Weekly market wrap

Market rally takes a breather, as focus returns to inflation and Fed policy

Key takeaways

- This past week, stock markets gave back some of the robust post-election gains. The S&P 500 was down about 2% for the week, although gains for the full year still exceed 23%, and the index is up over 1% since U.S. election day.

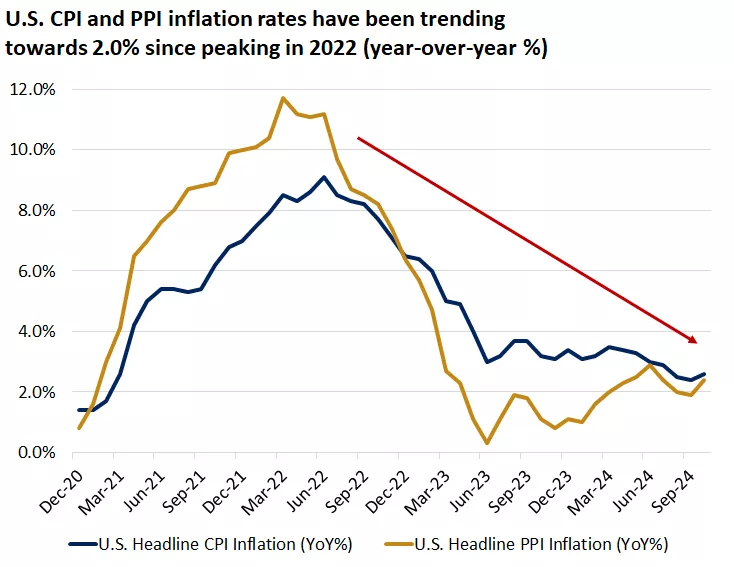

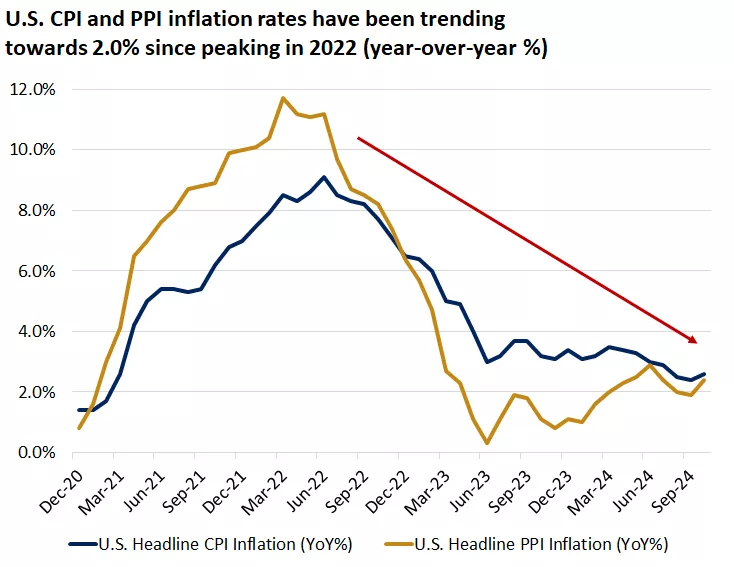

- Consumer price index (CPI) inflation data for the month of October was in line with expectations. While there continues to be a downward trend in inflation broadly, there are components of prices that remain elevated. Areas like shelter, rent, and even motor vehicle insurance have not moderated as much or as quickly as expected. Nonetheless, we continue to see potential for inflation to gradually reach the Fed's 2.0% target in the months ahead and perhaps settle in the 2.0% - 3.0% range longer-term.

