Weekly market wrap

New year, new policies — but a familiar supportive backdrop

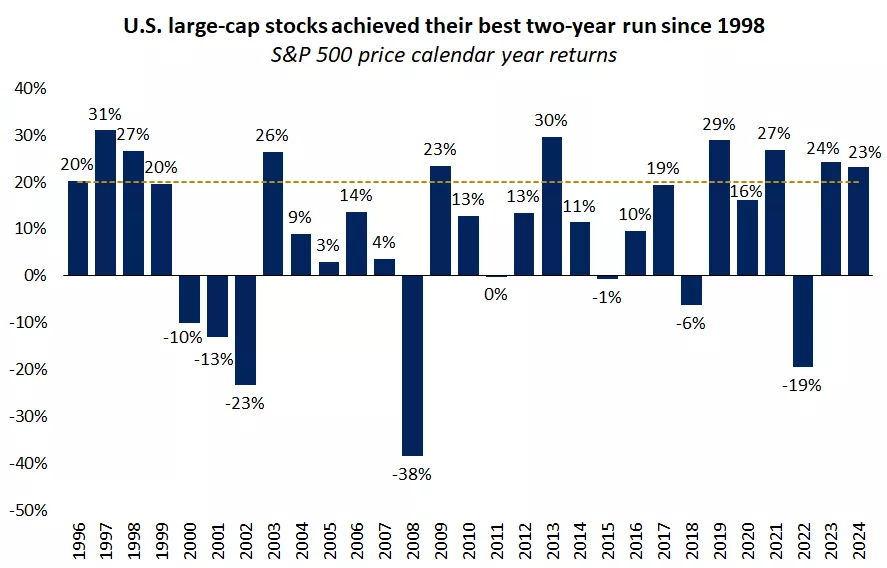

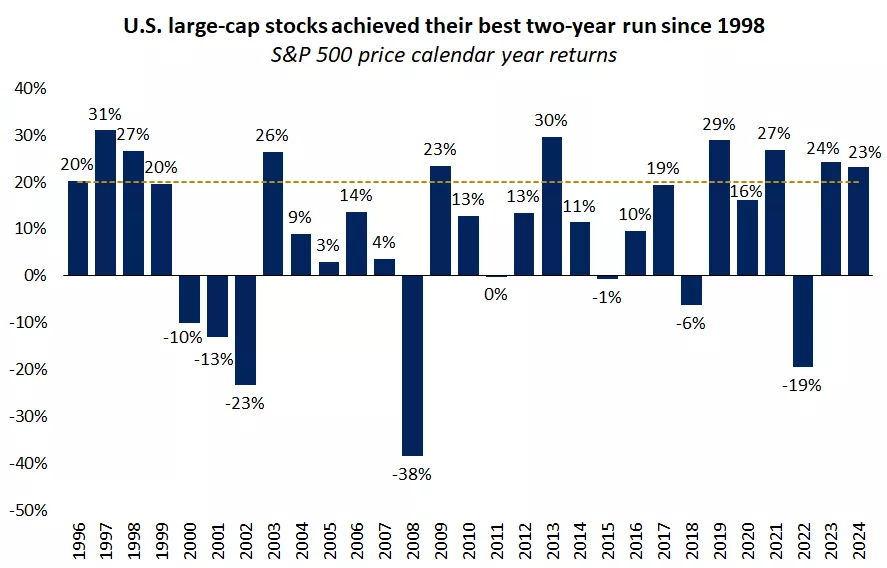

Despite an underwhelming end, 2024 proved to be a stellar year for investors. The S&P 500 set 57 record highs and achieved its second consecutive year of 20%-plus performance for the first time since 1998.1 Mega-cap tech led the way, but portfolios enjoyed solid gains across sectors, styles and market caps. Now that 2024’s strong performance is in the rearview mirror, it’s natural for investors to ask if the good times can continue.

We think 2025 will bring a mix of headwinds and tailwinds along with some policy uncertainty around tariffs, taxes and interest rates. But ultimately, we believe stocks and bonds can build on 2024’s gains, as the main drivers that propelled the stock market higher over the past 12 months appear poised to continue. We expect another year of healthy economic growth, rising corporate profits and a continued normalization of Federal Reserve policy, all of which can support the ongoing bull market.

Here are five key views for 2025.

