How to invest in CDs

Interest rates are changing, but there are ways for you to benefit as they fluctuate. Fixed-income investments issued at higher rates will generate more income.

A certificate of deposit (CD) is a fixed-income investment and is typically considered among the lowest-risk investment options. CDs let you invest your money for a set period — ranging from months to years — to earn a fixed rate. For some, a CD presents the ideal combination of reliable returns and low risk.

Edward Jones is not a bank or FDIC-insured institution, and deposit insurance only covers the failure of an insured bank. FDIC insurance for brokered CDs offered by Edward Jones is provided by the FDIC-insured banks that issue the CDs on a pass-through basis, which requires certain conditions to be met for coverage to apply. The list of those banks frequently changes. For a list of FDIC-insured banks in our network offering brokered CDs, see our List of Banks for Brokered FDIC-Insured Certificates of Deposit (CDs).

How CDs work

When someone invests in a CD, they essentially lend a specific amount of money to the financial institution for a set period, known as the term. In return, the financial institution pays the investor a fixed interest rate over the term.

CDs typically have higher interest rates compared to regular savings accounts, though an early withdrawal from a CD can result in penalties. The duration of a CD term can vary, ranging from a few months to several years, with longer terms generally offering higher interest rates.

When a CD matures, the investor gets back their principal investment along with interest. Investors can choose to reinvest their CD upon maturity or withdraw the principal along with the accrued interest.

If you don't withdraw your money after maturity, it may get automatically reinvested into a new CD. Many investors choose to use a CD investment strategy instead of buying a single CD.

Building your bond and CD ladder

Many investors follow a CD ladder strategy when investing in CDs.

CD ladder

A CD ladder involves investing in multiple CDs with varying maturity dates. For example, you might purchase five different CDs with varying dates. When the first CD matures in one year, for example, you purchase a new five-year CD. In two years, when the second CD matures, you also roll it over into a five-year CD.

With this strategy, 20% of your CD investment will mature each year. As a result, you will have access to the full value of that investment, which you can reinvest at the prevailing interest rates.

