Monthly portfolio brief

Doubling down on disciplined investing

What you need to know

- Interest rates drifted lower in June, lifting bond prices, as inflation trends lower and markets anticipate central bank interest rate cuts over the next couple of years.

- Stock leadership narrowed, with a handful of mega-cap tech-related stocks soaring back into the spotlight amid negative returns across most equity asset classes.

- With the potential for market volatility to pick up, double-check your portfolio’s diversification, and view pullbacks opportunistically.

- Global economic growth and easing monetary policy should be supportive for stocks and bonds overall, but we favor stocks, especially U.S. large and mid caps, in this environment.

- We favor a tilt toward emerging-market debt and longer-term high-quality bonds, given our belief higher interest rate risk will prove beneficial for portfolios.

Portfolio tip

You may be tempted to focus on top-performing investments, but your comfort with risk, time horizon and financial goals should drive your portfolio’s design.

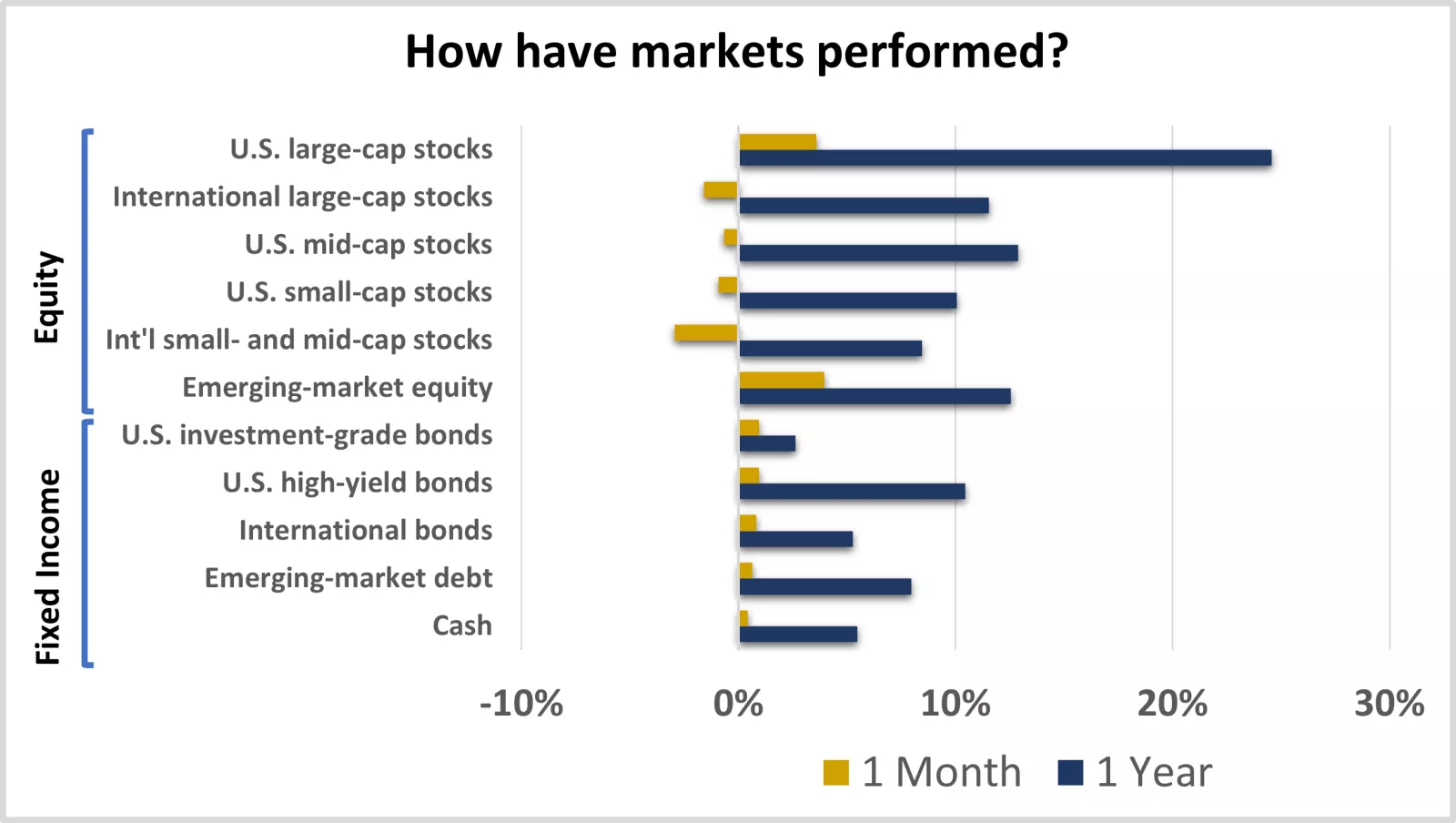

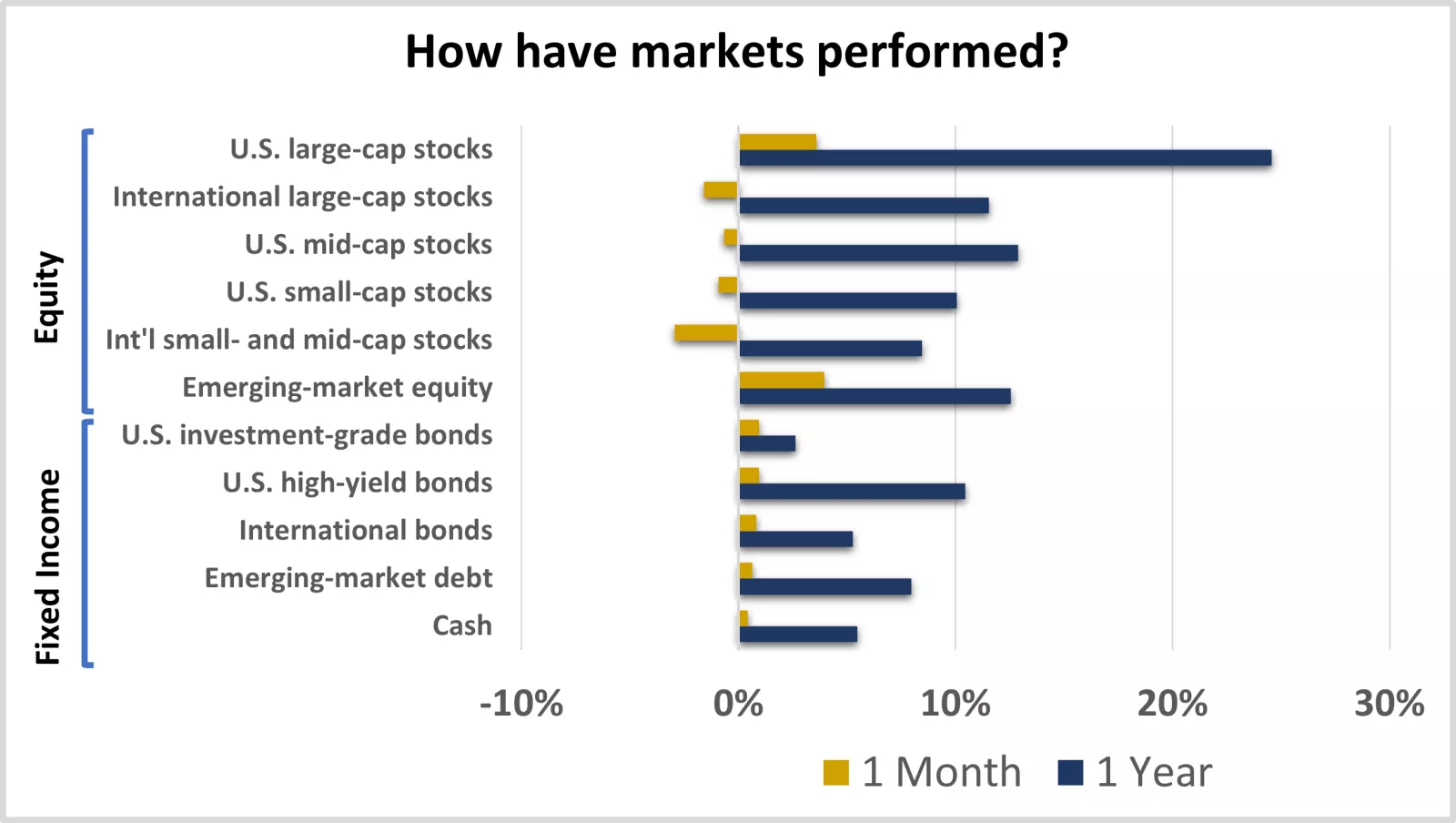

This chart shows the performance of equity and fixed-income markets over the previous month and year.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

Where have we been?