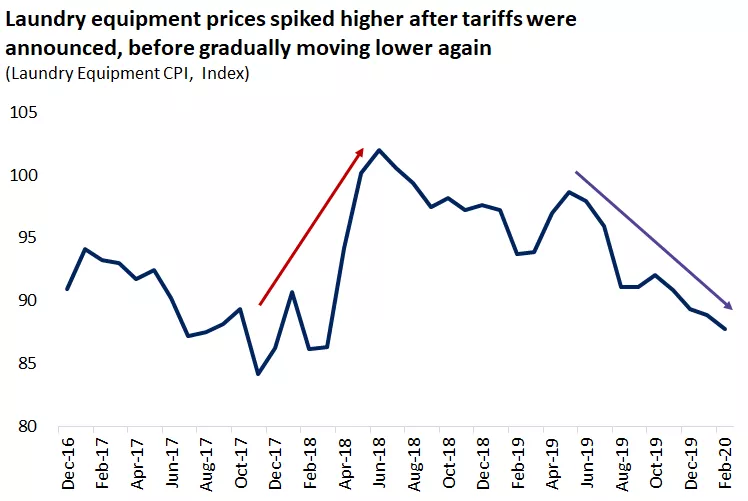

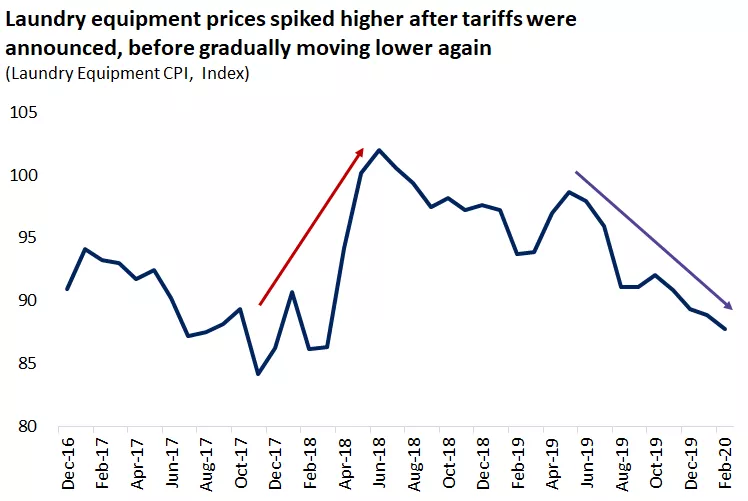

- The uncertainty around policy, particularly around tariffs, has also sparked some caution in markets. While tariffs can be a tax on consumers, history shows us that over time the impacts of tariffs, especially targeted tariffs, tend not to be a long-term driver of inflation.

- Overall, we are entering a seasonally stronger period for financial markets during the last couple months of the year. While some of this return may have been pulled forward after U.S. elections, positive fundamentals continue to underpin the bull market. We would expect policy uncertainty to spark bouts of volatility in the months ahead, but we believe markets will be able to climb these walls of worry over time, especially if economic growth remains resilient and inflation is contained.

CPI inflation was a bit persistent, but long-term trends remain intact

Inflation was front and center once again last week, with data released on both U.S. consumer price inflation (CPI) and producer price inflation (PPI) for the month of October. Overall, while inflation was in line with expectations, there were parts of the inflation baskets that remained elevated, particularly in services inflation.

In the much-anticipated CPI inflation readings, headline CPI inflation ticked higher to 2.6% year-over-year, versus last month's 2.4%, and core inflation remained steady at 3.3%, both in line with forecasts.* Parts of the inflation basket did move lower last month, including energy, gasoline, certain foods, and new vehicle prices. However, areas like housing and rent prices, and even motor vehicle insurance, remained stubbornly elevated.

Overall, in our view, inflation has made quite a bit of progress since the peak 9.1% year-over-year headline CPI reading in June 2022. However, the last mile toward the Fed's 2.0% inflation target is likely to remain bumpy. We would expect that if economic growth moderates, and the labor market eases further, the persistent services inflation may move lower as well.

However, over time, as the economy reaccelerates, perhaps boosted by some of the new, pro-growth policies that could take hold in late 2025 or early 2026, inflation may ultimately settle in the 2% - 3% year-over-year range. This could still be a welcome outcome for long-term investors, especially if wage gains settle above this level, and there is no return to the post-pandemic spikes in inflation that shocked consumers and the economy in recent years.

This chart shows the year over year change in U.S. headline CPI and PPI.

This chart shows the year over year change in U.S. headline CPI and PPI.

Tariff uncertainty remains an overhang, but there are mitigating factors

Perhaps the broader uncertainty for many investors is that, while inflation rates continue to be generally contained and well below recent highs, there is concern this may reverse if we see inflationary policies emerge in the year ahead under the new administration.