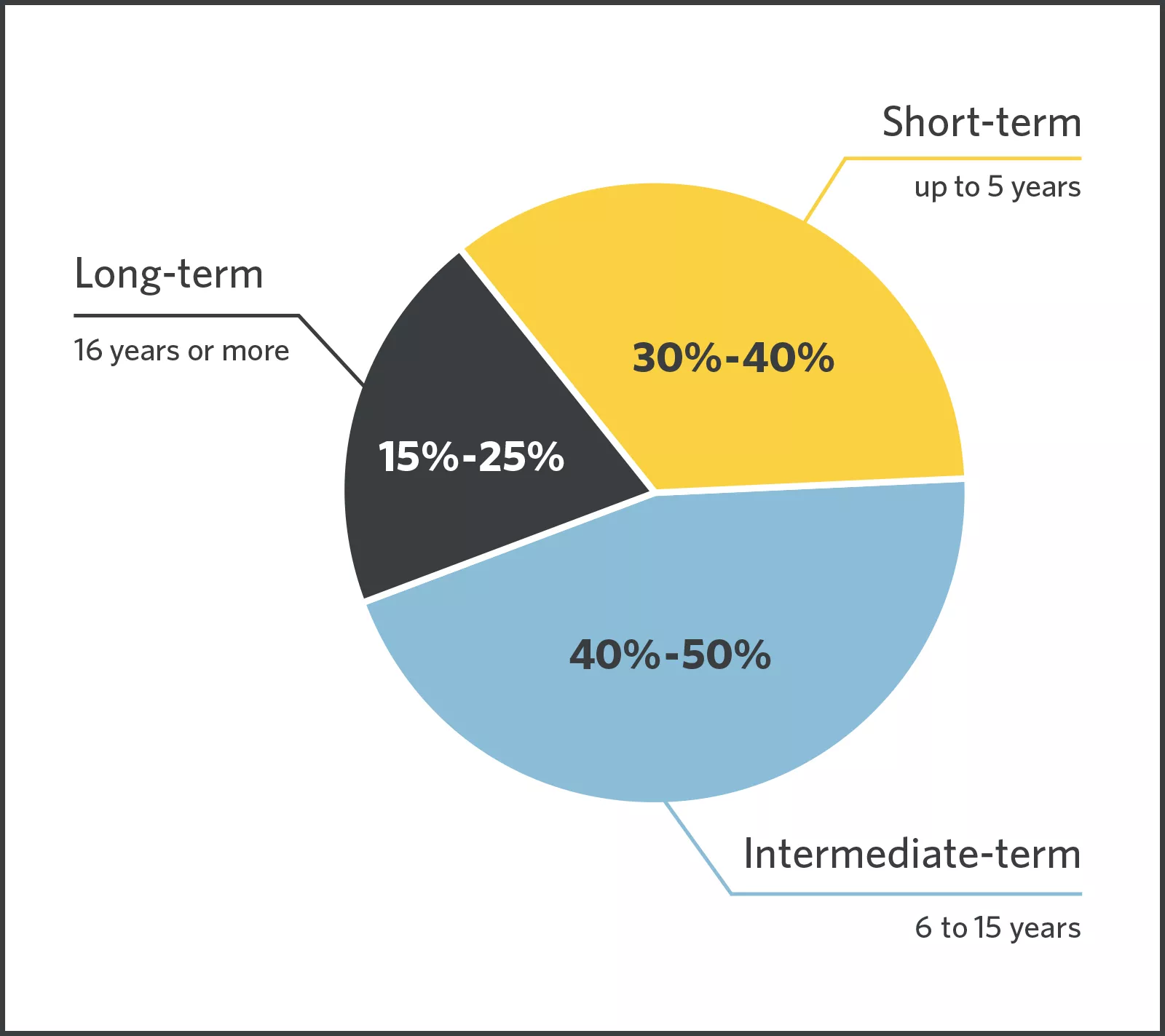

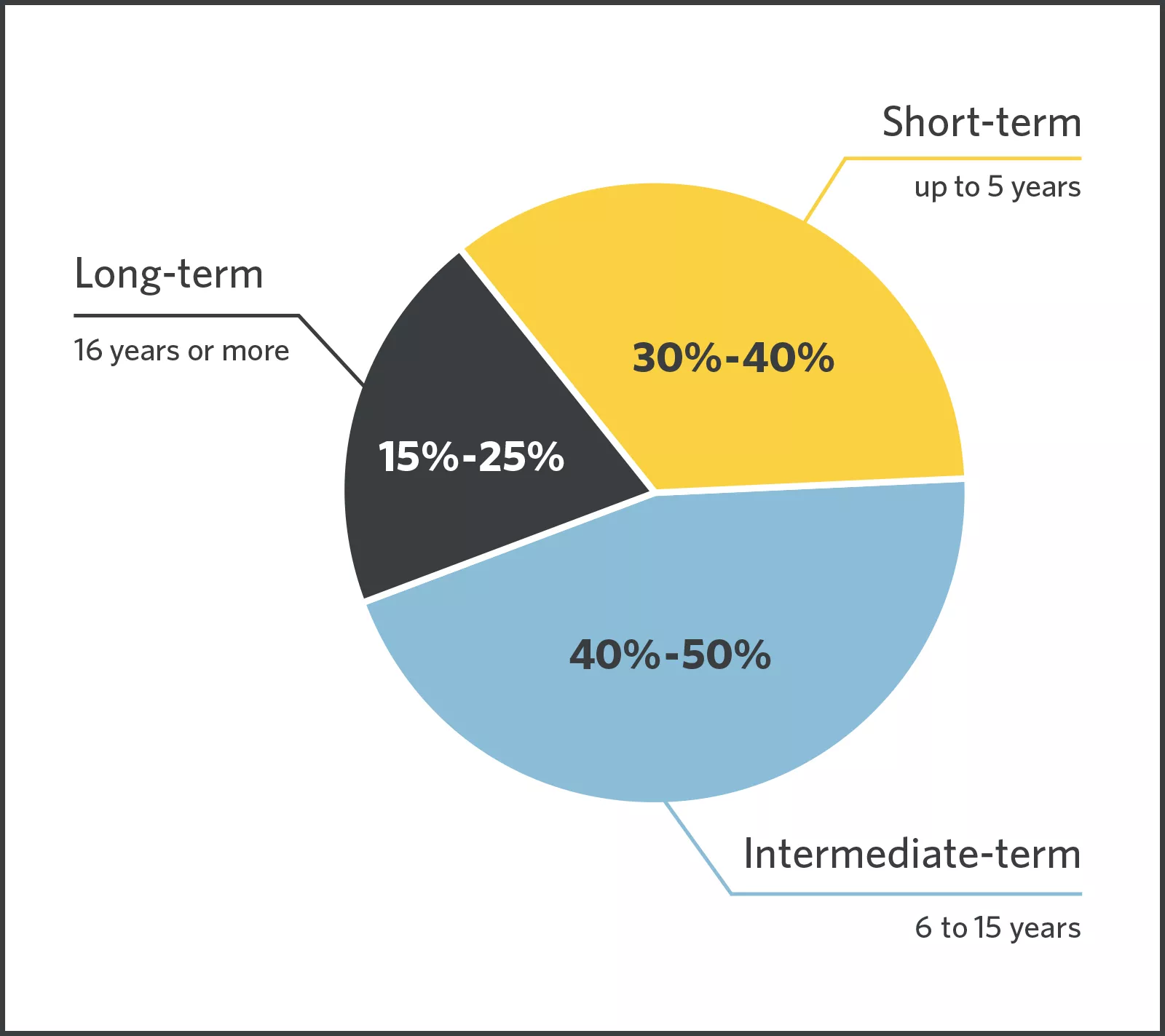

This pie chart details the types of bonds and certificates of deposit (CDs) you should consider in building in your bond and CD ladder by percentages. It recommends the largest percentage — 40% to 50% — should be bonds and CDs with an intermediate-term maturity of six to 15 years. The second-largest amount — 30% to 40% — should be in bonds and CDs with a short-term maturity of up to five years. The smallest amount — 15% to 25% — should be in bonds and CDs with a long-term maturity of 16 years or more.

This pie chart details the types of bonds and certificates of deposit (CDs) you should consider in building in your bond and CD ladder by percentages. It recommends the largest percentage — 40% to 50% — should be bonds and CDs with an intermediate-term maturity of six to 15 years. The second-largest amount — 30% to 40% — should be in bonds and CDs with a short-term maturity of up to five years. The smallest amount — 15% to 25% — should be in bonds and CDs with a long-term maturity of 16 years or more.

Factors to check before buying CDs

1. Maturity

It can be tempting to invest in short-term CDs while you wait for rates to rise. However, short-term rates are generally lower than intermediate- and long-term rates, so holding too much in short-term CDs can reduce your income. Also, there is no guarantee rates will be higher when the CD matures.

As mentioned above, we recommend owning bonds and CDs with a variety of maturities, which can help smooth out wide swings in your income and doesn’t depend on rates rising or falling.

2. Call features

Some brokered CDs offered by Edward Jones may be callable. Callable brokered CDs are a type of FDIC-insured CD that exhibits a call feature, similar to other types of callable fixed-income securities. These can be redeemed prior to maturity by the issuing bank at a stated time frame and set call price.

Most often, a callable brokered CD is called when interest rates are falling. This allows the issuer to stop paying CD holders more than the prevailing rates. The holder could then face a loss of the interest earned or be forced to reinvest at a lower rate.