Interest rates drift lower as a rate-cutting cycle begins, helping lift bond prices. The Bank of Canada and the European Central Bank began cutting interest rates in June after a lengthy pause, slightly easing restraints on economic growth. Interest rates drifted lower over the month, as markets anticipated additional rate cuts from central banks over the next couple of years.

Consequently, returns across fixed-income asset classes ended in positive territory, helping offset weakness within equities. U.S. investment-grade bonds led fixed income in June, returning 1.3%, with cash-like investments falling to the back. But lower-quality bonds maintained their lead over the one-year period, given their higher-yield advantage and contained credit spreads.

Some bond asset classes remain down over three years, reflecting central banks’ aggressive rate-hiking campaign in their battle against higher inflation. While central banks are likely to move cautiously in the months ahead, inflation data released in June helped increase confidence that rate cuts lie ahead.

Tech-oriented stocks stand out amid negative equity returns elsewhere. U.S. large-cap stocks and emerging-market equity, each of which have technology as their largest sector, performed equally well in June, up just over 3%. Developed international stocks, on the other hand, weighed on portfolios.

U.S. large-cap stocks have performed best over the past year, though we’d note the asset class has become increasingly concentrated. Excitement around artificial intelligence’s (AI) growth prospects has driven significant leadership among a handful of mega-cap tech-oriented stocks, propelling the asset class.

Three sectors — technology, consumer discretionary and communication services — now make up over 50% of U.S. large-cap stocks, and they were the top-performing sectors in June. Technology alone was up nearly 10%. Conversely, six of the remaining eight sectors dropped this past month, demonstrating narrower markets. Strength within technology is also what helped drive emerging-market equity higher.

Smaller, more cyclical U.S. stocks also fell on the likelihood that economic growth cools from its recent strength as monetary policy remains restrictive. Election uncertainty in France weighed on developed international markets. International equities were also weighed down by a strengthening dollar, driven in part by the Federal Reserve’s decision to stay patient before cutting rates.

What do we recommend going forward?

Double down on your diversification and rebalancing strategies. Top-performing investments can be tempting, particularly in narrowly led markets. But chasing them can distract you from more goal-oriented strategies.

In addition, market volatility has been relatively tame this year, but that doesn’t mean it will stay that way. We anticipate short-term pullbacks in the back half of 2024, given the attention markets have placed on inflation, monetary policy and global elections.

Broad diversification can help reduce the swings in your portfolio. And rebalancing, when appropriate, can help keep you aligned with your risk and return objectives. Set goal-focused strategic asset allocation targets for your portfolio and then keep these targets in sight to stay disciplined when incorporating timely investment opportunities.

Target higher equity allocations with a focus on U.S. equity. We believe trailing sectors and asset classes within U.S. equities have catch-up potential as inflation falls further and the Fed enters its interest rate-cutting cycle, which should ease some restraints on economic growth later this year and into 2025. Given this, we believe higher-quality U.S. large- and mid-cap stocks appear attractive.

Despite some higher valuations within the tech-heavy U.S. large-cap stocks, we believe the potential for innovation and growth related to AI can continue to boost the asset class’s momentum over time.

Reduce U.S. investment-grade bond allocations to offset the overweight to U.S. mid-cap stocks. Today’s higher yields enhance the forward return potential for U.S. investment-grade bonds compared to where they started two to three years ago. But we believe portfolios will benefit more from the cyclical nature of U.S. mid-cap stocks as economic growth remains supportive.

Tilt away from emerging-market equity. While China’s policymakers have stepped up their stimulus measures to support growth, we believe regulatory, geopolitical and economic uncertainty remains high. To help manage these risks in your portfolio, we recommend slightly reallocating toward U.S. large-cap stocks.

Favor higher interest rate risk within bond allocations. In our view, interest rates are likely to drift lower, given our expectations for lower inflation, moderating economic growth and loosening central bank monetary policies. Falling interest rates help lift returns for bond allocations. And any given drop in rates is better for bonds with higher interest rate sensitivity (interest rate risk).

While we don’t expect interest rates to travel as fast or as far on the way down as they did on the way up in 2022 and 2023, we believe slightly increasing the interest rate risk in portfolios can help you take advantage of their likely path.

Reallocating from U.S. high-yield bonds toward emerging-market debt can help raise the interest rate sensitivity of portfolios. The relatively higher-quality characteristics and catch-up potential of emerging-market debt may also prove beneficial in this environment. Reallocating from short-term bond investments or overweight cash allocations toward high-quality, long-term bonds can also help position portfolios for the second half of 2024.

