Weekly market wrap

2025 kicks off with solid fundamentals, even as political shifts are underway

Key Takeaways:

- In both the U.S. and Canada, the economic fundamentals heading into 2025 were resilient. Real GDP (gross domestic product) growth was positive, inflation remained contained, and central banks were moving interest rates lower.

- This past week, the data confirmed a continuation of this positive economic trend. The December labor market data in both economies surprised to the upside. Notably, wage gains continue to outpace inflation rates, a positive for consumers and sentiment.

- However, with economic strength improving, the odds of further central-bank rate cuts have moved lower. As a result, government bond yields moved higher last week, and stock markets declined. While higher rates may put pressure on valuations and spark some bouts of volatility, we believe the bull market remains supported, especially as we see earnings growth continuing to deliver in the year ahead.

- Both economies also face shifts in political regimes in the weeks ahead. In the U.S., inauguration day for President-elect Trump is on January 20. All eyes remain on which policies the new administration will choose to prioritize, including immigration, energy reform, tariffs and taxes.

- In Canada, this past week, Prime Minister Trudeau announced his resignation and halted Parliament operations through March 24. However, this resignation had been largely speculated since mid-December, and Trudeau will remain in power until a new leader of the Liberal Party is selected.

- Overall, history has shown us that political headlines alone do not drive markets. Instead, financial markets take cues from fundamentals, including economic and earnings growth and central-bank policy. In our view, the economic and labor-market fundamentals in the U.S. and Canada remain resilient, and central banks are still poised to move rates lower, albeit more modestly so. We believe volatility may remain elevated while political and policy uncertainty is resolved, but pullbacks can be used as opportunities for investors amid the ongoing economic and earnings expansion.

