Weekly market wrap

First Half Winners and Losers

Key Takeaways:

- Stocks posted a strong first-half gain, helped by ongoing positive economic readings and the ongoing prospects of a Fed rate cut materializing this year. Strong first halves have historically seen markets go on to produce above-average full-year returns.

- Beyond overall stock-market performance, winners in the first half included mega-cap technology (again), powered by ongoing excitement around AI. At the same time, some more traditionally defensive segments, areas like utilities and gold, also saw strong performance to start the year.

- On the other side, what didn't fare as well in the first half were things like volatility (market swings were historically low), small-cap equities, and interest-rate predictions, which required material revisions amid incoming inflation and economic readings.

- The bottom line: 2024 is off to a stellar start in terms of overall investment returns. Looking under the hood and evaluating the fundamental setup supports the case for prudent portfolio diversification and an optimistic (but realistic) view of the road ahead for the balance of the year.

The release of some additional inflation data and the first presidential debate were the headliners in an otherwise quiet week. With the first half of 2024 now in the books, here's a look at a few notable winners and losers in the markets, and our take on what that performance means for the remainder of the year.

Winner: Stocks

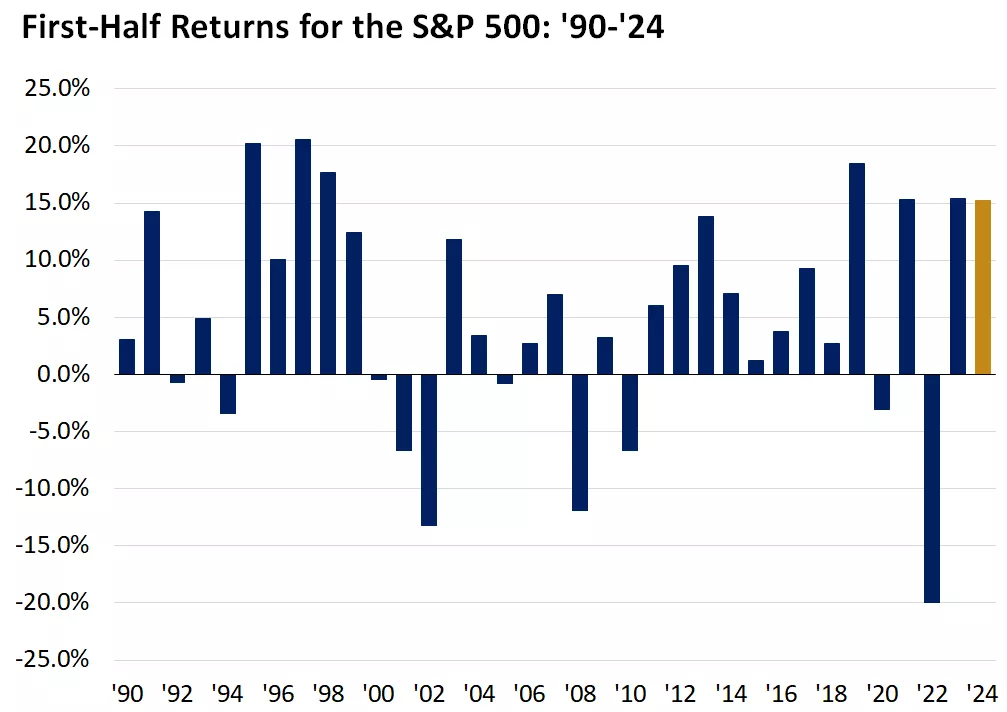

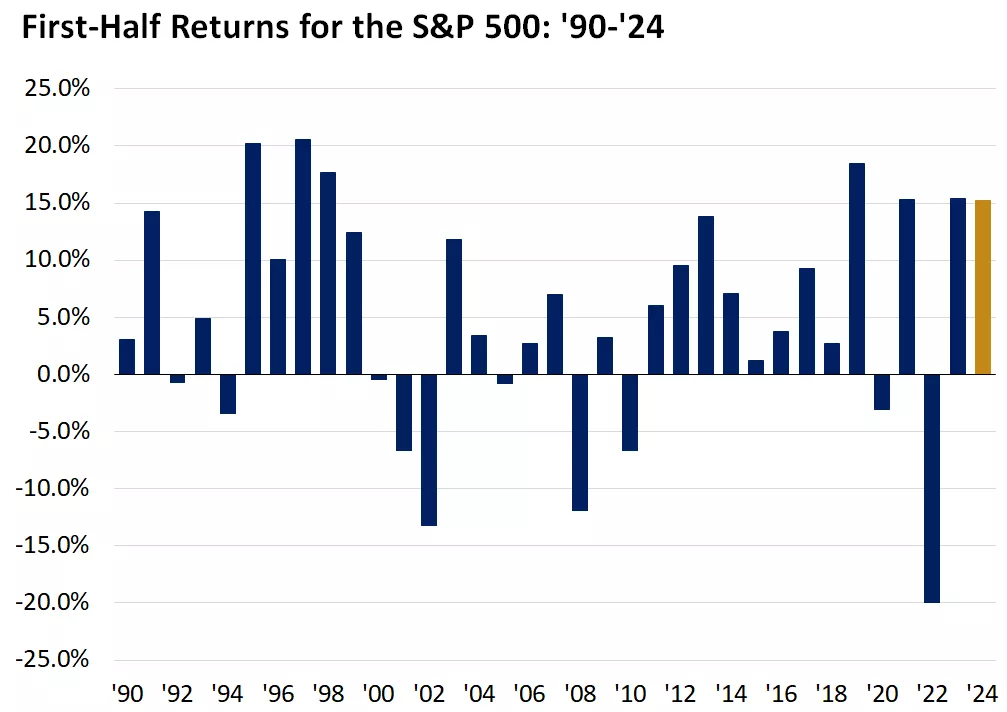

- The stock market, as measured by the S&P 500, has booked a 15% return at the halfway mark this year. This is among the top-seven best starts in the last 35 years, with the S&P 500 setting more than 30 new record highs year-to-date.

- Fast first halves have not typically been indicative of markets that burned all their gas early. In fact, in the 11 years in which stocks were up 10% or more at the end of June, the average full-year return went on to be 29%.

Stocks are off to a very strong start in 2024.

This chart shows the return in the first half of each year since 1990. The S&P 500 has risen more than 15% in the first half of 2024. Past performance does not guarantee future results.

This chart shows the return in the first half of each year since 1990. The S&P 500 has risen more than 15% in the first half of 2024. Past performance does not guarantee future results.

- Second-half outlook: This market has a lot of fundamental support, though we're not penciling in a full repeat of first-half gains in the second half. There is a good case for additional gains as we advance, supported by the Fed letting its foot off the brake and corporate profits that are poised to rise further. However, a portion of that outlook has been captured in the 2024 gains so far. We think investors have reason to be optimistic about the rest of 2024, but they should also expect more moderate gains.