The graph shows calendar year returns for the S&P 500. In 2024 large-cap stocks achieved their best two-year run since 1998. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

The graph shows calendar year returns for the S&P 500. In 2024 large-cap stocks achieved their best two-year run since 1998. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

1. U.S. economic growth cools, but the “soft landing” prevails

- Defying expectations for a sharper slowdown, the U.S. economy appears to have grown at a 2.7% pace in 2024 (including Q4 estimates). This is down only marginally from 2023’s 2.9% rate and above the estimated long-term growth rate of around 2%.1 For 2025, we believe the U.S. economy will continue to see positive but more moderate economic momentum.

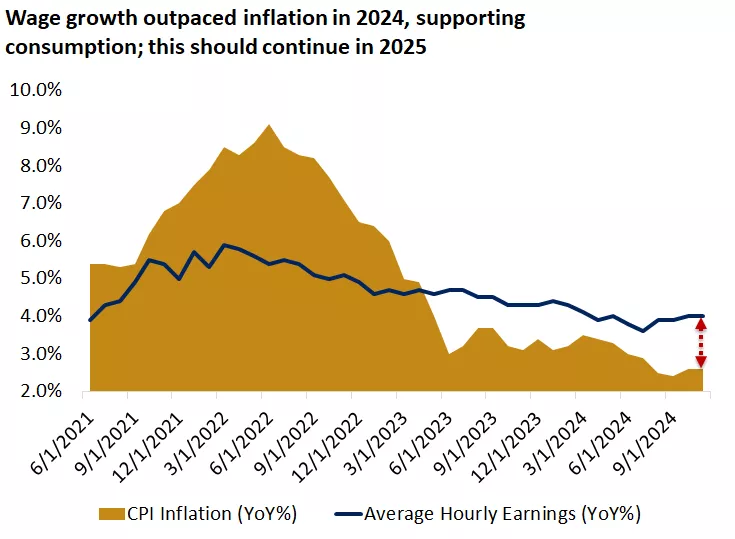

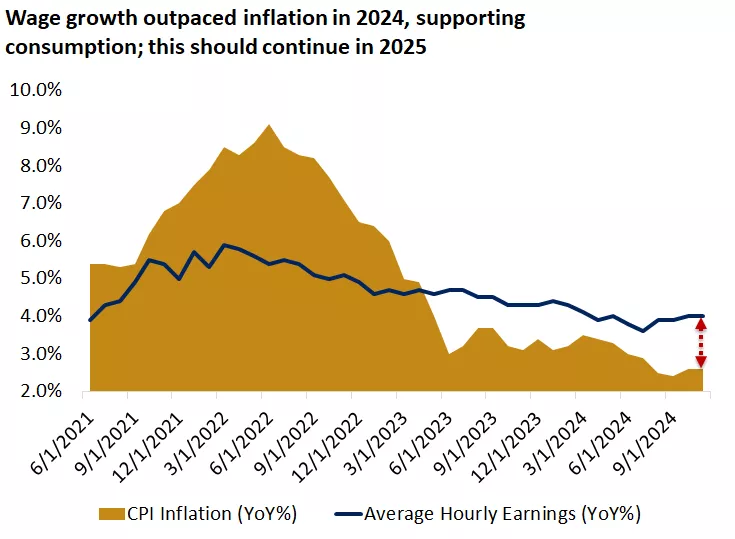

- Consumer spending, which accounts for 70% of gross domestic product (GDP), remains supported by a healthy labor market, wages that are rising faster than inflation, and appreciating real estate and portfolio values.

- Spending on services such as travel and hospitality is likely to slow after a period of exceptional strength, but the U.S. manufacturing sector may stabilize and expand. An “average” year — with GDP growing around its long-term potential — can validate expectations of a soft landing and still provide a favorable backdrop for corporate profits to continue to grow.

This chart shows that wage growth has outpaced headline inflation since mid-2023.

This chart shows that wage growth has outpaced headline inflation since mid-2023.

2. The Fed slows the pace of interest rate cuts, settling in the 3.5%–4% range

- The Fed’s 0.25% rate cut and updated projections in December shifted interest rate expectations higher, as policymakers now see fewer cuts in 2025. The economy continues to perform well, and there is some uncertainty around how fast inflation will return to target, so the Fed is in no rush to cut rates.

