Monthly international market focus

The good, the bad and the ugly

What you need to know

- Coordinated central bank policy easing is expected to help sustain the global economic expansion into 2025.

- Europe appears to be hitting a soft patch, but falling inflation and low unemployment remain supportive.

- China growth trends worsened in the third quarter, triggering policymakers to announce a basket of policy stimulus measures that indicate a high degree of urgency compared to past efforts.

- The potential for a broadening in sector leadership, a softer U.S. dollar and heavily discounted valuations provide reasons to consider having an appropriate allocation in international stocks.

The good: The global economy skirts recession, while easing cycle gains steam

Despite aggressive interest rate hikes by major central banks and heightened geopolitical tensions over the past two years, global growth has outperformed expectations. The list of central banks easing their monetary policies continued to grow in the third quarter: The Federal Reserve (Fed) and the Bank of England (BoE) joined the European Central Bank (ECB) and others in lowering interest rates.

U.S. policymakers will likely take a cautious approach to rate cuts because inflation has not yet returned to target. But we think an easing cycle has kicked off and will continue next year. Lower rates can help drive a manufacturing recovery and benefit cyclical sectors that carry a higher weight in international indexes.

The Fed hiked rates more than other central banks, so it has more room to cut. This could potentially weigh on the U.S. dollar and provide a tailwind for international stocks.

The chart on the left shows the path of interest rates for major central banks, including the Federal Reserve. The chart on the right displays the composition percentages for international and U.S. sectors.

The chart on the left shows the path of interest rates for major central banks, including the Federal Reserve. The chart on the right displays the composition percentages for international and U.S. sectors.

