One of the many important things your Edward Jones financial advisor does is get to know you, to understand your financial needs and what’s important to you—and why—and then work with you to create a portfolio to help you achieve your goals. So how does your financial advisor actually go about doing this?

They start with your goals. Why do you want to invest money? It could be for your retirement, your kid’s college tuition, or a Florida mansion to see out your days.

Next your financial advisor will consider three key risk considerations:

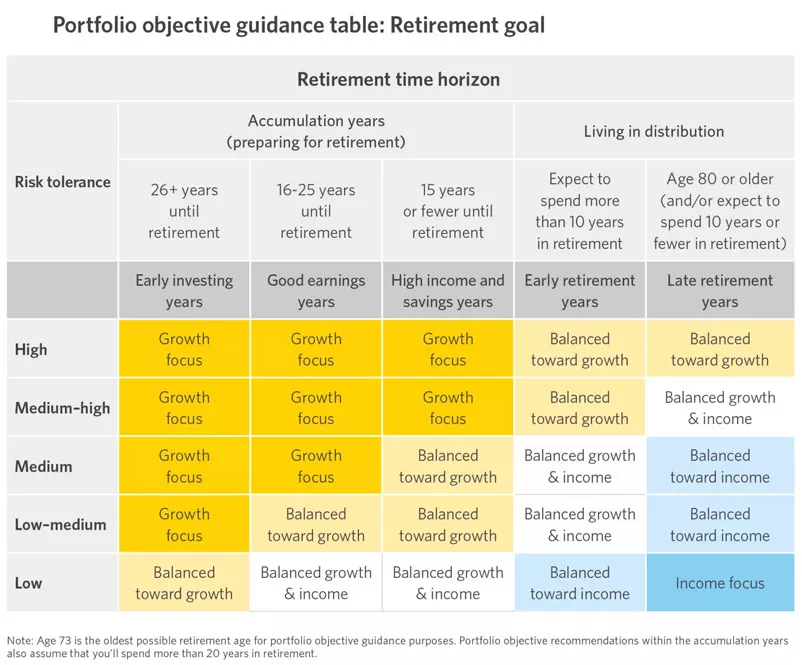

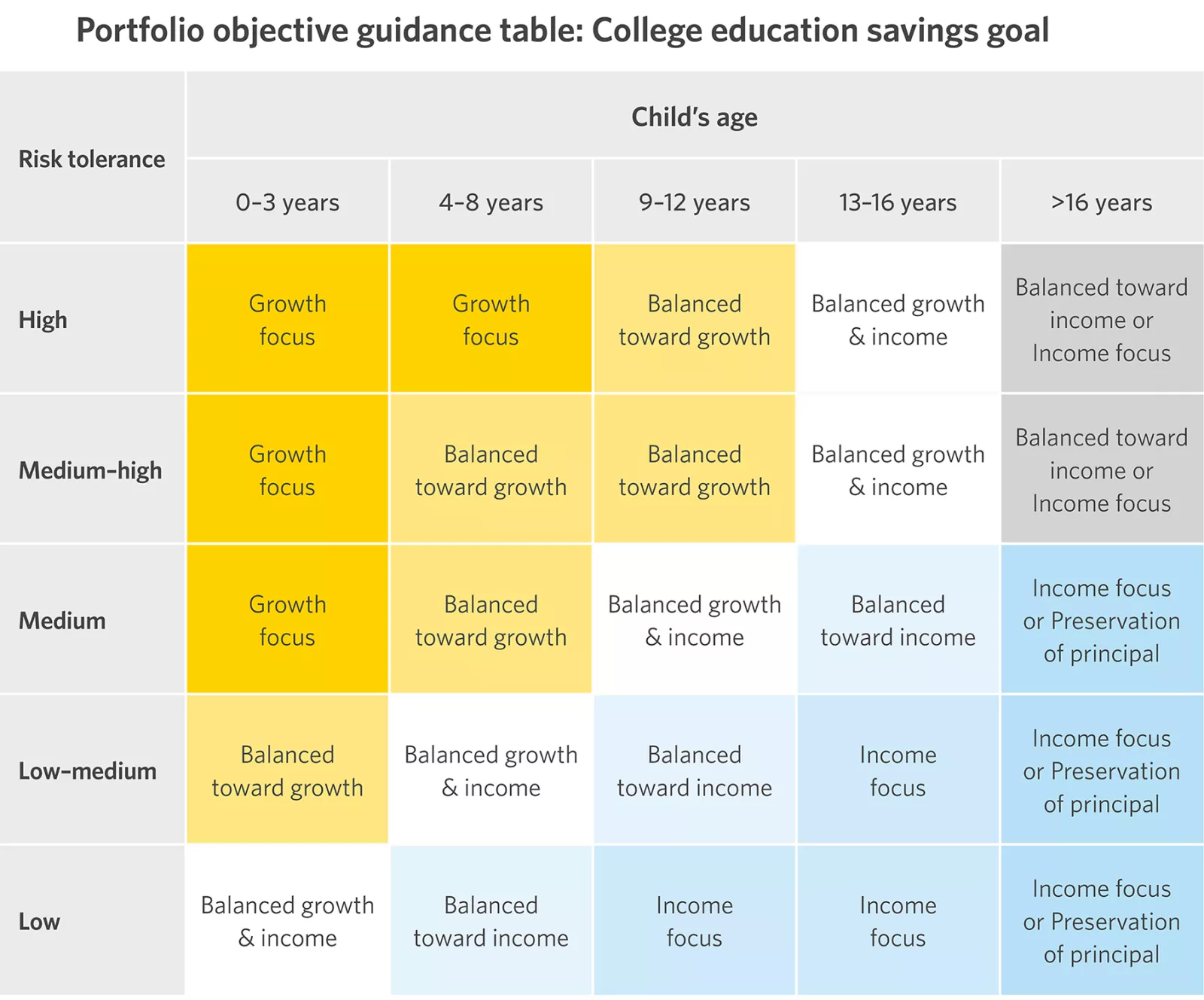

First, how comfortable are you with the ups and downs that come with investing? It’s important to be honest with yourself about this. Sometimes you think you’re fine with risk, until the market goes down, along with your account. Higher tolerance for market swings might steer you toward a more aggressive portfolio; lower tolerance, a less aggressive portfolio.

Second, when will you need your money for your goals? Let’s say you are comfortable with high-risk investments and the ups and downs of the market don’t give you ulcers—do you have enough time to recover from a market downturn if you plan to retire in 5 years? A longer time horizon might support a more aggressive portfolio; a shorter time horizon, a less aggressive portfolio.

Finally, there’s the third big question. How much do you really need and what kind of return will it take to get you there? Requiring a higher return to meet your objective may also require higher risk and perhaps a more aggressive portfolio. Extra money is always welcome, but too much risk and you may not meet your goals—which could be one of the biggest risks of all.