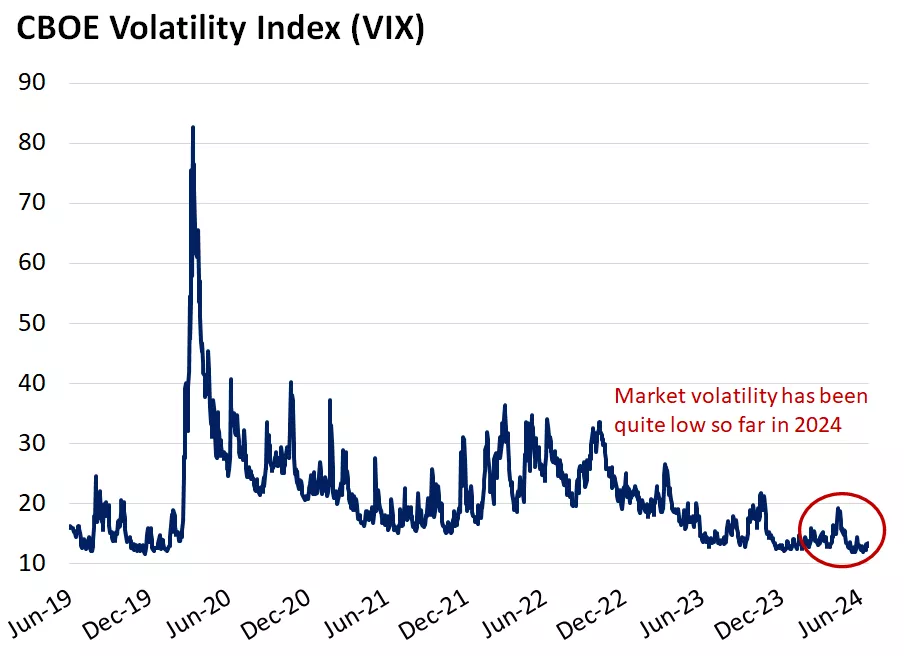

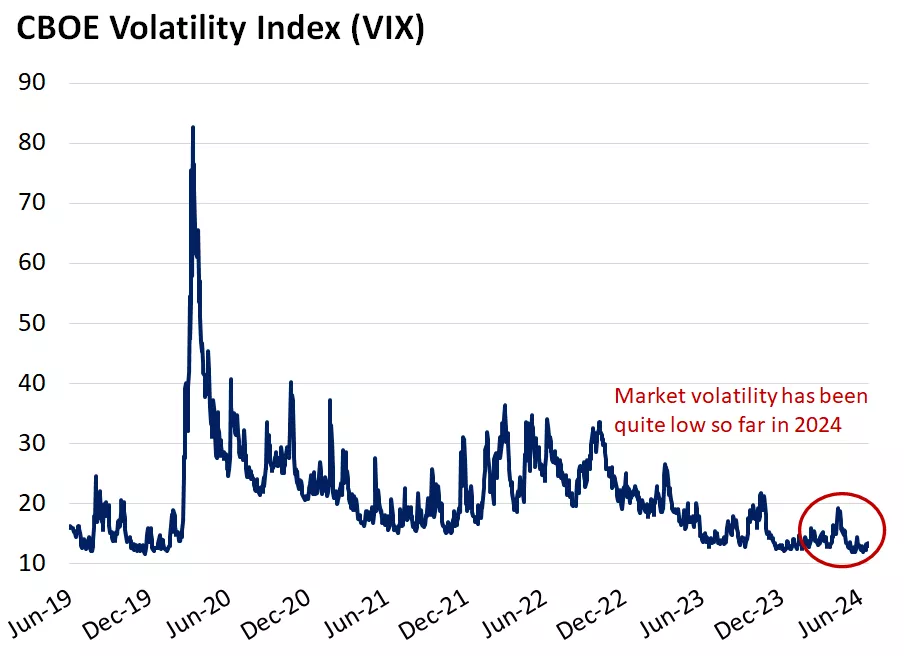

Loser: Volatility

- If you like big swings or sharp sell-offs in the market, 2024 has not been your year. A loss for volatility is generally a win for investors, in the same way that calm waters make for less seasick sailors.