The bad: Europe faces a slowdown

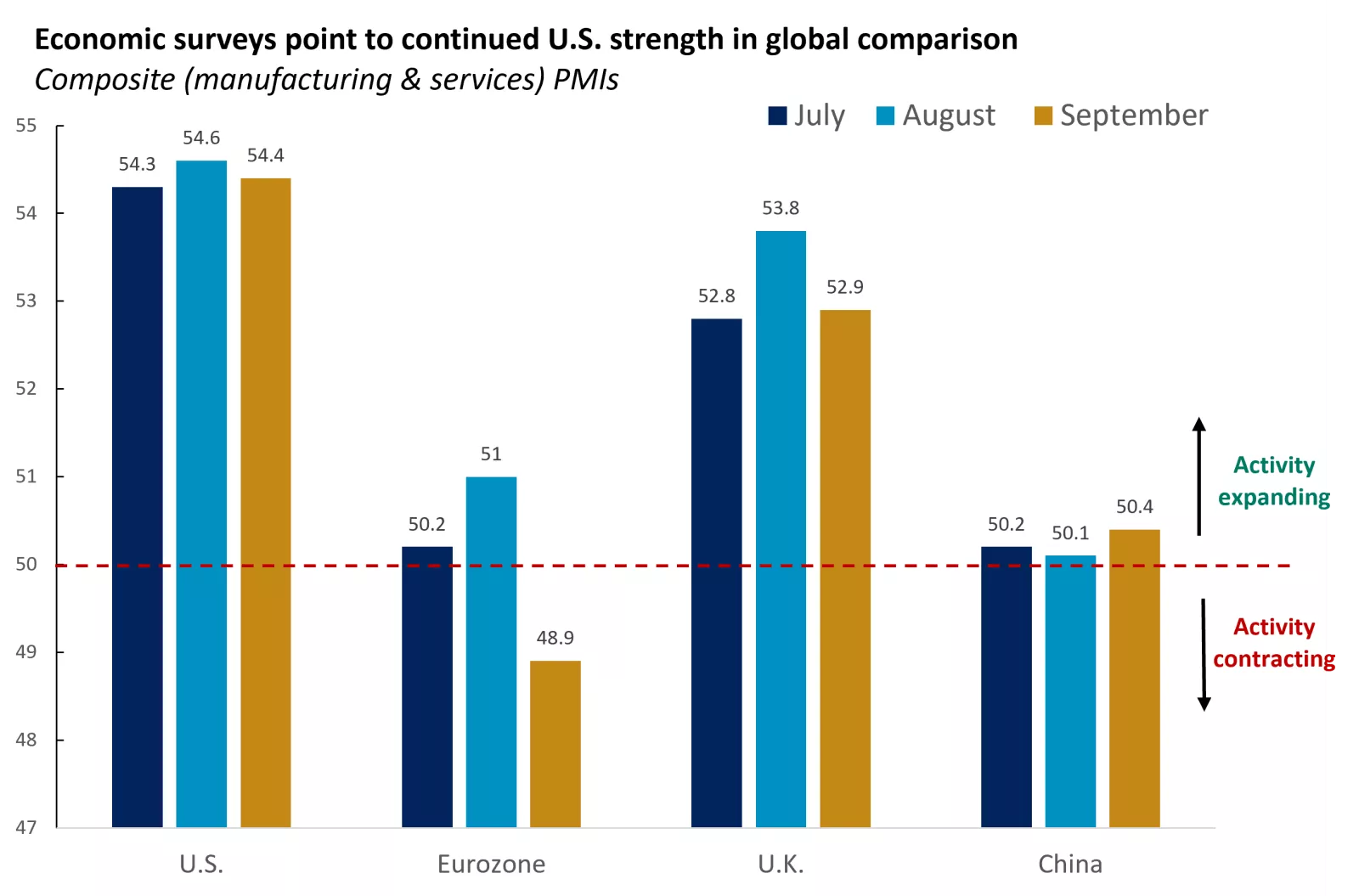

As mentioned, the global economy has stayed resilient, and declining borrowing costs underpin a positive outlook for 2025. But the U.S. is carrying most of the load, supported by strong consumer spending and a notable uptick in productivity.

The manufacturing sector remains the weak link. Together with lackluster demand from China, this is weighing on the eurozone, which is more reliant on exports than the U.S.

The latest economic activity surveys point to weakening growth at the end of the third quarter for Europe, with Germany — its largest economy — stagnating over the past two years. On the other hand, positive momentum in Southern Europe appears poised to continue, helped by strength in services.

Also providing support, eurozone unemployment remains low, and September headline inflation dropped below 2% for the first time since 2021.1 We expect below-trend growth ahead for the region, which should continue to support a modest rise in corporate profits.