- However, the fed funds rate is now around 4.5%, well above inflation rates of about 2.5%. We believe there is room to bring policy rates down, likely settling in the 3.5% to 4% range in 2025. Two or possibly three rate cuts is a realistic expectation, in our view, but there are uncertainties the Fed will have to navigate.

- The new administration’s pro-growth policies and inflationary pressures could cause the Fed to cut rates less than expected. On the other hand, any deterioration in growth could bring the Fed to cut rates more than expected.

- The good news is that we expect inflation to remain contained, without a return to rates above 4%. The Fed will proceed cautiously as the last mile for inflation might be bumpy, but we still believe inflation will continue its cooling trend.

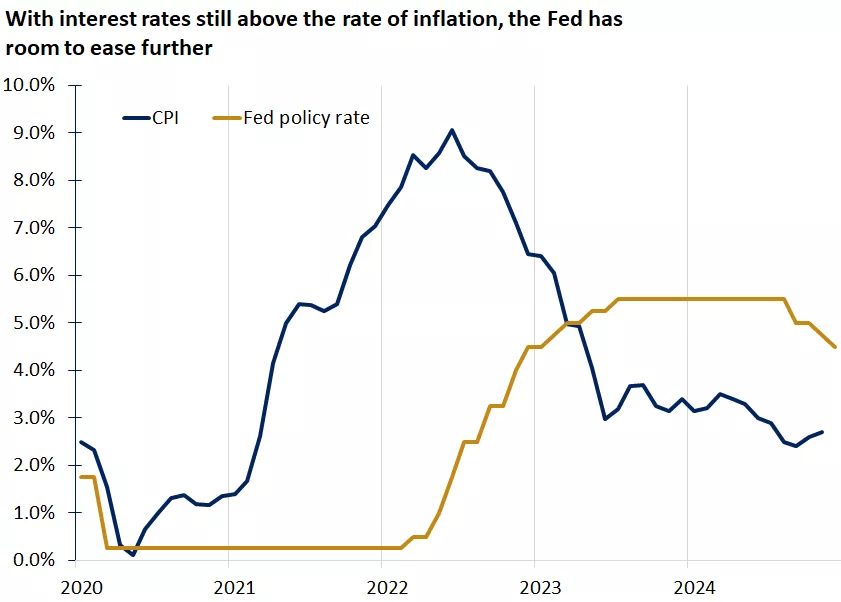

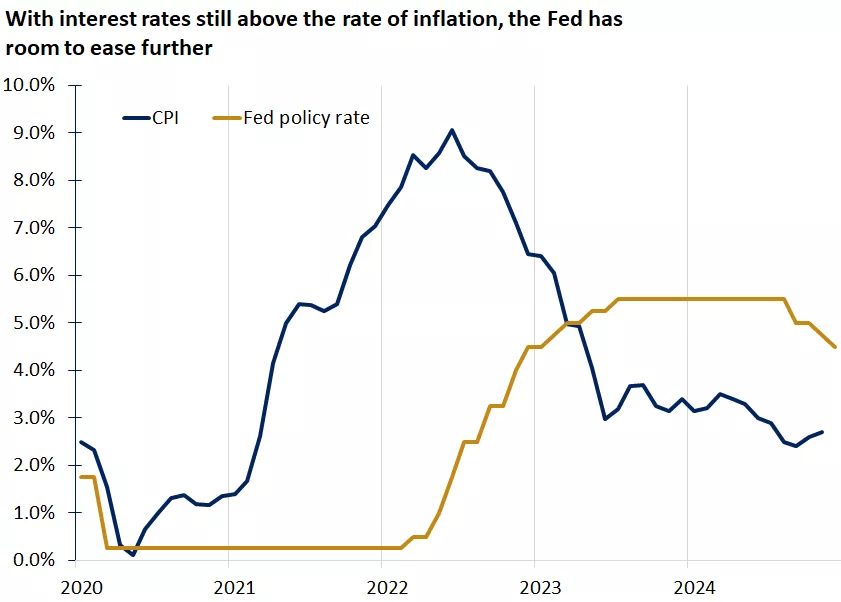

The graph shows that Fed policy rates are still above the rate of inflation suggesting that the Fed has room to ease policy further.

The graph shows that Fed policy rates are still above the rate of inflation suggesting that the Fed has room to ease policy further.