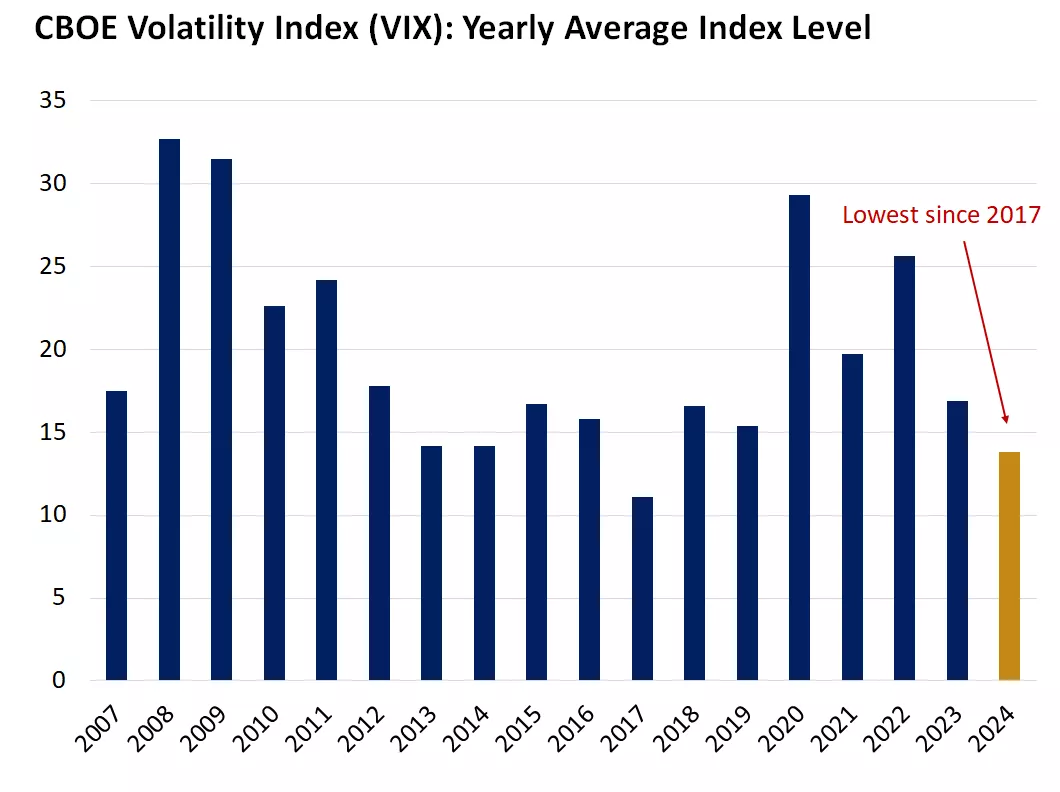

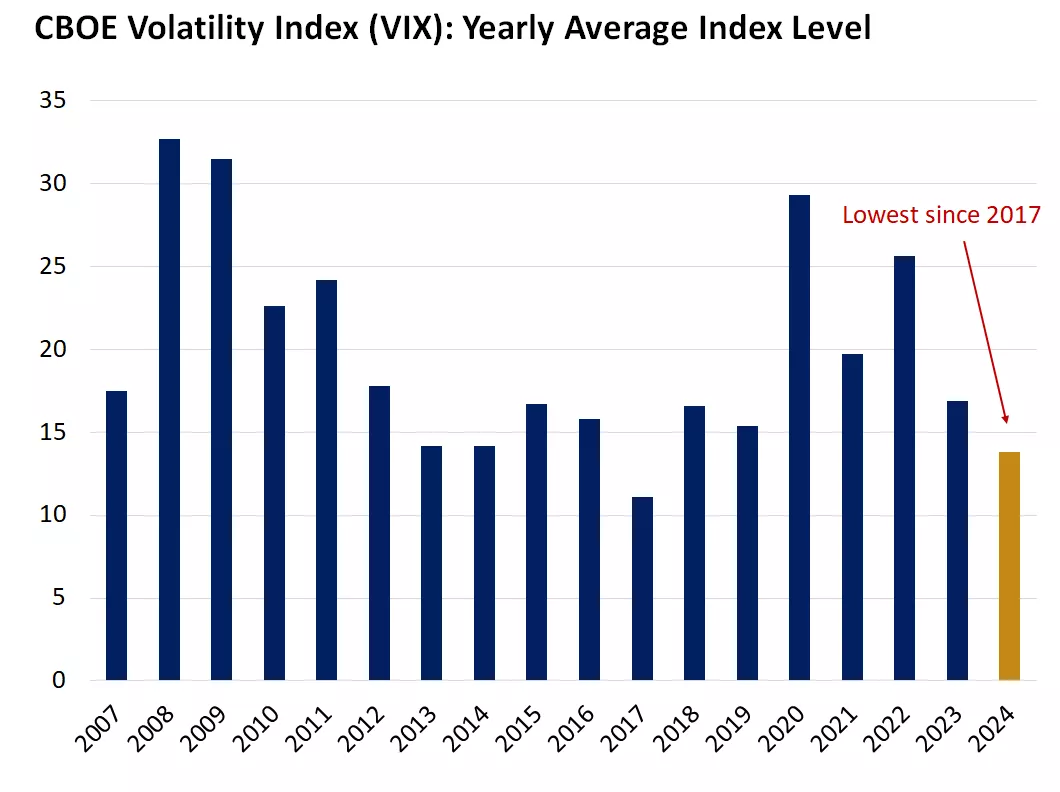

- The VIX index (an index measuring market volatility, often referred to as the "Fear Index") recently fell to its lowest daily reading since 2019. Looking at a broader annual average for the VIX index, 2024's average level of 13.8 is the lowest since 2017 and would be the second-lowest yearly average in more than two decades.

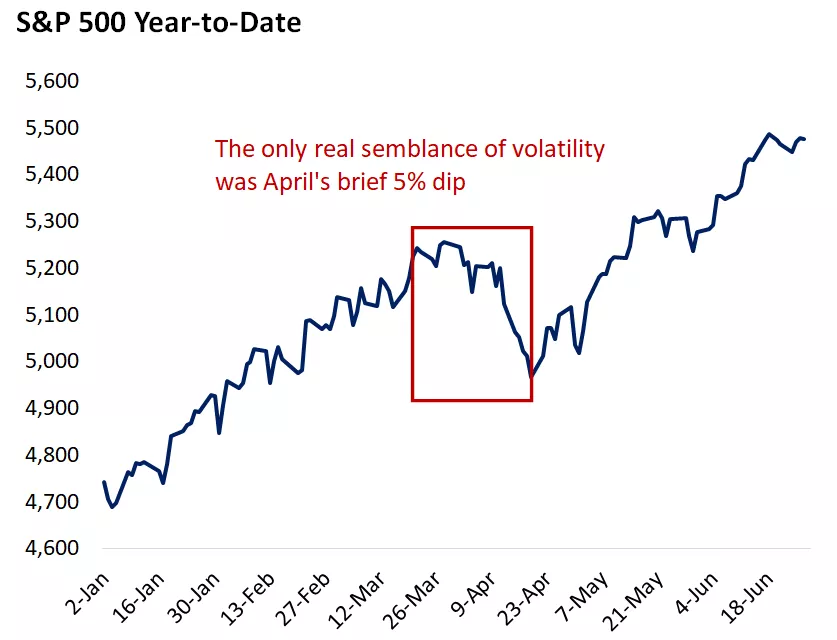

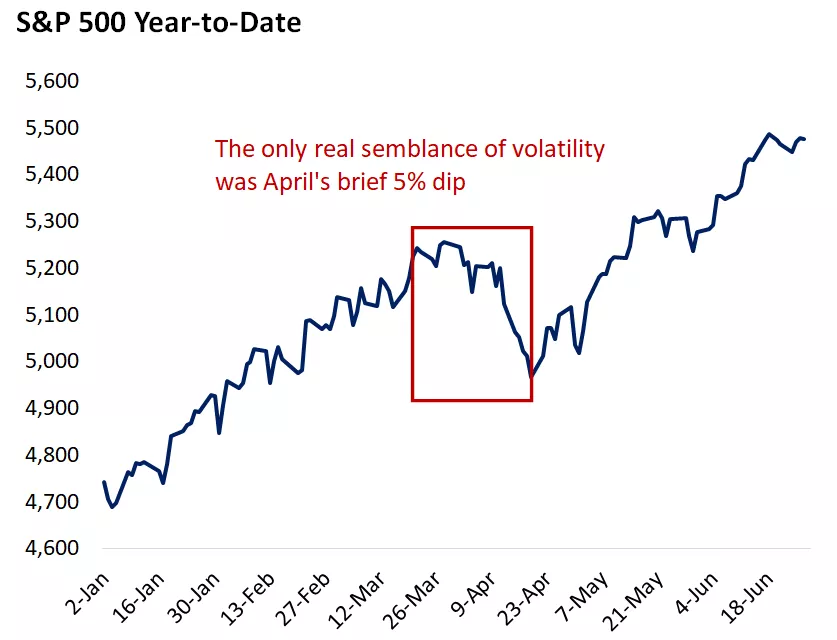

- The largest stock-market pullback in the first half was just a bit over 5%, benign in size and frequency when compared with historical yearly market declines. The drawdown emerged in April as a string of higher-than-anticipated inflation reports pushed interest rates higher and stoked worries of persistent restrictive policy from the Fed. The pullback abated as quickly as it emerged, with the stock market returning to new highs amid additional consumer price and corporate earnings data confirming that investment conditions were still in favorable shape.

Markets have been calm in 2024.

This chart shows the level of the VIX index since 2019. Volatility has been low in 2024.

This chart shows the level of the VIX index since 2019. Volatility has been low in 2024.

Average daily volatility has been the lowest in seven years.

This chart shows the average level of the CBOE volatility index by year. Volatility has been low by historic standards thus far in 2024.

This chart shows the average level of the CBOE volatility index by year. Volatility has been low by historic standards thus far in 2024.

Stocks have only experienced a mild dip so far this year on the path to new highs.

This chart shows the level of the S&P 500 Index year to date. Past performance does not guarantee future results.

This chart shows the level of the S&P 500 Index year to date. Past performance does not guarantee future results.

- Second-half outlook: There's no rule that calm markets cometh before the fall. In fact, we've seen entire calendar years recently – 2013, 2017, 2021 – in which stocks never saw anything more than a 6% pullback for the full year. While that's not inconceivable for 2024, our sense is that investors should anticipate a choppier path in the second half, spurred by election anxieties, any signs of significant weakening in the economy, and/or a spurt of firming inflation that pushes back the timeline for Fed rate cuts. At this stage, we don't see anything brewing that we think would produce a worrisome or lasting decline, but we wouldn't be surprised to see the market catch its breath in the form of a rather routine and temporary 5%-10% dip. Given the positive fundamental backdrop, we'd recommend treating any such pullback as a buying and rebalancing opportunity.