Fundamentals intact: The labor market is off to a strong start in 2025

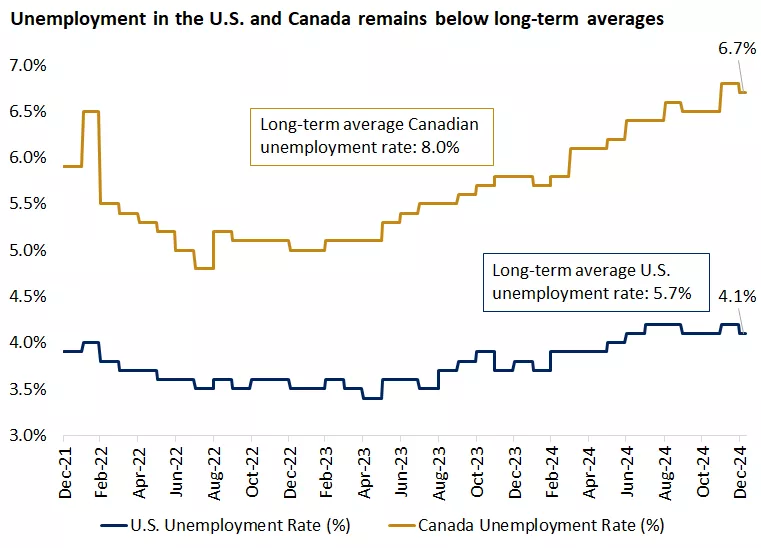

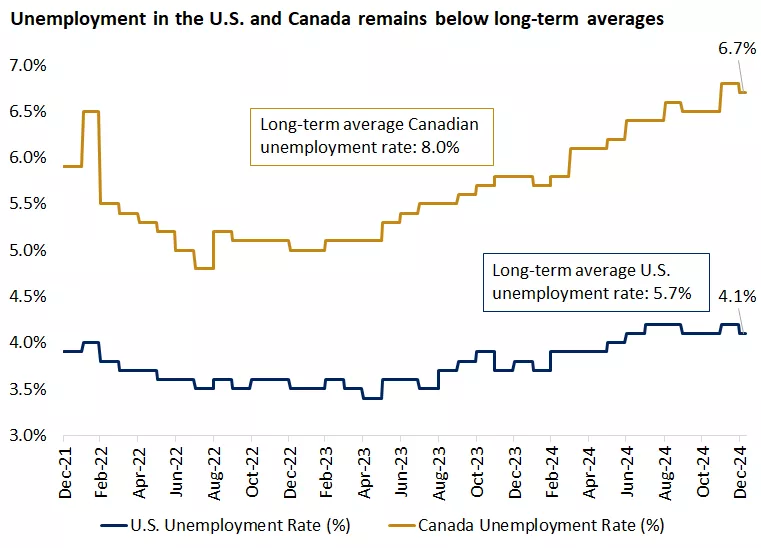

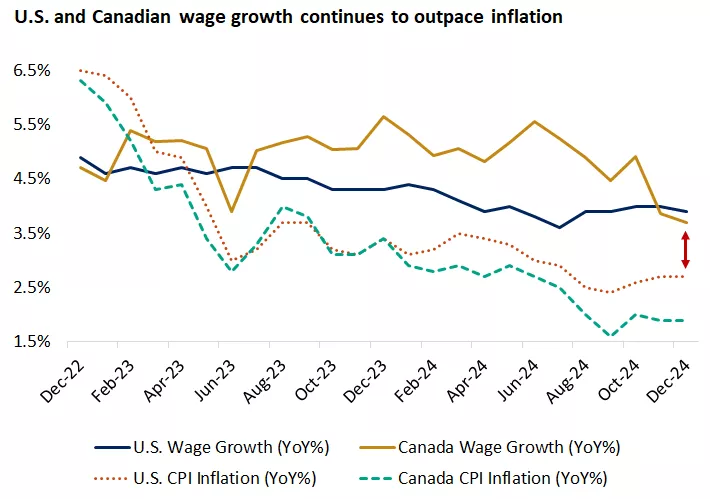

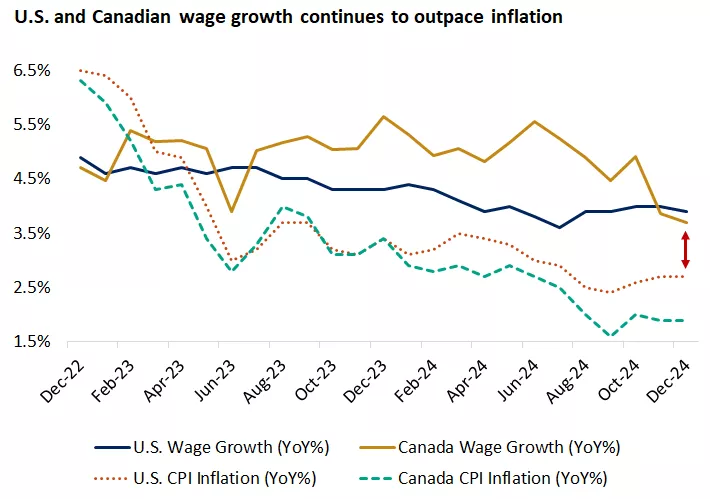

The first jobs reports of 2025 in both the U.S. and Canada exceeded expectations. In the U.S., nonfarm payrolls for December came in at 256,000, well above expectations of 165,000, while the unemployment rate fell to 4.1% from 4.2%.* Average hourly wage growth rose 3.9% year-over-year, slightly below forecasts of 4.0% wage growth, signaling a bit of potential easing in services inflation as well.*

The story around the jobs data was similar in Canada. Total net change in jobs for December came in around 91,000, well above expectations of 25,000, and the unemployment rate fell to 6.7% from 6.8% last month.* Wage gains in Canada also eased to 3.7% year-over-year, below estimates of 3.8%, supporting better inflationary trends broadly.

Overall, the employment data points to two key positive trends for economic growth. First, the unemployment rate in both economies remains benign and well below long-term historical unemployment rates. This provides a supportive backdrop for both consumers and businesses to operate. Second, wage gains still exceed the rate of inflation in both the U.S. and Canada, which means employees are taking home positive real wages. This is supportive of consumer confidence and spending as well.

This chart shows the level of the U.S. and Canadian unemployment rate. Both are below long-run averages.

This chart shows the level of the U.S. and Canadian unemployment rate. Both are below long-run averages.

This chart shows the year over year change in U.S. and Canadian CPI inflation versus the year over year change in U.S. and Canadian wages. Wages have outpaced inflation in both countries in recent months.

This chart shows the year over year change in U.S. and Canadian CPI inflation versus the year over year change in U.S. and Canadian wages. Wages have outpaced inflation in both countries in recent months.

Why were financial markets negative after this news? Repricing of central-bank rate cuts

