The value of saving earlier

As the saying goes, “The best time to plant a tree was 20 years ago. The second-best time is now.” The same principle applies to saving money: No matter your financial situation, it pays to start right now, even if retirement is in the distant future. Setting aside just a fraction of your income can turn into significant savings over time.

Saving early in life means time is on your side, and waiting to invest could cost you money down the road. Take advantage of the time you have by establishing a savings strategy today. Doing so will allow you to take advantage of compound earnings for as long as possible.

Use the power of compound earnings

The earlier you start saving, the longer your money can work for you, and the more powerful compound earnings becomes. Compounding is taking the money you earned from your investments and reinvesting it to earn even more, which helps your savings grow faster and faster.

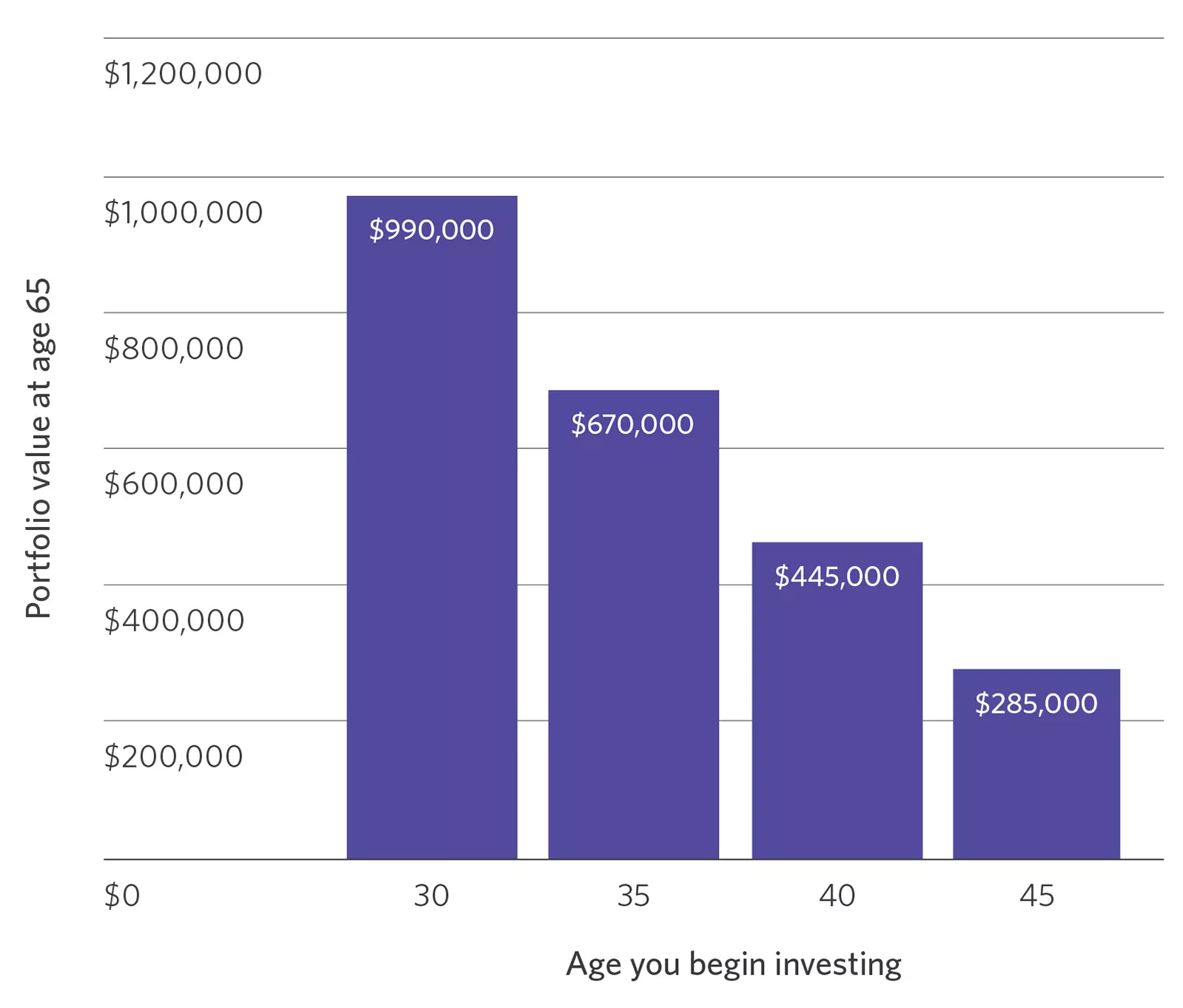

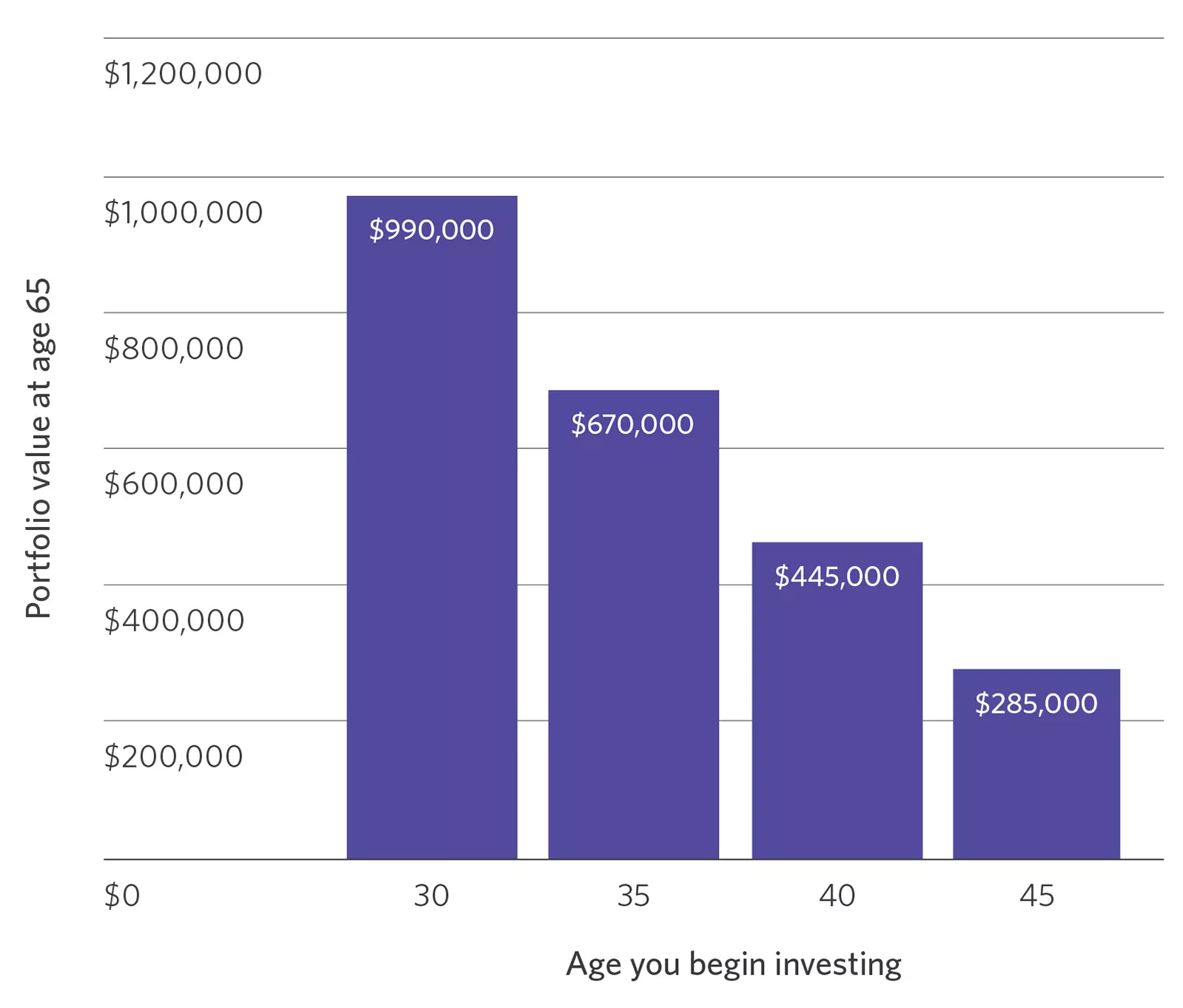

A modest investment can grow exponentially with this strategy, which gives you the opportunity to flourish, not just get by. The money-saving chart below shows the powerful effects of compound earnings on an investment if you were to start contributing steadily five, 10 or even 15 years earlier:

Saving early vs. saving later

This bar chart shows that waiting a few years to start saving can significantly decrease the amount of money you’ll have when you’re ready to retire. The tallest blue bar shows that you could have a portfolio valued at $990,000 by age 65 if you started investing $550 per month with a 7% annual return at age 30. The next-tallest blue bar shows that the same portfolio with the same monthly investment amount and annual rate of return would be valued at $670,000 by age 65 if you started investing at age 35. The next-tallest blue bar shows that the same portfolio with the same monthly investment amount and annual rate of return would be valued at $445,000 by age 65 if you started investing at age 40. The last and smallest blue bar shows that the same portfolio with the same monthly investment amount and annual rate of return would be valued at $285,000 by age 65 if you started investing at age 45. This example doesn’t include taxes, fees and commissions, which would reduce the return. Figures are rounded to the nearest $5,000. Example is for illustration purposes only and does not reflect the performance of any specific investment.

This bar chart shows that waiting a few years to start saving can significantly decrease the amount of money you’ll have when you’re ready to retire. The tallest blue bar shows that you could have a portfolio valued at $990,000 by age 65 if you started investing $550 per month with a 7% annual return at age 30. The next-tallest blue bar shows that the same portfolio with the same monthly investment amount and annual rate of return would be valued at $670,000 by age 65 if you started investing at age 35. The next-tallest blue bar shows that the same portfolio with the same monthly investment amount and annual rate of return would be valued at $445,000 by age 65 if you started investing at age 40. The last and smallest blue bar shows that the same portfolio with the same monthly investment amount and annual rate of return would be valued at $285,000 by age 65 if you started investing at age 45. This example doesn’t include taxes, fees and commissions, which would reduce the return. Figures are rounded to the nearest $5,000. Example is for illustration purposes only and does not reflect the performance of any specific investment.