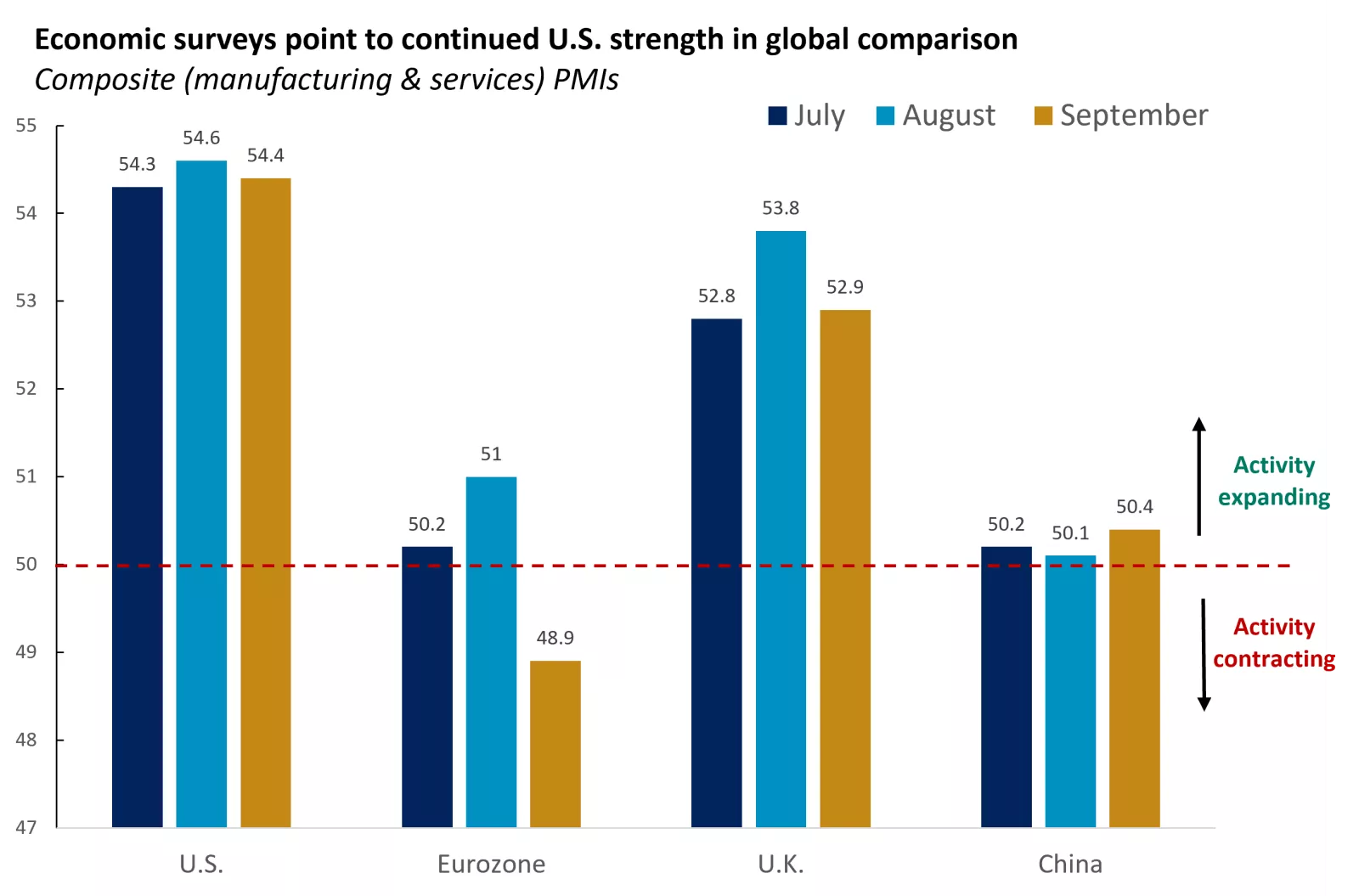

This chart shows the composite purchasing managers’ index (PMI) for the U.S., the eurozone, the UK and China in July, August and September 2024.

This chart shows the composite purchasing managers’ index (PMI) for the U.S., the eurozone, the UK and China in July, August and September 2024.