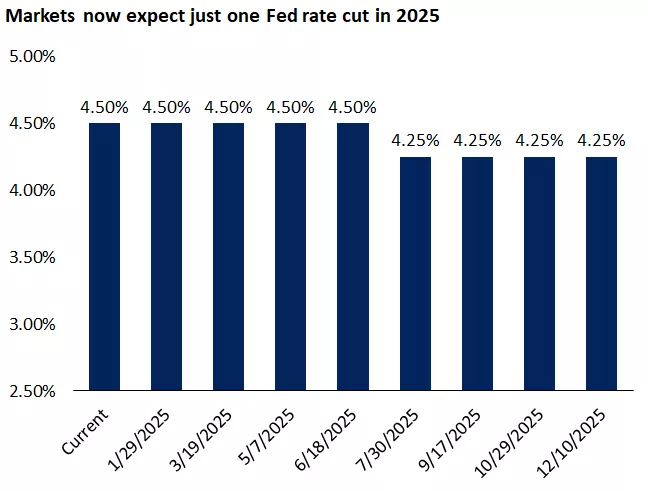

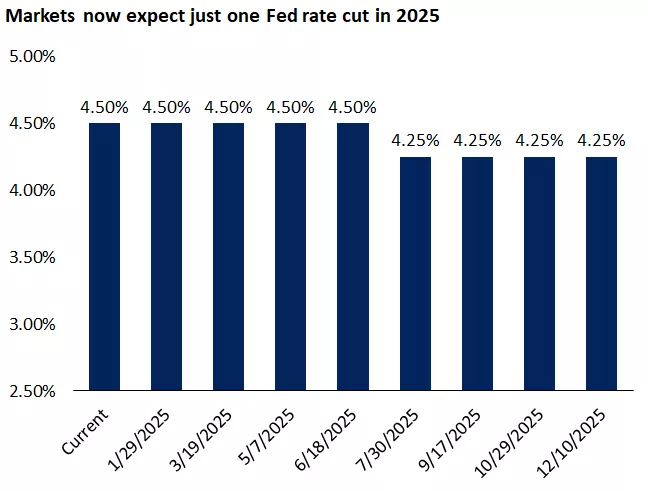

Although the jobs reports were positive, the reaction in the financial markets was largely negative after this news. This was in part because markets are reassessing the need for further central-bank rate cuts. In fact, according to the CME FedWatch tool, markets now expect just one more Fed rate cut in 2025, in the July timeframe, which would bring the fed funds rate to 4.0% - 4.25%. Similarly, the probability of a January rate cut by the Bank of Canada (BoC) decreased after the jobs data too.

This chart shows that futures markets now expect only one 0.25% Fed rate cut in 2025.

This chart shows that futures markets now expect only one 0.25% Fed rate cut in 2025.

As a result, government bond yields moved sharply higher, especially short-term government yields, which tend to be more driven by central-bank policy rates. The higher yields weighed on stocks, particularly those parts of the market with the highest valuations. In the U.S. markets, the technology-heavy Nasdaq underperformed, while defensive parts of the market like utilities and health care held up better. In our view, maintaining a diversified approach to both growth and value investments in portfolios will be an ongoing theme for the year ahead.

Both the U.S. and Canada face new political regimes in the months ahead

In addition to the economic data and central-bank rate cuts, investors also have their eye on the shift in political regimes occurring in both the U.S. and Canada.

The U.S. is waiting for clarity around policy initiatives after Inauguration Day

In the U.S., Inauguration Day is less than two weeks away, with President-elect Trump taking the oath of office on January 20. While the incoming administration has highlighted several policy initiatives – including tariffs, immigration and energy reform, deregulation and tax cuts – it remains to be seen which of these are prioritized in the weeks ahead.

The uncertainty around which policies are prioritized, and in what order, may continue to remain an overhang on markets. If the administration focuses on some of the more potentially inflationary policies first, like tariffs and immigration reform, this could be more disruptive for markets. However, if these are balanced with pro-growth initiatives like deregulation and tax cuts, we could also see a more balanced outcome in markets. Overall, though, the removal of this policy uncertainty alone may be welcomed by the markets, regardless of the initiatives that are prioritized.

In Canada, Prime Minister Trudeau announces his intent to resign

On January 6, Canadian Prime Minister Justin Trudeau announced that he will resign as prime minister and leader of the Liberal Party once a suitable replacement has been chosen to succeed him. With that announcement, he also prorogued or suspended Parliament until March 24.

This move has been widely speculated since mid-December when the then minister of finance, Chrystia Freeland, resigned. However, this announcement comes at a time when proposed legislation (including an increase to the capital-gains inclusion rate and extending the 2024 charitable-donation deadline) has not yet been passed into law. The Canadian Revenue Agency (CRA), however, has stated that it will enforce the proposed capital-gains inclusion-rate change given the practice of the CRA to administer any previously proposed legislation when Parliament is prorogued.

More broadly, a Canadian federal election is set to occur in 2025, either on October 20, 2025, or earlier if the Liberal government loses a nonconfidence vote once Parliament returns. Current polling suggests that the Conservative Party in Canada maintains a sizable lead, although polls may shift as the political race unfolds.