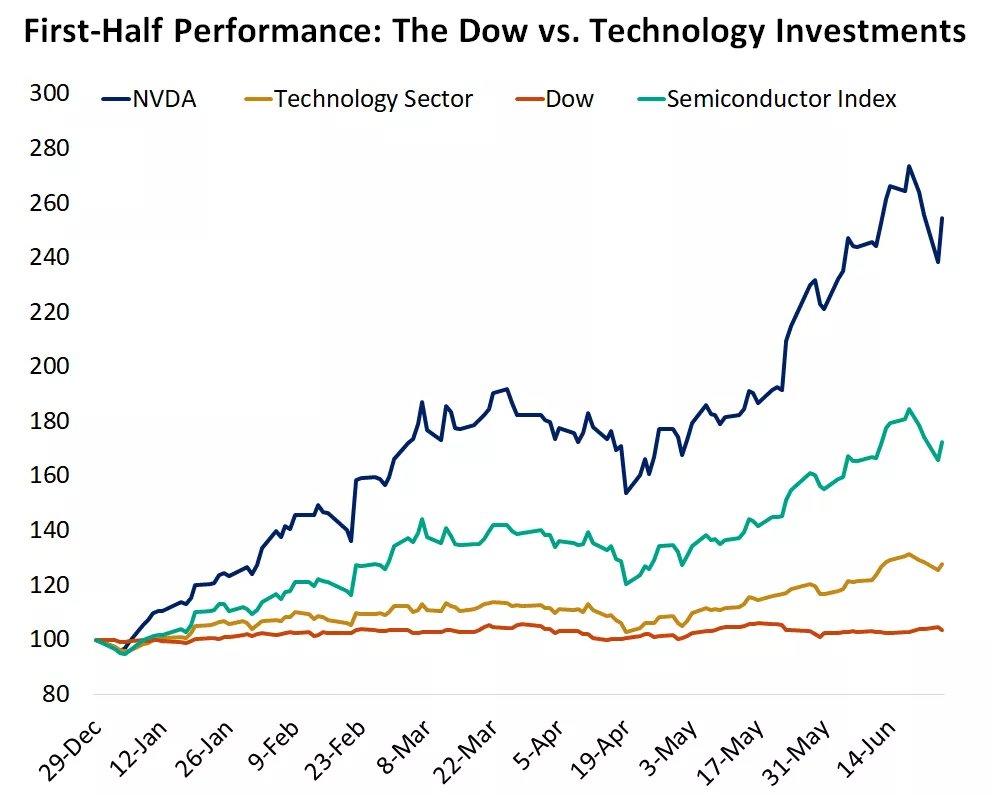

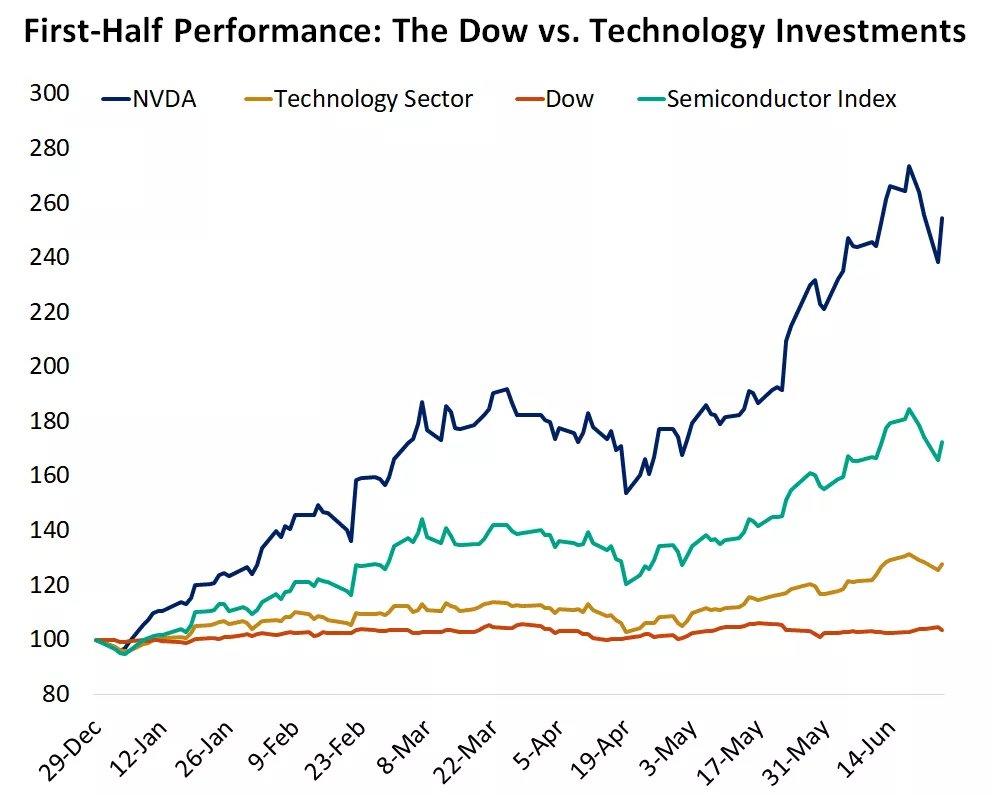

Winner: AI

- Enthusiasm around AI continued in full force in the first half, with the mega-cap technology names delivering outsized gains. The so-called Magnificent 7 (NVIDIA, Microsoft, Apple, Google, Tesla, Meta, Amazon) were in pole position again, logging an average gain of 39% (despite a double-digit decline for Tesla). NVIDIA continued in its role as the poster child for the AI mania in the markets, with shares rising around 150% as the company ascended to the top spot as the world's largest by market cap.