We’re here for you

To work toward your financial goals, you’ll need a disciplined approach to investing to help you stay focused as markets swing. As you discuss your goals with your financial advisor, use strategic asset allocation to construct a portfolio with the combination of asset classes and investments appropriate for you. Then consider incorporating our opportunistic asset allocation guidance to help enhance your return potential or reduce risks in the current market environment without losing sight of your goals.

If you don’t have a financial advisor and would like help identifying disciplined investment strategies most appropriate for what you’re trying to achieve, we invite you to meet with an Edward Jones financial advisor to help you align your portfolio with your financial goals.

Strategic portfolio guidance

Defining your strategic investment allocations helps to keep your portfolio aligned with your risk and return objectives, and we recommend taking a diversified approach. Our long-term strategic asset allocation guidance represents our view of balanced diversification for the fixed-income and equity portions of a well-diversified portfolio, based on our outlook for the economy and markets over the next 30 years. The exact weightings (neutral weights) to each asset class will depend on the broad allocation to equity and fixed-income investments that most closely aligns with your comfort with risk and financial goals.

Diversification does not ensure a profit or protect against loss in a declining market.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: U.S. large-cap stocks, international large-cap stocks, U.S. mid-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks, emerging-market equity.

Fixed-income diversification: U.S. investment-grade bonds, U.S. high-yield bonds, international bonds, emerging-market debt, cash.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: U.S. large-cap stocks, international large-cap stocks, U.S. mid-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks, emerging-market equity.

Fixed-income diversification: U.S. investment-grade bonds, U.S. high-yield bonds, international bonds, emerging-market debt, cash.

Opportunistic portfolio guidance

Our opportunistic portfolio guidance represents our timely investment advice based on current market conditions and a shorter-term outlook. We believe incorporating this guidance into a well-diversified portfolio may enhance your potential for greater returns without taking on unintentional risks, helping keep your portfolio aligned with your risk and return objectives. We recommend first considering our opportunistic asset allocation guidance to capture opportunities across asset classes. We then recommend considering opportunistic equity style, U.S. equity sector and U.S. investment-grade bond guidance for more supplemental portfolio positioning, if appropriate.

Our opportunistic asset allocation guidance follows:

Equity — overweight overall; overweight for U.S. large-cap stocks, U.S. mid-cap stocks; neutral for international large-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks; underweight for emerging-market equity.

Fixed income — underweight overall; overweight for emerging-market debt; neutral for international bonds, cash; underweight for U.S. investment-grade bonds, U.S. high-yield bonds.

Our opportunistic asset allocation guidance follows:

Equity — overweight overall; overweight for U.S. large-cap stocks, U.S. mid-cap stocks; neutral for international large-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks; underweight for emerging-market equity.

Fixed income — underweight overall; overweight for emerging-market debt; neutral for international bonds, cash; underweight for U.S. investment-grade bonds, U.S. high-yield bonds.

Our opportunistic equity style guidance is neutral for value-style equity and growth-style equity.

Our opportunistic equity style guidance is neutral for value-style equity and growth-style equity.

Our opportunistic equity sector guidance is as follows:

• Overweight for consumer discretionary, industrials and utilities

• Neutral for consumer staples, energy, health care, real estate and technology

• Underweight for communication services, financial services and materials

Our opportunistic equity sector guidance is as follows:

• Overweight for consumer discretionary, industrials and utilities

• Neutral for consumer staples, energy, health care, real estate and technology

• Underweight for communication services, financial services and materials

Our opportunistic U.S. investment-grade bond guidance is overweight in interest rate risk (duration) and underweight in credit risk.

Our opportunistic U.S. investment-grade bond guidance is overweight in interest rate risk (duration) and underweight in credit risk.

Tom Larm, CFA®, CFP®

Tom Larm is a Portfolio Strategist on the Investment Strategy team. He is responsible for developing advice and guidance related to portfolio construction, asset allocation and investment performance to help clients achieve their long-term financial goals.

Tom graduated magna cum laude from Missouri State University with a bachelor’s degree in finance. He earned his MBA from St. Louis University, is a CFA charterholder and holds the CFP professional designation. He is a member of the CFA Society of St. Louis.

Important information

Past performance of the markets is not a guarantee of future results.

Investing in equities involves risk. The value of your shares will fluctuate, and you may lose principal. Mid- and small-cap stocks tend to be more volatile than large-company stocks. Special risks are involved in international and emerging-market investing, including those related to currency fluctuations and foreign political and economic events.

Diversification does not ensure a profit or protect against loss in a declining market.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.