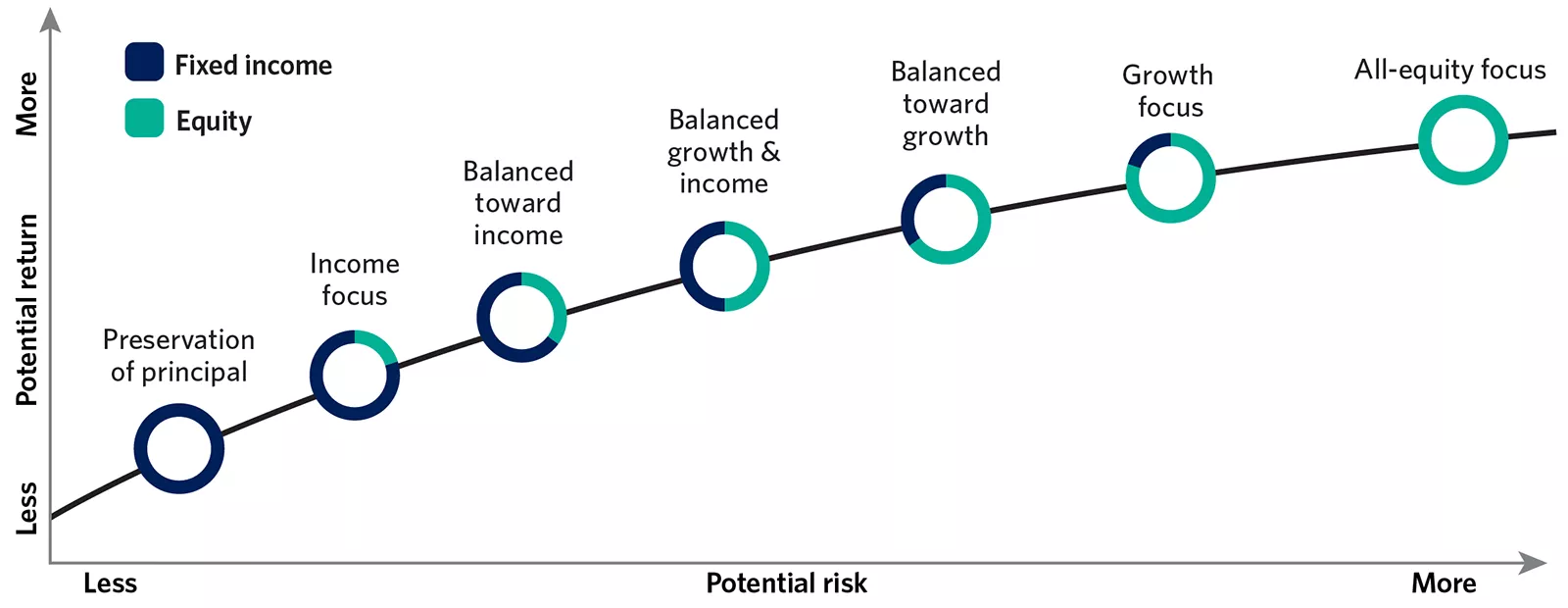

Your financial advisor helps you select an investment strategy which balances your needs and risk considerations, and then helps you build a portfolio designed to deliver on that strategy.

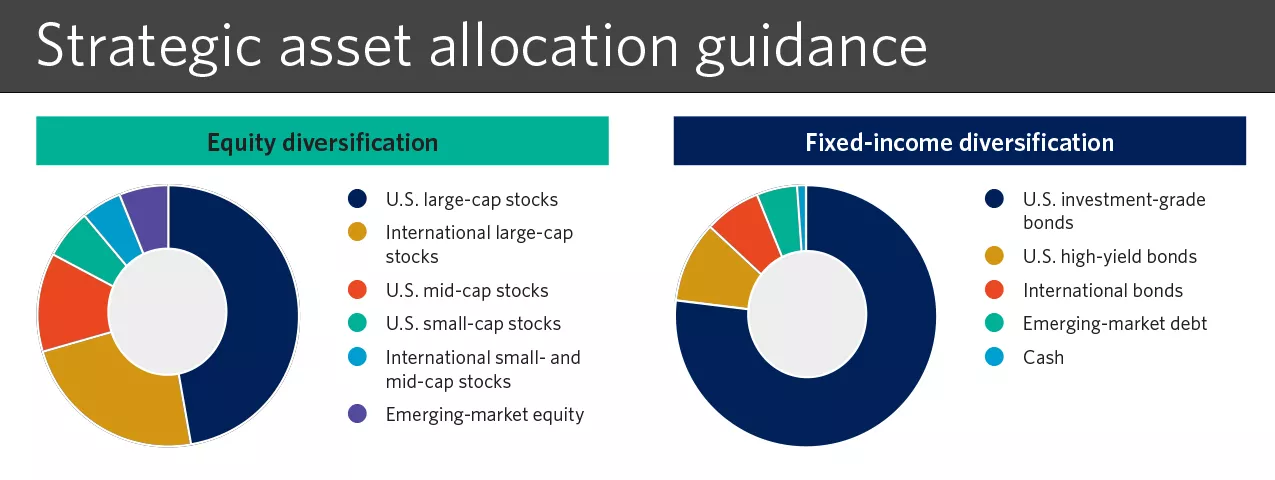

Each strategy has recommendations about where and how much to invest. How much of your money should be invested in U.S. or international bonds? Or U.S. or international stocks? We also make recommendations about what areas you should invest in such as tech, banking, or energy. Spreading your investments in this way may help manage risk, as one type of investment goes down, another may go up.

We know that you may have preferences about how your money is invested. You may choose not to invest in tobacco for example, or have special tax needs. Your financial advisor can balance these needs and preferences with our investment strategy recommendations to ensure your portfolio still supports achieving your goals.

You shouldn’t need a financial degree to understand how your portfolio was built. That’s what your financial advisor is for. Your financial advisor uses time-tested processes and Edward Jones strategies to build a portfolio that helps you achieve your financial goals. Trust your strategy and reach out to your financial advisor if your goals change or when you're thinking about making a change to your portfolio.