One area that investors point to as a source of potential inflation is tariff policy. While on the surface, imposing tariffs – whether across-the-board tariffs or escalation on Chinese tariffs – is considered a tax on households and a potential source of inflationary pressures, there may be offsetting factors to support consumers:

- One-time impact to prices: Generally, when tariffs are imposed on goods, these tend to have a one-time impact to the price of the imports. Unless there is a retaliation or ongoing escalation in tariffs, the price increase will be a step-function higher and then pause there. Inflation, as we know, is a comparison of prices from a month ago or a year ago. All else equal, once a one-time tariff is implemented, after a month or a year, the rate of comparison will again be zero.

- History tells us that prices over time return to normal: One real-world example of the impact of tariffs on goods is the washing-machine example that occurred back in January 2018. The administration had imposed tariffs of 20% - 50% on large residential washing machines, which expired in 2023. After a brief surge in prices, consumer prices on these goods fell, and tariffs had no noticeable effect longer-term. In this example, foreign washing-machine producers like LG and Samsung also decided to move some manufacturing to the U.S. over time. While this may not always be the outcome, tariffs can spark some diversification of global supply chains as well.

This chart shows the level of the laundry equipment component of the U.S. CPI. The index rose following tariffs in 2018 before moving lower in 2019.

This chart shows the level of the laundry equipment component of the U.S. CPI. The index rose following tariffs in 2018 before moving lower in 2019.

- Negotiating tactic: More broadly, the proposed tariff policies may also be a starting point for bilateral negotiations between the U.S. and different economies on certain goods and sectors, but this will be determined once the new administration enters office in 2025.

Fed Chair Powell indicates that there is "no rush" to cut rates, as the economy is resilient

Fed Chair Jerome Powell also spoke to the Federal Reserve Bank of Dallas last week, and his comments indicated a more gradual approach to rate cuts. Powell noted that the U.S. economy remains resilient, and the labor market, while slowing a bit in October, remains healthy, with a 4.1% unemployment rate that is well below historical averages.

The Fed Chair also noted that U.S. economic growth is "by far the best of any major economy in the world." This notion of U.S. exceptionalism has also played out in stock markets, with the S&P 500 outperforming other country and global-market indexes thus far in 2024.