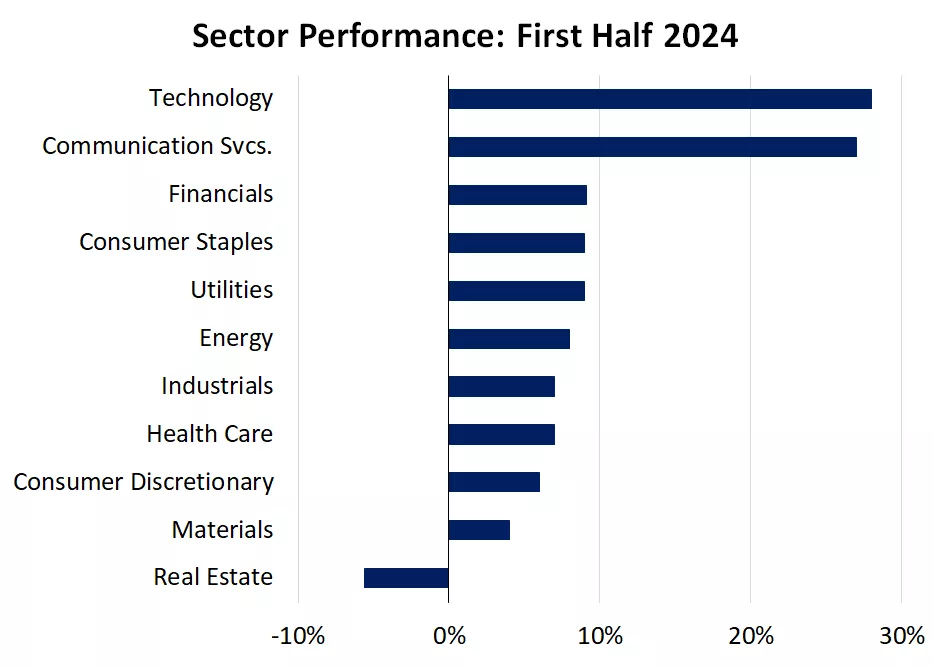

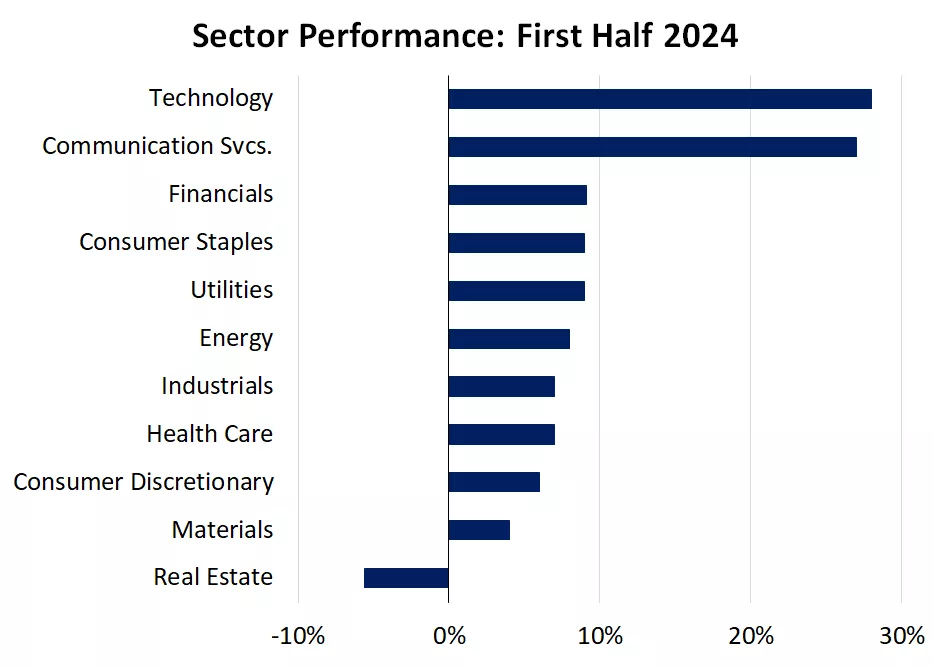

- The technology and communication services sectors led the way, posting first-half returns north of 25%. AI excitement and demand is showing up in both earnings growth and rising valuations. Mega-cap tech names are now trading north of 30 times consensus earnings estimates, reflecting expectations for future growth to remain strong.

Enthusiasm over AI has powered ongoing technology sector outperformance.

This chart shows the performance of the S&P 500 technology sector, NVDIA, the Dow Jones Industrial Average and S&P 500 semiconductor index with performance indexed to 100 on 12/29/2023. Technology investments have far outperformed the Dow year to date. Past performance does not guarantee future results.

This chart shows the performance of the S&P 500 technology sector, NVDIA, the Dow Jones Industrial Average and S&P 500 semiconductor index with performance indexed to 100 on 12/29/2023. Technology investments have far outperformed the Dow year to date. Past performance does not guarantee future results.

- Second-half outlook: The AI train is not at risk of derailing, in our view. We think the impact it can and will have on economic growth (via productivity gains) and corporate profits will be significant and long-lived. At the same time, financial markets have pulled forward that impact (which we think will be felt over the next many years) in the form of prolific gains for investments in the AI space. We don't think the party has to come to an abrupt end, but valuations in the mega-cap tech cohort are full, to say the least. We think tech can continue to do well, but we would not be surprised to see other sectors narrow the lead in the second half.