Remain financially stable

A long-term, low-risk investment strategy offers more financial stability than a more aggressive short-term one, as bouts of market volatility over time are less likely to derail your plans. Long-term savings rely on time in the market, not timing the market (PDF).

Plus, putting money aside consistently means that you’ll be better equipped to handle sudden financial setbacks, such as losing your job.

Ease your financial burden

A long-term savings strategy lets you save small sums of money at regular intervals to achieve your retirement savings goals instead of forking over large sums in a short period. Doing the latter can strain your finances tremendously and cause you to put other life goals or events on pause.

Get tax breaks

Whether you use a 401(k), a traditional IRA, a Roth 401(k), or a Roth IRA, you’ll enjoy tax benefits when saving with these retirement accounts. The money you put toward a 401(k) or traditional IRA is tax-deferred, meaning you won’t be taxed until you withdraw funds at retirement age, lowering your current income taxes.

A Roth 401(k) and Roth IRA are a bit different, as these accounts don’t offer the same upfront tax break. However, a Roth account has its own kind of benefit: Although you do pay taxes on Roth contributions right now, withdrawals are generally tax-free, meaning the tax benefits come at retirement age when you take that money out of your account. The earlier you save, the longer you can take advantage of the tax benefits of these retirement accounts. Note that you must hold at least 5 years and be age 59.5 or older to avoid taxes.

Edward Jones, its employees and financial advisors cannot provide tax or legal advice. You should consult your attorney or qualified tax advisor regarding your situation.