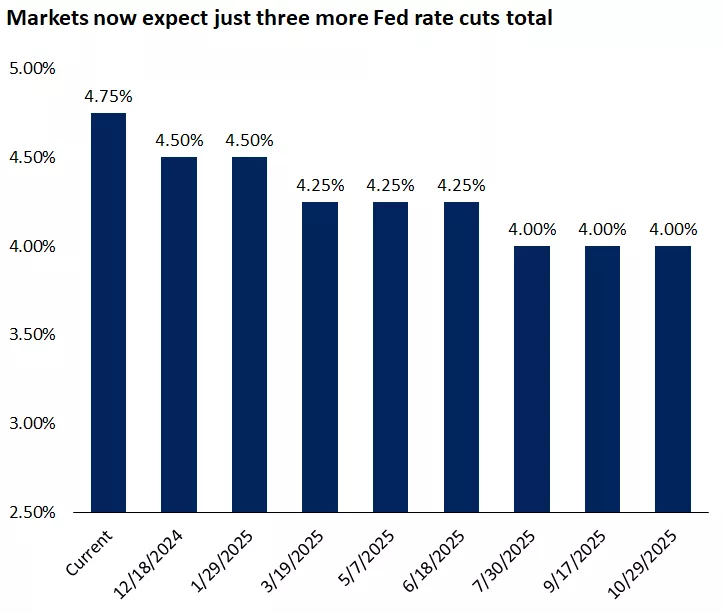

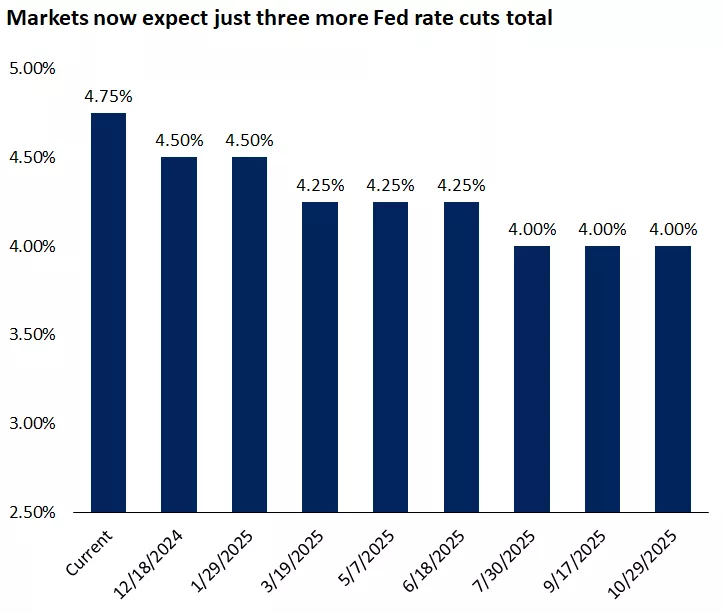

Given this resilience, Powell also noted that "the economy is not sending any signals that we need to be in a hurry to lower rates." This sparked some concern in markets that the Fed may not be cutting rates as much as previously thought. However, the forecasts for the total number of Fed rate cuts had already come down ahead of Powell's comments and after U.S. elections last week. After Powell's comments, the probability of a December rate cut again moved lower, according to the CME FedWatch tool.

In our view, the Fed is likely to bring the fed fund rates from the current 4.75% to 3.5% - 4.0% next year. The good news is that the Fed is cutting rates not because the economy is faltering, but because inflation has moved well below its current 4.75% policy rate. It can gradually bring its policy rate down to a less restrictive and more neutral level, which over time should be positive for both consumers and corporations.

This chart shows that markets now expect three 0.25% rate cuts from now until October 2025.

This chart shows that markets now expect three 0.25% rate cuts from now until October 2025.