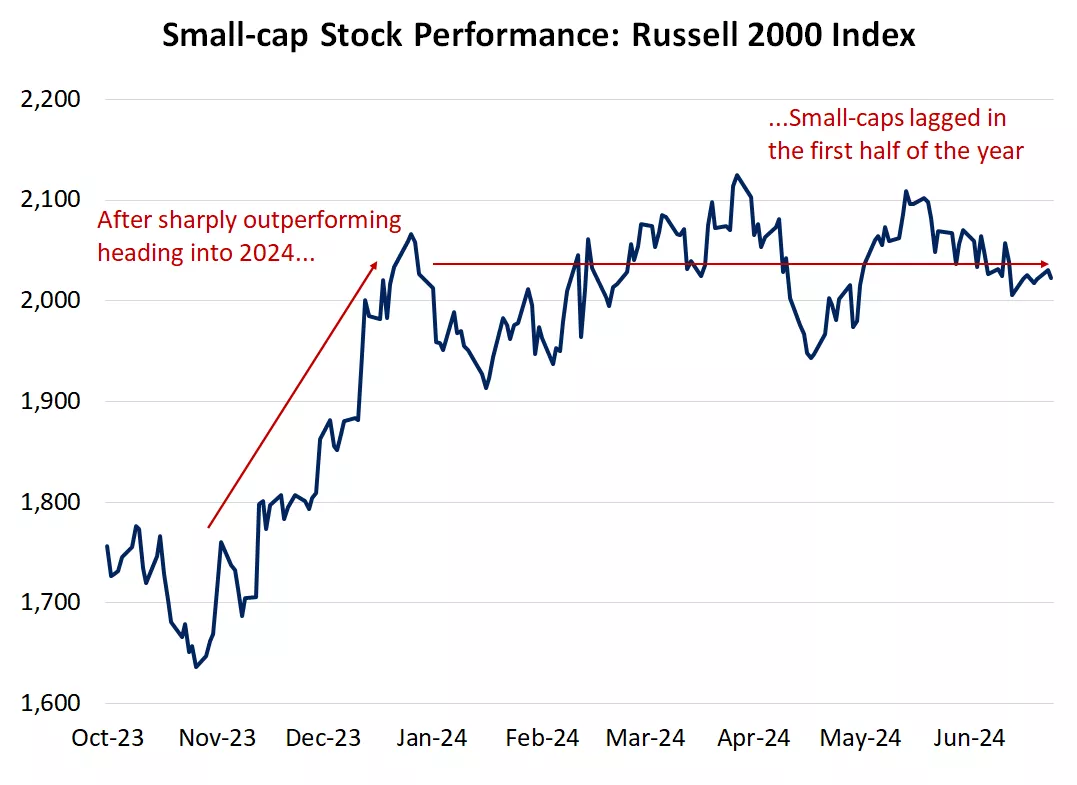

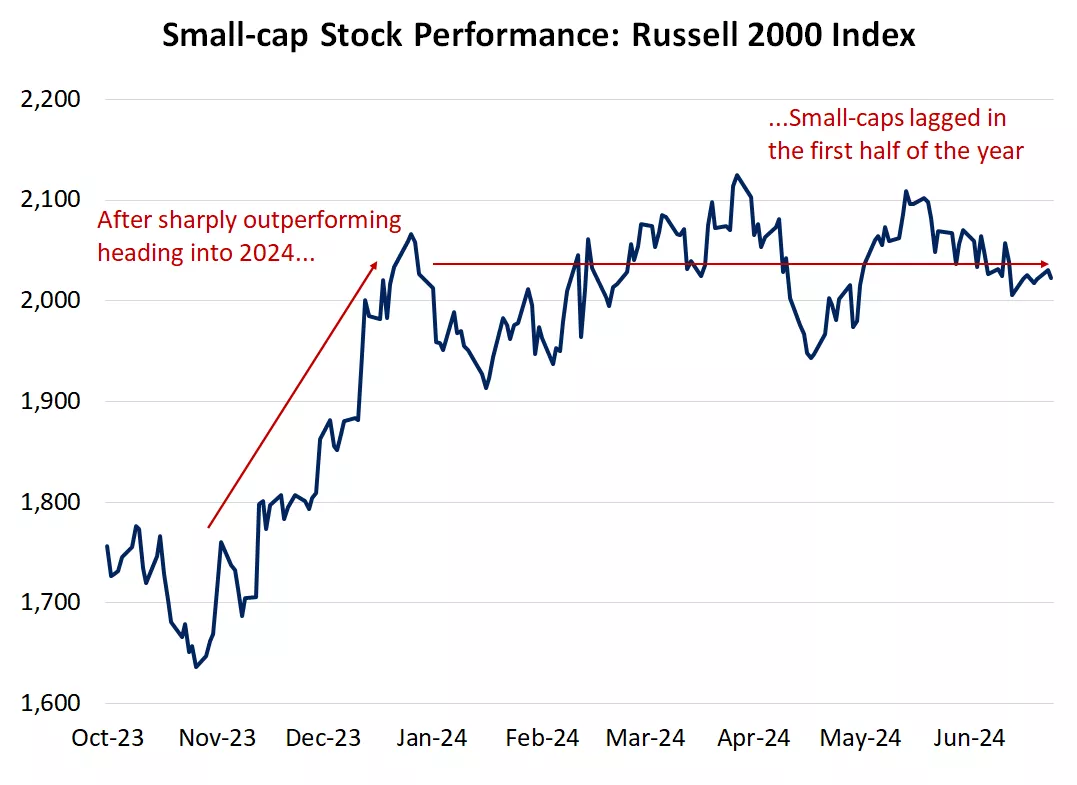

Loser: Small-caps

- Small-cap equities were up slightly in the first half but underperformed large-caps, thanks in large part to the outsized gains in the mega-cap technology cohort alongside weaker earnings growth given the outsized impact from higher funding costs (interest rates) and emerging signals of slowing economic momentum.

- Higher weightings to the industrial and energy sectors, and significantly less exposure to the technology and communication services sectors, were factors in the small-cap index's smaller gains, though it should be noted that small-caps have posted a respectable return of better than 11% over the last 12 months.

Small-cap stocks have trailed amid the mega-cap tech surge, high rates, and signs of softer economic growth.

This chart shows the level of the Russell 2000 Index. After a sharp rally in the final months of 2024, the index is roughly flat year to date. Past performance does not guarantee future results.

This chart shows the level of the Russell 2000 Index. After a sharp rally in the final months of 2024, the index is roughly flat year to date. Past performance does not guarantee future results.

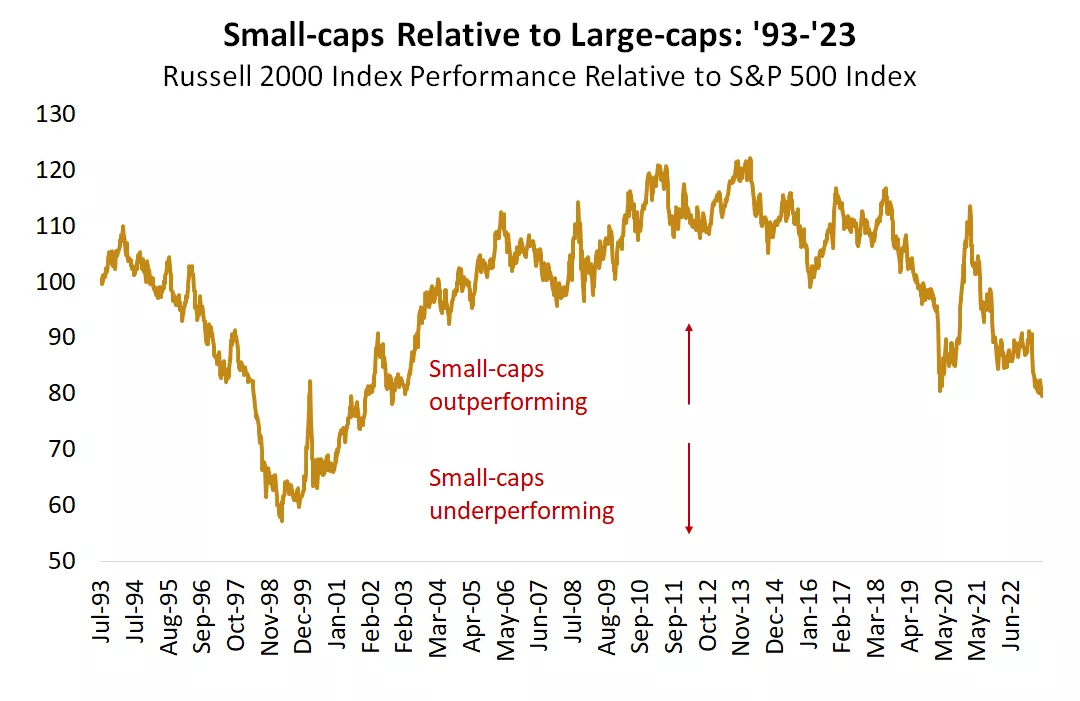

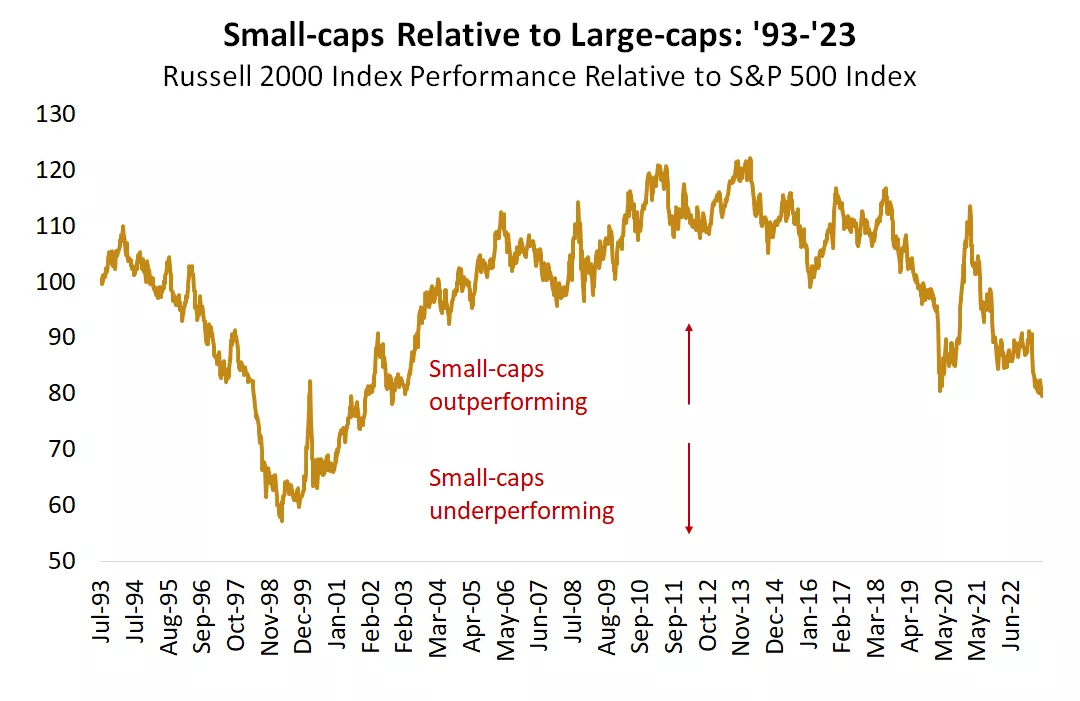

A broader view: Relative performance between small- and large-caps has rotated.

This chart shows the relative performance of U.S. large-cap versus U.S. small-cap stocks since 1993. Large-cap stocks have outperformed since 2021. Past performance does not guarantee future results.

This chart shows the relative performance of U.S. large-cap versus U.S. small-cap stocks since 1993. Large-cap stocks have outperformed since 2021. Past performance does not guarantee future results.