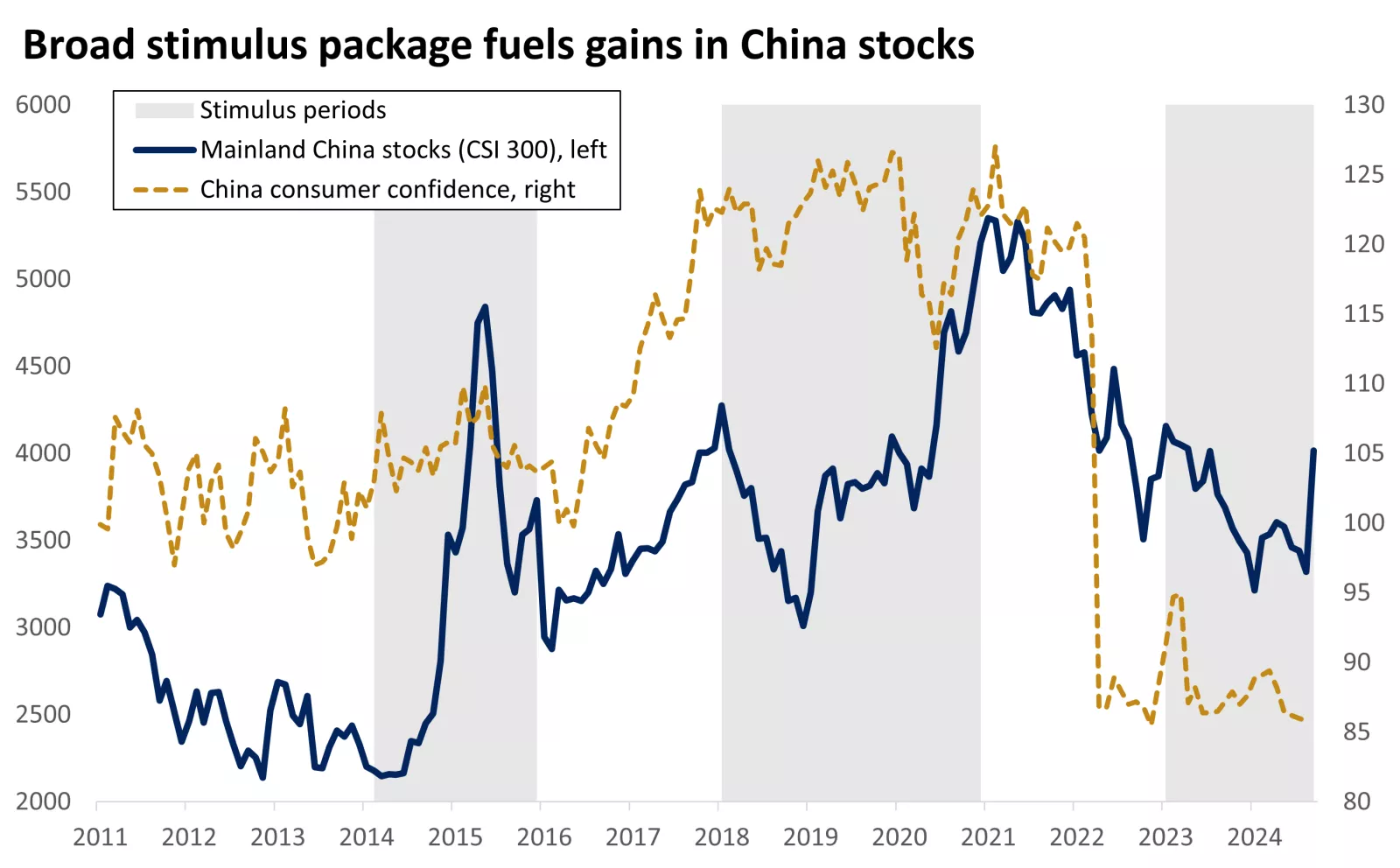

The ugly: China trends worsen, yet stimulus push revives optimism

China has been navigating a property sector crisis over the past two years, with high unsold inventory, falling prices and a drop in housing investment to a 16-year low.1 Consumption isn’t filling the gap left by slowing investment, as consumer confidence has fallen to a record low. And excess capacity has limited the central bank’s ability to boost economic activity with targeted rate cuts.

To break the negative cycle and revive growth, policymakers in China recently announced a basket of stimulus measures targeting the general economy, the real estate sector and the stock market. These include broad interest rate cuts, lower mortgage down payment minimums, freed-up funds for banks to increase lending, and pledges for greater fiscal support.

The timing and comprehensive nature of the stimulus initiatives indicate a high degree of urgency and determination to support the economy, triggering a sharp rally in Chinese equities. But questions remain whether the promises for fiscal stimulus, if delivered, will be enough to prop up the economy.

However, we expect the combination of policy support, depressed investor sentiment and cheap stock valuations to improve the near-term outlook for China and emerging-market equities.