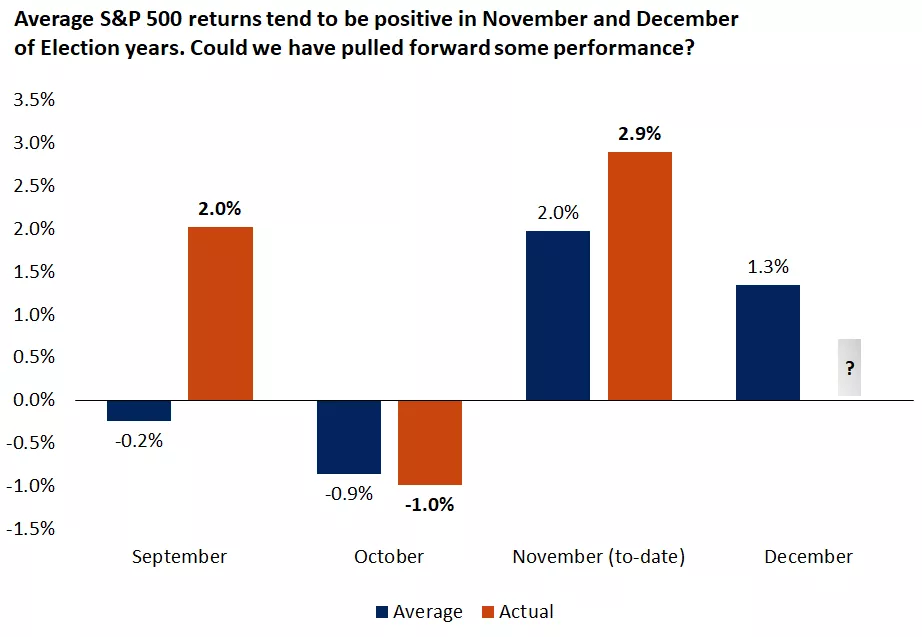

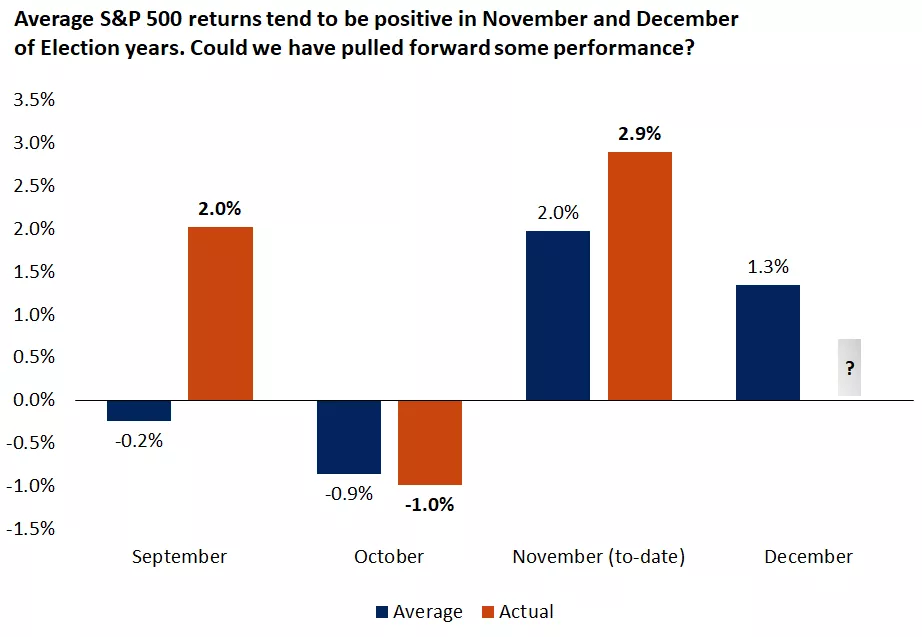

Markets are heading toward a seasonally stronger time of year, but have returns been pulled forward?

Overall, we are now entering a seasonally stronger time of year for markets. Especially in election years, November and December historically have been positive months in the markets, and momentum may resume in the weeks ahead. However, keep in mind that after a strong year in markets, and an especially strong post-election stock-market rally, some of these gains may have already occurred.

Nonetheless, in our view, the fundamentals continue to underpin this bull market. Economic growth remains above trend, and while it may moderate next year, we do not anticipate a downturn or recession. Inflation also remains largely contained, and while there may be bumps along its path, we also would not expect a return to the high rates seen in 2022.

Policy uncertainty will continue to weigh on markets and likely spark bouts of volatility. However, assuming no external shocks to the system, and an economy that may be supported further by pro-growth policies ahead, markets should be able to climb these "walls of worry." While the pace of gains of this bull market may moderate, we continue to see pullbacks as opportunities, especially as economic and earnings growth continue to support the ongoing market expansion.

This chart shows the average monthly performance of the S&P 500 Price Index in the final four months of election years as well as the actual return of the index from September - November in 2024. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and isn't meant to depict an actual investment.

This chart shows the average monthly performance of the S&P 500 Price Index in the final four months of election years as well as the actual return of the index from September - November in 2024. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and isn't meant to depict an actual investment.

Mona Mahajan

Investment Strategist

Source: *FactSet

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 43,445 | -1.2% | 15.3% |

| S&P 500 Index | 5,871 | -2.1% | 23.1% |

| NASDAQ | 18,680 | -3.1% | 24.4% |

| MSCI EAFE | 2,275.34 | -2.6% | 1.8% |

| 10-yr Treasury Yield | 4.44% | 0.1% | 0.6% |

| Oil ($/bbl) | $67.03 | -4.8% | -6.4% |

| Bonds | $97.66 | -0.9% | 1.4% |

Source: FactSet, 11/15/2024. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *Morningstar Direct 11/17/2024.

The week ahead

Important economic releases this week include the Conference Board's leading indicators and PMI data.

Review last week's weekly market update.

Mona Mahajan

Mona Mahajan is responsible for developing and communicating the firm's macroeconomic and financial market views. Her background includes equity and fixed income analysis, global investment strategy and portfolio management.

She regularly appears on CNBC and Bloomberg TV, and in The Wall Street Journal and Barron’s.

Mona has a master’s in business administration from Harvard Business School and bachelor's degrees in finance and computer science from the Wharton School and the School of Engineering at the University of Pennsylvania.

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.