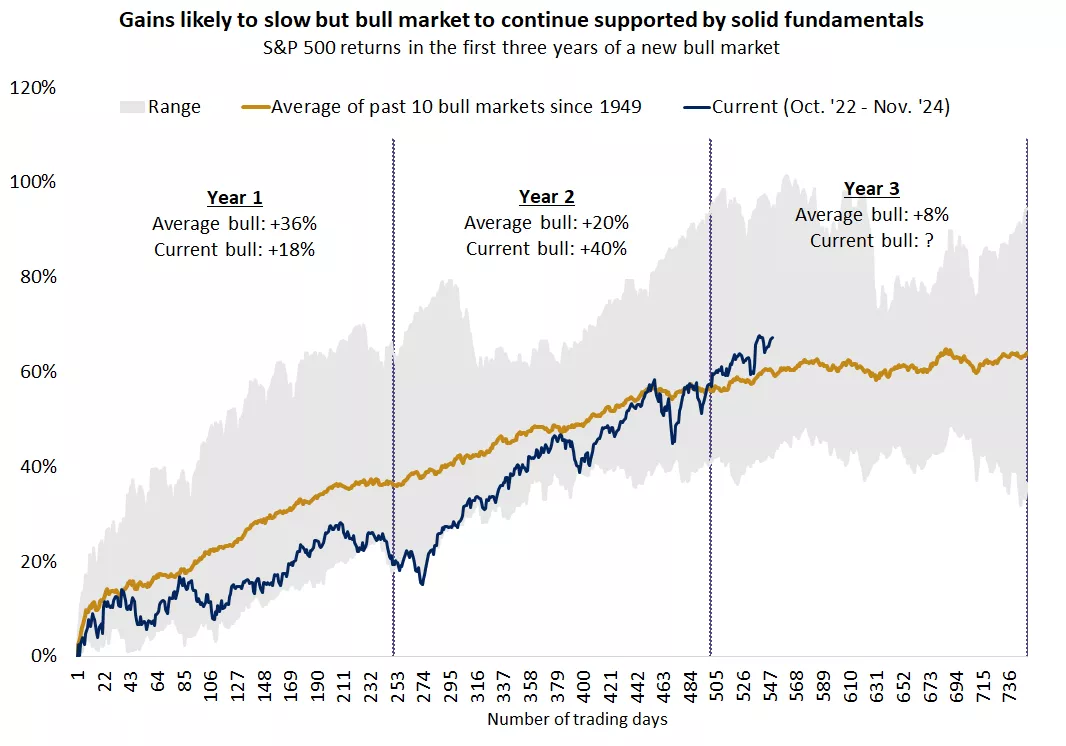

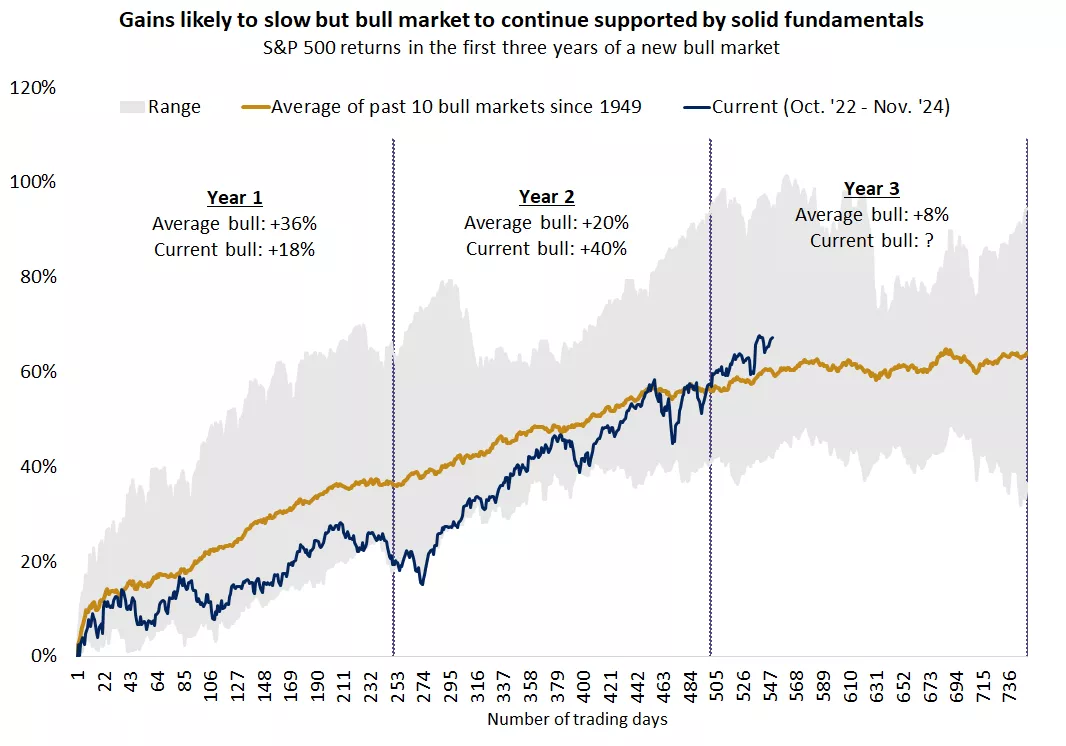

3. The bull market continues into year 3, with moderate gains

- As with the pace of economic growth, stock market gains are likely to cool. After the sharp move higher for equities in 2024, it will not be surprising to see markets take a breather in the short term. Expectations are high given the rise in valuations over the past two years, leaving less cushion for error as we advance. Also, uncertainty around the policies a second Trump administration will pursue could trigger bouts of volatility, especially if issues such as tariffs are pushed through before the pro-growth measures kick in.

- Nonetheless, fundamentals remain broadly positive, suggesting investors can lean into any emerging volatility. Historically, bull markets end because of a recession, Fed interest rate hikes or an external shock. While the latter is tough to handicap, we don’t see an economic downturn or the resumption of Fed tightening on the horizon.

- Earnings growth will have to do the heavy lifting for market returns instead of further valuation expansion. We expect S&P 500 profits to grow 10%–15%. The low end of this range is our base case expectation, but the high end is possible if policies such as corporate tax cuts are delivered.

This chart shows the performance of the S&P 500 price index in each of the past 10 bull markets since 1949 as they have approached year three. Historical bull markets include 1949, 1957, 1962, 1974, 1982, 1987, 1990, 2002, 2009 and the current bull market. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows the performance of the S&P 500 price index in each of the past 10 bull markets since 1949 as they have approached year three. Historical bull markets include 1949, 1957, 1962, 1974, 1982, 1987, 1990, 2002, 2009 and the current bull market. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