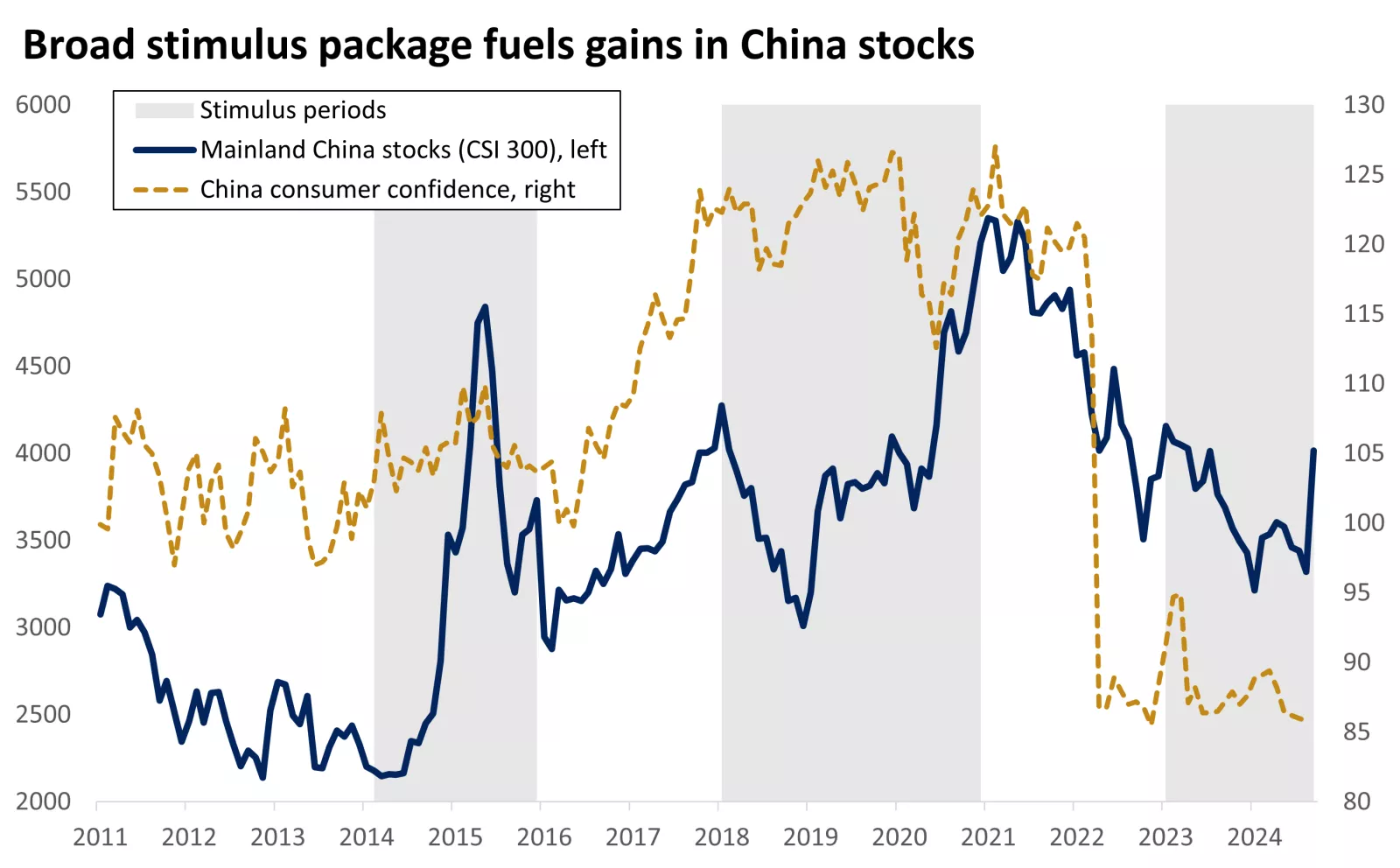

This chart displays stimulus periods in China since 2011 as well as the path of mainland China’s stocks and consumer confidence in China.

This chart displays stimulus periods in China since 2011 as well as the path of mainland China’s stocks and consumer confidence in China.

Why international diversification still makes sense

International equities have underperformed domestic stocks since 2010. Because of this, many investors ask why these investments deserve a spot in their portfolios.

While some of the recent challenges will likely persist in the near term, we see three reasons an appropriate allocation to international equities still makes sense:

Market leadership often rotates, and major turning points in interest rate policy and earnings can act as catalysts. Tech and other growth sectors of the U.S. economy have supported this outperformance.

But as interest rates decline and earnings growth broadens, sectors that trade at lower valuations and focus on paying dividends could come back into favor. While it is nearly impossible to predict exactly when leaders turn into laggards, and vice versa, diversification across regions can help spread out portfolio risk.

- Historically, international equities tend to perform well during periods of a weakening dollar, while U.S. investments typically outperform during periods of a strengthening dollar. Even a modest shift lower in the dollar, which we have begun to see, could be a driver for improved international equity returns.

- International stocks are trading at a record 38% discount versus their 20-year average of 20%. This suggests there is significant room to catch up, even if only half that valuation gap closes.2 Additionally, many international companies offer attractive dividend yields compared to their U.S. counterparts, providing a reliable source of income.

This chart shows the relative valuation of international vs. U.S. stocks since 2004.

This chart shows the relative valuation of international vs. U.S. stocks since 2004.

Angelo Kourkafas

Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, FORTUNE magazine, Marketwatch, U.S. News & World Report, The Observer and the Financial Post.

Angelo graduated magna cum laude with a bachelor’s degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

Important information:

1 Source: Bloomberg.

2 Source: FactSet.

Past performance of the markets is not a guarantee of future results.

Investing in equities involves risk. The value of your shares will fluctuate, and you may lose principal. Mid- and small-cap stocks tend to be more volatile than large-company stocks. Special risks are involved in international and emerging-market investing, including those related to currency fluctuations and foreign political and economic events.

Diversification does not ensure a profit or protect against loss in a declining market.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity. High-yield bonds carry a high risk of principal loss and may experience more price volatility than investment-grade bonds. Emerging-market bonds are riskier than bonds from more developed countries.