Reminder – politics don't drive financial markets, fundamentals do

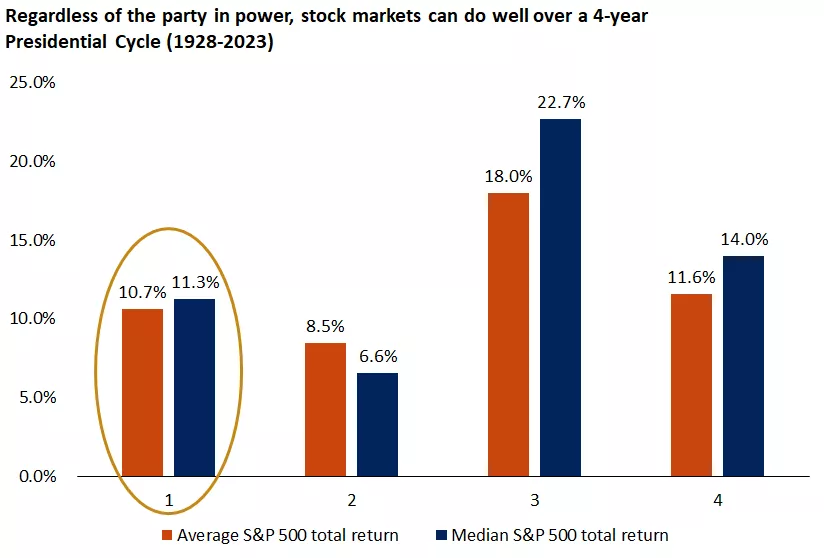

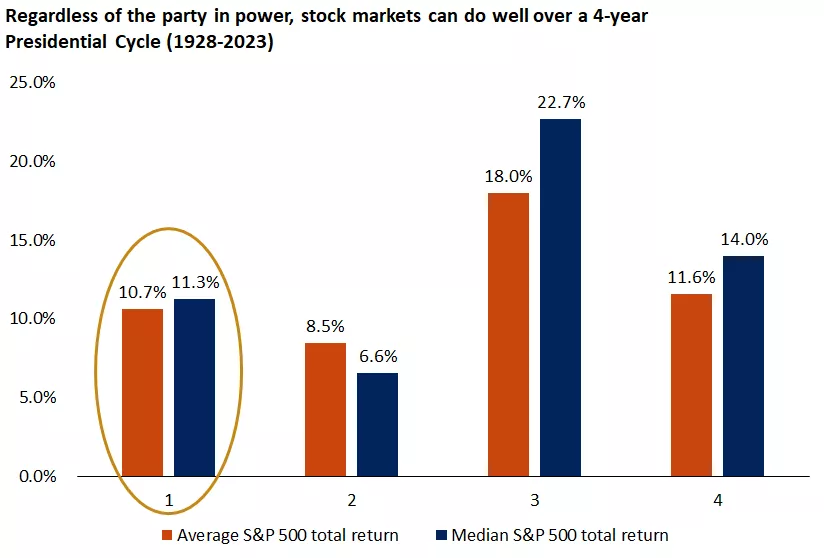

Overall, while there is ongoing uncertainty in the political backdrop both in the U.S. and Canada, now is a good reminder that financial markets tend not to be driven by politics and headlines, but by fundamentals.

We continue to see the economic and market expansion being supported by three key fundamental factors: A solid labor market, which continues to support consumption; positive S&P 500 earnings growth, which will likely reach over 10% in 2025; and central banks that will still move policy rates lower from here, albeit perhaps more modestly so.

Remember, after two back-to-back years of solid gains in the U.S. and Canadian markets, and low volatility during this period, we would expect to see some moderation in returns and bouts of increased market volatility ahead. However, we continue to believe that investors can use these pullbacks as opportunities, to diversify, rebalance and add quality investments at better prices, across both growth and value parts of the market.

As we kick off 2025, now is a great time to connect with your financial advisor (or consider partnering with one), to discuss your personalized financial goals, risk preferences, and how to optimize investment allocations for the year ahead and beyond.

This chart shows the performance of the S&P 500 Total Return Index broken down by year of U.S. presidential cycles. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows the performance of the S&P 500 Total Return Index broken down by year of U.S. presidential cycles. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

Mona Mahajan

Investment Strategy

Source: *FactSet

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 41,938 | -1.9% | -1.4% |

| S&P 500 Index | 5,827 | -1.9% | -0.9% |

| NASDAQ | 19,162 | -2.3% | -0.8% |

| MSCI EAFE* | 2,244.94 | -0.4% | -0.7% |

| 10-yr Treasury Yield | 4.76% | 0.2% | 0.9% |

| Oil ($/bbl) | $76.67 | 3.7% | 6.9% |

| Bonds | $95.95 | -0.9% | -0.4% |

Source: FactSet, 1/10/2025. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *Morningstar Direct 1/12/2025.

The week ahead

Important economic releases this week include CPI inflation for December and retail sales data.

Review last week's weekly market update.

Mona Mahajan

Mona Mahajan is responsible for developing and communicating the firm's macroeconomic and financial market views. Her background includes equity and fixed income analysis, global investment strategy and portfolio management.

She regularly appears on CNBC and Bloomberg TV, and in The Wall Street Journal and Barron’s.

Mona has a master’s in business administration from Harvard Business School and bachelor's degrees in finance and computer science from the Wharton School and the School of Engineering at the University of Pennsylvania.

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.