- Second-half outlook: Historically, periods of material underperformance for small-caps relative to large-caps were followed by a reversal in that leadership. We wouldn't rule out a revival in small-cap outperformance, but it will, in our view, require a few things: a more convincing decline in interest rates, easing Fed policy, and an acceleration in expected economic growth. Small-caps are more sensitive to borrowing and labor costs as well as domestic demand, so the emergence of the three conditions would put some wind at the back of this asset class, as was the case in the months leading up to 2024. With the economy showing some signs of fatigue of late, a reacceleration in economic momentum may take longer than the second half of 2024 to fully materialize, but we think the commencement of easier monetary-policy settings could be a good start.

Winner: Defensives

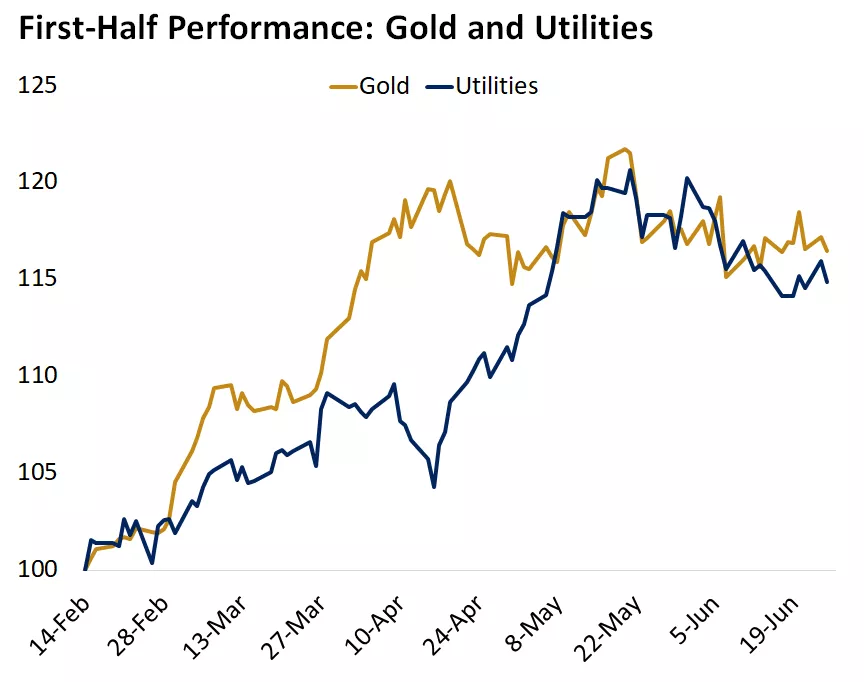

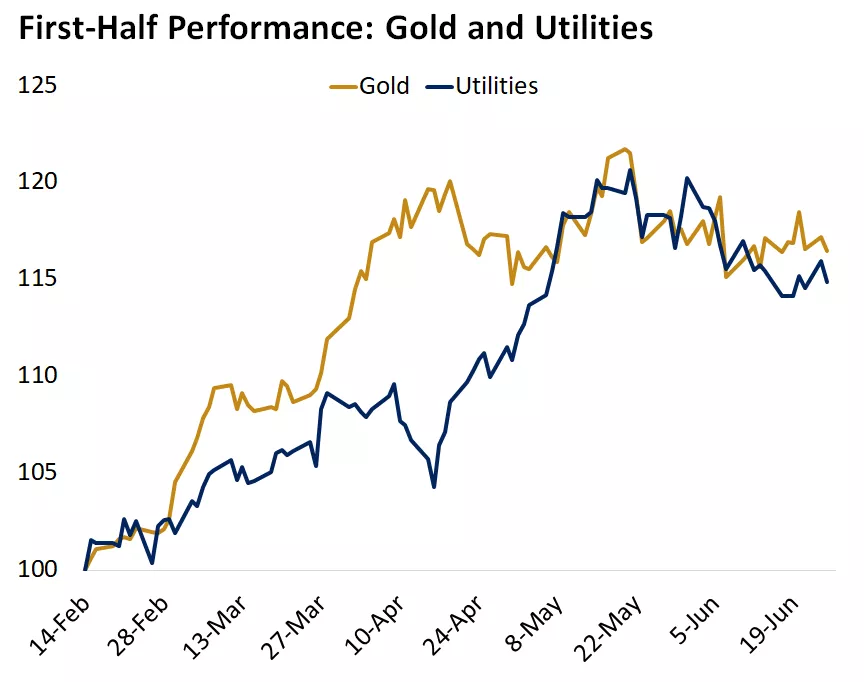

- Looking simply at the sizable market gain and the absence of any meaningful pullback so far this year, one might logically assume it's been a "risk on" environment in which riskier and high-growth investments have seen all the rewards. One would be wrong. Traditionally defensive areas like utilities, consumer staples and gold have produced strong gains. Since mid-February, utilities and gold have risen roughly 15%.

Traditionally defensive investments like gold and utilities rallied sharply from February through May.

This chart shows the performance of the S&P 500 utilities sector and the price of gold since February 14, 2024. Both have risen over this period. Past performance does not guarantee future results.

This chart shows the performance of the S&P 500 utilities sector and the price of gold since February 14, 2024. Both have risen over this period. Past performance does not guarantee future results.

While tech continues to lead, other sectors closed the gap in the first half compared with last year.

This chart shows the S&P 500 sector performance year to date. Technology and communication services have been the top performers, each gaining over 25%. Past performance does not guarantee future results.

This chart shows the S&P 500 sector performance year to date. Technology and communication services have been the top performers, each gaining over 25%. Past performance does not guarantee future results.

- Second-half outlook: Our view at the start of the year was that equity-market leadership would rotate, with gains broadening out, including better performance from cyclicals and defensives. We expect economic growth to slow but not disappear in the coming quarters as consumers show a bit of spending fatigue. Worries over stagflation (high inflation, no growth) would be misplaced in 2024, in our view, but such concerns could offer additional support to defensives. At the same time, a shift toward a Fed easing cycle offers the prospects of renewed support to the economy, which would help more cyclical investments. The bottom line: This has been, and may continue to be, a tech-driven market, but we think the outlook bodes well for greater breadth within future gains.

