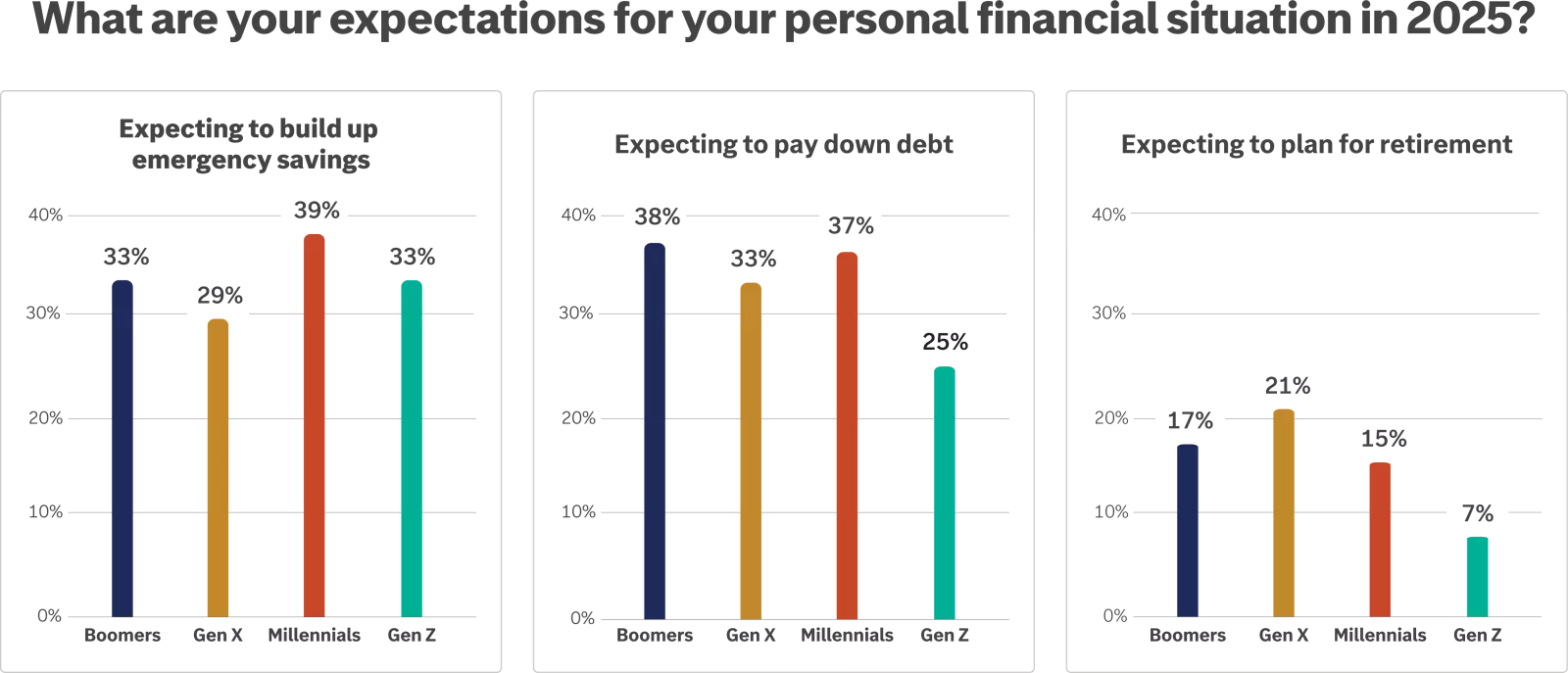

Those in the survey said in addition to making financial resolutions, they also have financial expectations for 2025, many of which are similar, across generations:

Inflation obstacles

While those surveyed expressed optimism about keeping their financial resolutions in 2025, more than half (55%) of respondents said inflation was their main challenge to financial accountability this year — and nearly the same number (56%) said they're concerned that higher prices could again prevent them from sticking to their resolutions in 2025. What’s more, 63% of people feeling the effects of inflation said it is affecting their ability to save, which makes achieving their financial goals more difficult.

Beyond inflation, other obstacles Americans foresee as a challenge to maintaining their financial resolutions include:

- An unexpected financial strain (32%)

- Economic market changes (29%)

- Change in presidential administration and its financial impacts (25%)

- Lack of motivation (19%)

Spending on this, not that

With pressure on their budgets, Americans are looking to rebalance their spending to focus on their priorities and necessities, cutting back on some nonessential costs. One-third of respondents (33%) said they plan to spend less on travel in 2025 and 2 in 5 respondents (40%) said they plan to spend less at restaurants. Conversely, 30% said they plan to spend more on groceries in 2025, and 53% said they plan to spend the same amount.

Even amid their pulling back on “fun” spending, people are still making room in their budgets for investing. Nearly one-quarter of respondents (22%) said they plan to spend more on investments in 2025, and one-third (33%) said they plan to spend the same amount.

How a financial advisor can help

As people set their new year’s financial resolutions, including planning to make investments in 2025, half of respondents (50%) said they believe working with a financial advisor would help them stay on track with their goals. And these conversations are already in the works, with 2 in 5 (38%) respondents who work with a financial advisor planning to meet with them before the start of 2025, and 36% planning to meet between January and March to discuss their 2025 goals. Further, a third of respondents (33%) said they plan to meet with their financial advisors a few times a year.

Methodology

The data in this article is the result of a survey conducted by global data intelligence company Morning Consult among a national sample of 3,001 adults ages 18+ from Oct. 23–27, 2024.