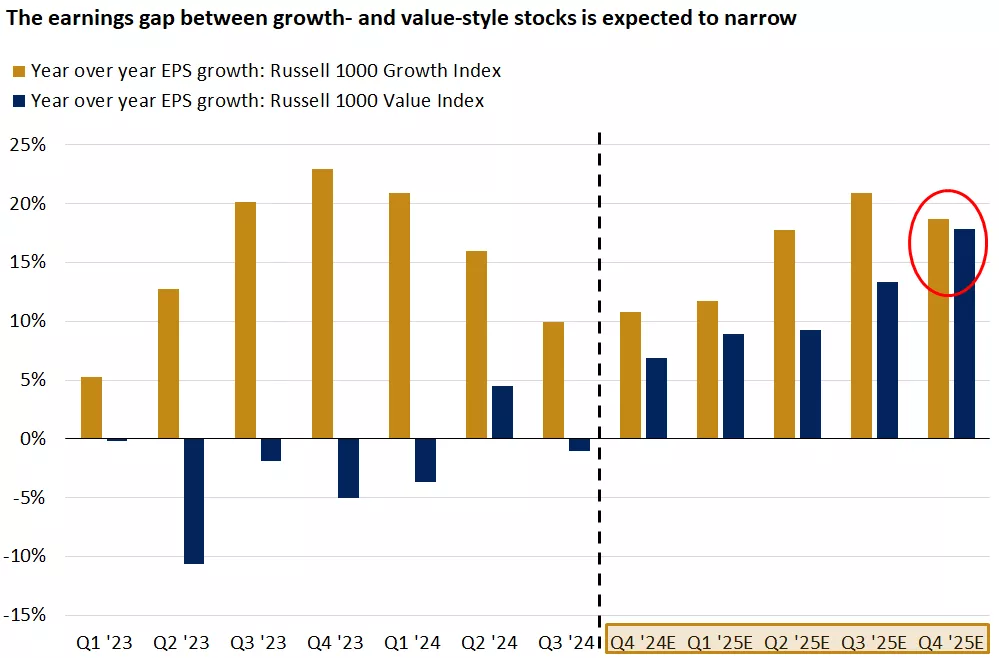

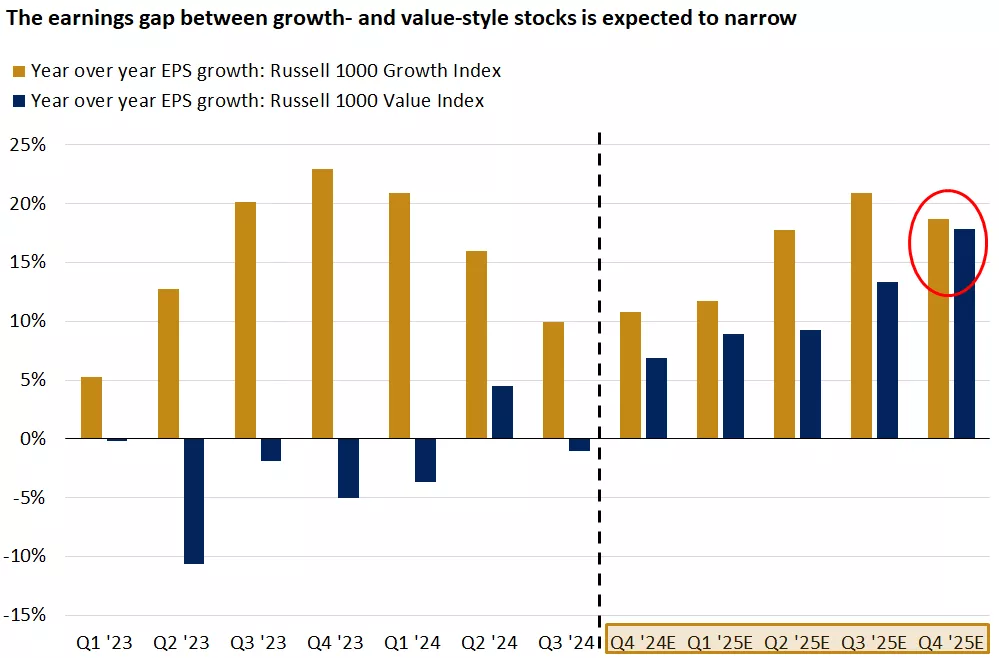

4. Broadening leadership strengthens the case for portfolio diversification

- While market leadership started to broaden in the second half of 2024, the divergence in performance remains wide, offering opportunities for long-term investors. Valuations for the lagging segments of the equity market — including small- and mid-caps, value-style investments, cyclical sectors and high-quality dividend stocks — are favorable. But a catalyst is needed to unlock these discounted valuations, especially as enthusiasm around AI and mega-cap tech stocks continues unabated.

- We consider the following potential catalysts for diversification to dethrone concentration in 2025:

- Accelerating earnings growth for other parts of the market versus strong but slowing earnings growth for mega-cap tech

- Deregulation and pro-growth policies benefiting cyclical sectors such as industrials and financials

- Trade uncertainty, which could impact growth-style stocks more as they derive 50% of their revenue from abroad versus 30% for value-style stocks.2

- A gradual transition from the build-out and development phase of AI, which benefited a narrow group of companies, to technology adoption across different sectors of the economy

This chart shows earnings estimates for the Russell 1000 Growth Index and Russell 1000 Value Index. Both indexes are expected to see positive earnings growth in 2025. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows earnings estimates for the Russell 1000 Growth Index and Russell 1000 Value Index. Both indexes are expected to see positive earnings growth in 2025. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