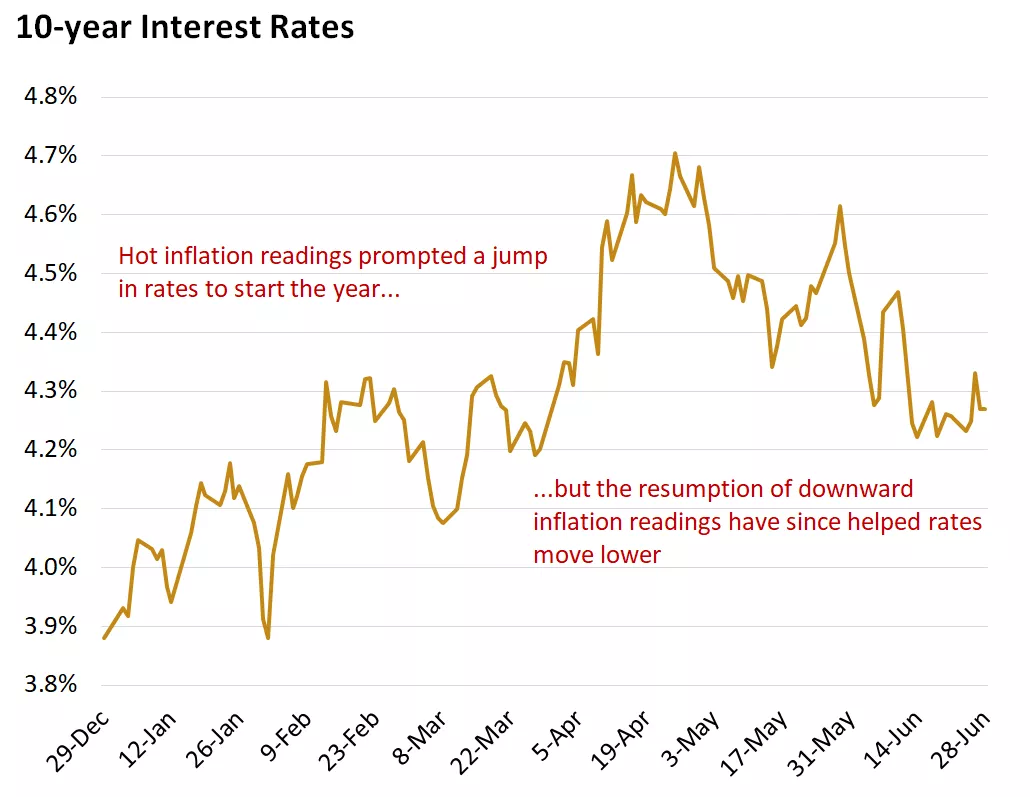

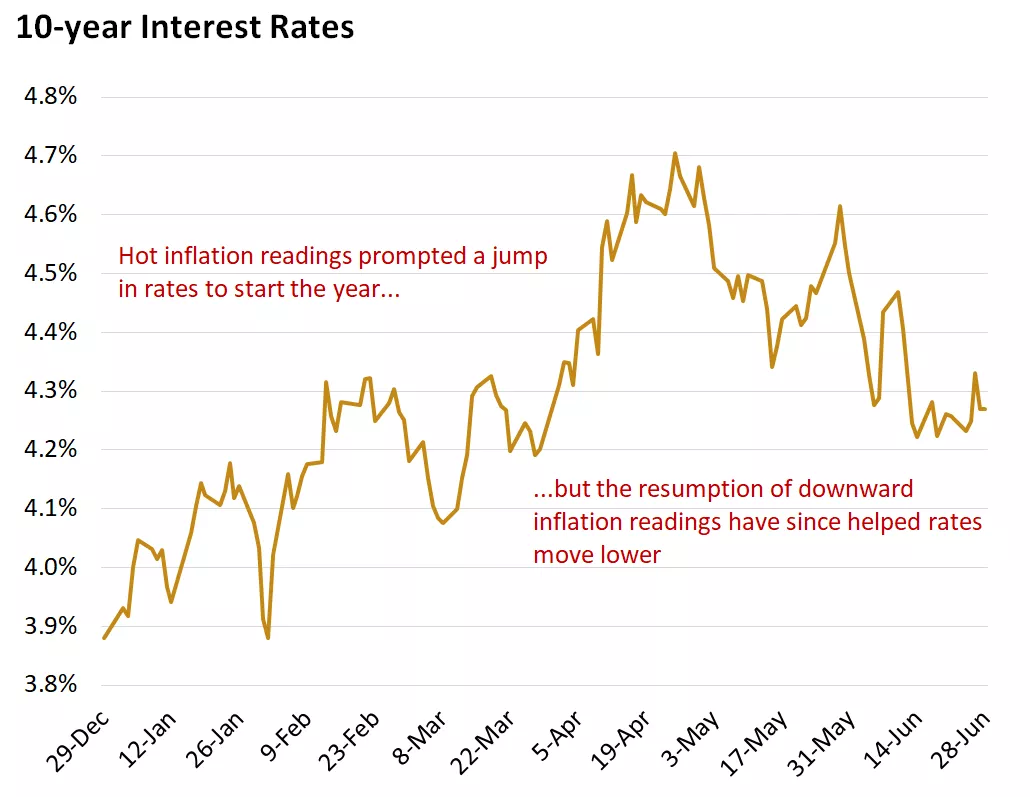

Loser: Interest-rate predictions

- There has been a camp within the markets calling for long-term rates to rise amid a new, persistently high inflation environment and runaway federal budget deficits. To be clear, we believe deficits are a real problem, with rising government debt posing a structural challenge down the road. But they're not, in our view, going to produce a bond-market seizure this year that would send rates dramatically higher on worries of a deteriorating fiscal position in the U.S.

- Rates did rise during a phase in the first half, but did so due to a string of hotter-than-expected inflation readings that prompted an adjustment to Fed rate-cut expectations. Futures markets reflected a consensus view at the beginning of the year that the Fed would cut rates six times starting in March.* As was well documented in our 2024 Outlook report and our Weekly Market Wrap commentary, we did not subscribe to that view. It didn't appear feasible to us that the Fed would cut rates before seeing a string of data confirming that inflation was on a credible path lower. To be fair, our crystal ball was not infallible, as our expectations at the start of the year were for the Fed to implement roughly three cuts in 2024, starting in the summer. This proved a bit premature, as stubborn inflation readings have delayed the Fed's pivot.

Longer-term rates rose and then fell in the first half as Fed rate cut predictions were revised.

This chart shows the level of the 10-year U.S. Treasury Yield. After rising to start the year, yields have pulled back in recent months. Past performance does not guarantee future results.

This chart shows the level of the 10-year U.S. Treasury Yield. After rising to start the year, yields have pulled back in recent months. Past performance does not guarantee future results.

- Second-half outlook: Longer-term interest rates have moved lower of late, with 10-year yields falling from 4.7% in April to below 4.3% in June. We maintain our view that 10-year rates will gradually move lower as we progress, led by moderating inflation, easier Fed policy, and softer economic activity. We've revised our expectations for Fed rate cuts, as we think recent and incoming data support a case for one cut (or possibly two, if the inflation stars align) in 2024. We believe the Fed will be content to take it slow when it comes to the easing cycle, seeking to reduce restrictive monetary settings to support the economy while trying to avoid the potential for a return to rate hikes, which would be a significantly adverse scenario for markets. We think this will take the form of a cut-pause-cut process, assessing incoming data to inform timing. The upshot is that the next phase of monetary policy will, in our view, be an easing one. While the markets may endure bouts of indigestion around the timing of the first cut, the bigger backdrop of a Fed rate-cutting cycle is broadly favorable for economic and investment conditions.

Craig Fehr, CFA

Investment Strategy

Source: *Bloomberg

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 39,119 | -0.1% | 3.8% |

| S&P 500 Index | 5,460 | -0.1% | 14.5% |

| NASDAQ | 17,733 | 0.2% | 18.1% |

| MSCI EAFE* | 2,314 | 0.3% | 3.5% |

| 10-yr Treasury Yield | 4.38% | 0.1% | 0.5% |

| Oil ($/bbl) | $81.52 | 1.0% | 13.8% |

| Bonds | $97.07 | -0.7% | -0.2% |

Source: FactSet, 6/28/2024. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *4-day performance ending on Thursday.

The week ahead

Important economic releases this week include the ISM manufacturing PMI and the nonfarm payrolls report for June.

Review last week's weekly market update.

Craig Fehr

Craig Fehr is a principal and the leader of investment strategy for Edward Jones. Craig is responsible for analyzing and interpreting economic trends and market conditions, along with constructing investment strategies and asset allocation guidance designed to help investors reach their financial goals.

He has been featured in Barron’s, The Wall Street Journal, the Financial Times, SmartMoney magazine, MarketWatch, the Financial Post, Yahoo! Finance, Bloomberg News, Reuters, CNBC and Investment Executive TV.

Craig holds a master's degree in finance from Harvard University, an MBA with an emphasis in economics from Saint Louis University and a graduate certificate in economics from Harvard.

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.