Callable brokered CDs are issued at higher rates than other brokered CDs to compensate for the extra risk premium. Because of this additional risk, be sure to discuss with your financial advisor whether callable brokered CDs are suitable for your situation.

3. Competitive rates

Rates on CDs offered by Edward Jones (brokered CDs) are competitive, especially when compared to the rates of many CDs offered directly by banks (bank CDs). As rates change, some banks may not offer comparably competitive rates for a variety of reasons.

4. Annualized rates

This is called the annual percentage yield (APY), and is based on each full year you hold the CD. For example, if you were to buy $10,000 of a one-year CD with an APY of 2%, you would receive approximately $200 in interest. However, if you make the same investment in a six-month CD with an APY of 2%, you would receive approximately $100 in interest, or half the amount for holding the CD for half a year.

FAQs for buying CDs

Can I make money from a CD before it matures?

While some CDs incur penalties if funds are withdrawn early, others may allow you to withdraw money without fees. Your financial advisor can review the terms and conditions of a CD with you before you invest. This way, you can evaluate what if any penalties would be incurred from an early withdrawal.

Are CDs a good investment right now?

CDs tend to be a good investment when interest rates are high and are expected to drop over the short or long term. But whether a CD is a good investment depends on your investing goals.

Should I buy CDs from Edward Jones?

Contact an Edward Jones financial advisor to discuss your goals and how CDs may fit into your strategy.

Important information:

You must evaluate whether a bond or CD ladder and the securities held within it are consistent with your investment objectives, risk tolerance and financial circumstances. Before investing in fixed-income investments, including bonds and CDs, you should understand the risks involved, including credit risk and market risk. Fixed-income investments are also subject to interest rate risk, such that when interest rates rise, the prices of these investments can decrease, and the investor can lose principal value if the investment is sold prior to maturity. Please see the Certificate of Deposit Disclosure Statement (PDF) for additional information.