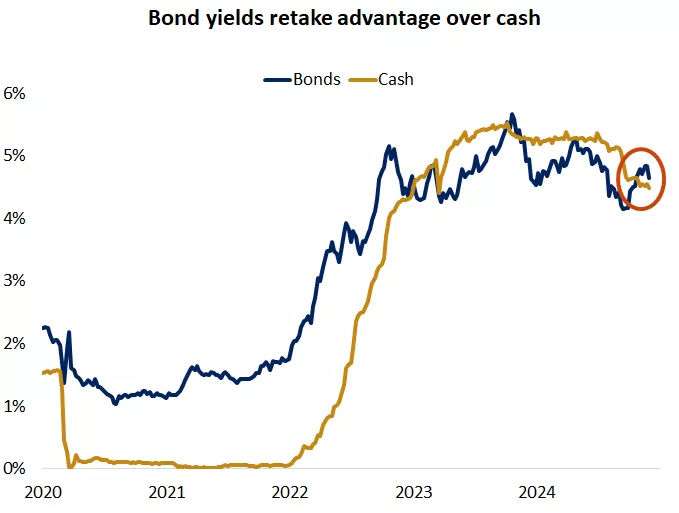

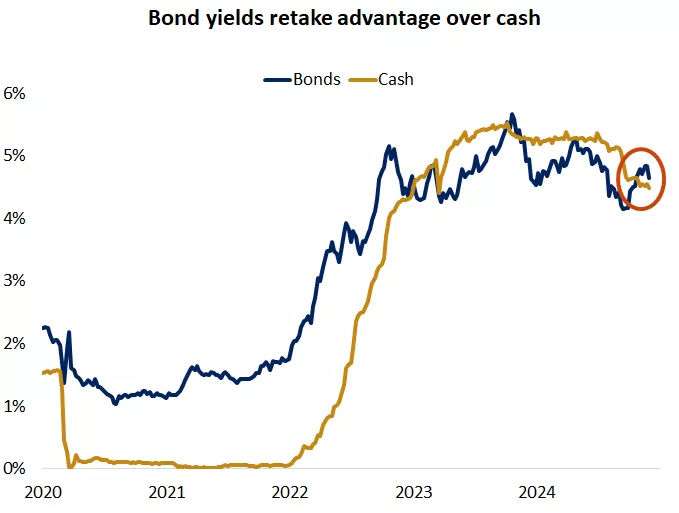

5. 10-year yield remains range-bound, but bonds take the lead over cash

- Bonds experienced another volatile year in 2024, with long-term yields rising despite the Fed cutting its policy rate by 1%. We think the 10-year Treasury yield might spend most of 2025 in the 4% to 4.5% range. We believe there are guardrails on both sides of that range. Additional Fed rate cuts and bond purchases should help keep yields from rising meaningfully. On the other hand, resilient growth, widening deficits and uncertainty around inflation could prevent yields from falling sustainably.

- In 2024, cash outperformed U.S. investment-grade bonds for the third time in the past four years. Despite these results, bonds still offer attractive income and the potential for price appreciation. The Fed easing cycle will continue in 2025, and cash yields are already below bond yields. In our view, this sets up bonds to outperform cash in 2025.

This chart shows that the yield on U.S. investment-grade bonds exceeds the yield on cash. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows that the yield on U.S. investment-grade bonds exceeds the yield on cash. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

Staying opportunistic while keeping expectations realistic

- No doubt 2025 will bring its own twists and turns in the market narrative, but there are reasons for cautious optimism as we enter the new year. We still see a Fed that wants to gradually ease policy, while the labor market is healthy and economic growth robust. Valuations have risen and policy uncertainty is high, but that should not preclude corporate profits from rising, providing fuel for further gains.

- While we recommend staying invested to participate in the broader expansion, investors should: 1) Rebalance appropriately to ensure proper diversification to help navigate the bumps along the way, 2) calibrate realistic expectations for volatility and more moderate gains as we advance.

- The upshot is that fundamentals remain healthy, pointing to a solid handoff to the new year. While it may not be a smooth ride, we believe equities have the potential to build on their strength as market leadership continues to evolve.

From all of us at Edward Jones, we wish you a healthy and prosperous new year!

Angelo Kourkafas, CFA

Investment Strategist

Sources: 1. Bloomberg, 2. FactSet

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 42,732 | -0.6% | 0.4% |

| S&P 500 Index | 5,942 | -0.5% | 1.0% |

| NASDAQ | 19,622 | -0.5% | 1.6% |

| MSCI EAFE* | 2,188.58 | -2.1% | -0.3% |

| 10-yr Treasury Yield | 4.60% | 0.0% | 0.7% |

| Oil ($/bbl) | $74.02 | 4.8% | 3.2% |

| Bonds | $96.81 | 0.2% | 0.0% |

Source: FactSet, 1/3/2025. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *Morningstar Direct 1/5/2025.

The week ahead

Important economic releases this week include the ISM services PMI and nonfarm payrolls for December.

Review last week's weekly market update.

Angelo Kourkafas

Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, FORTUNE magazine, Marketwatch, U.S. News & World Report, The Observer and the Financial Post.

Angelo graduated magna cum laude with a bachelor’s degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.