How secure is Social Security?

With concerns over the size of the U.S. debt and budget deficit, coupled with the influx of retiring baby boomers, many are asking if Social Security will remain a dependable source of income. While tough decisions may need to be made for the program, we believe the answer is yes.

The Social Security dilemma

About 67 million people receive some form of Social Security, including approximately 53 million retirees and their family members. This number will likely reach 76 million as baby boomers retire.1

If no changes are made to the program by 2033, Social Security may need to reduce benefits to about 79 cents for each dollar of projected benefits, according to the 2024 Board of Trustees Report issued by the Social Security and Medicare trust funds. This reduction would affect generations of retirees.

Social Security benefits will continue to be paid. But changes are needed to potentially avoid future cuts and keep the program on solid financial footing.

Fixing Social Security

Congress, the Congressional Budget Office (CBO) and the Social Security Board of Trustees have floated proposals that are straightforward but involve decisions that aren’t easy to make.

Key adjustments could include:

- Raising the earliest eligibility age (EEA) from 62

- Raising the full retirement age (FRA) from 67

- Revising how the cost-of-living adjustment (COLA) is calculated2

- Increasing payroll tax rates used to fund Social Security

- Removing the earnings ceiling for payroll taxes

This list is not exhaustive, and the above options could be used together. The key is that Social Security can be fixed. The question is what will be recommended and how soon Congress will act to improve the program’s long-term outlook.

Focus on what you can control

While you can’t control what, if anything, will change with Social Security, here are four tips for helping take control of your retirement.

1. Don’t panic.

It’s worth noting, we’ve been here before.

The last major reforms to Social Security occurred in the early 1980s, largely to help address the program’s shaky footing at that time. Changes included increasing the full retirement age and adjusting payroll taxes.

While we don’t know which reforms are on the horizon, we believe Congress will act to shore up the program’s finances. After all, millions of Americans rely on Social Security to help make ends meet.

2. Consider delaying Social Security to increase your payment.

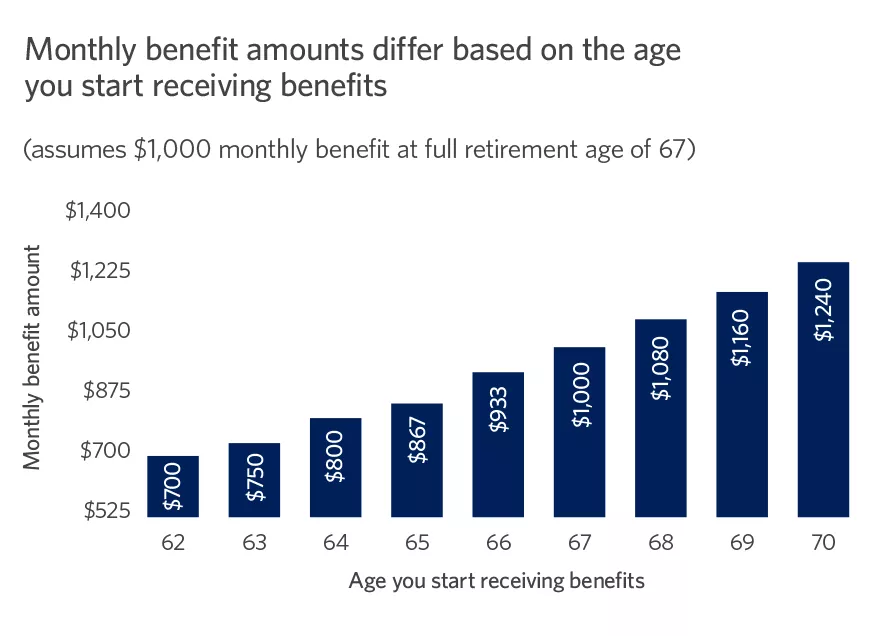

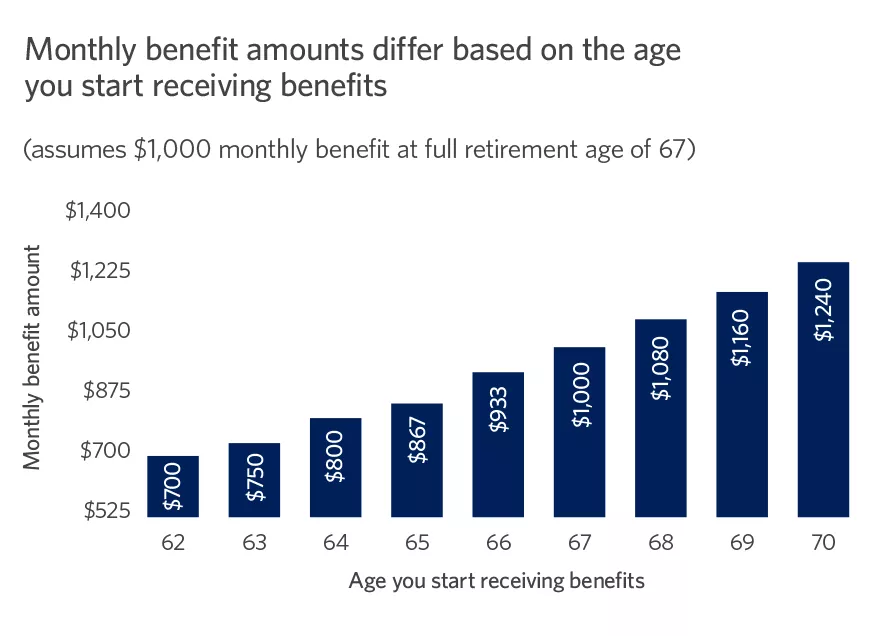

Nearly 65% of all retired workers receive reduced benefits because they started taking Social Security before their full retirement age (FRA).3 While many likely took benefits early because they needed the income, some may have had concerns about the program’s future.

This chart illustrates how taking Social Security before your FRA can permanently reduce your monthly benefit. And your selections don’t just affect you; they can permanently affect the benefit received by your surviving spouse. Be sure you understand the long-term effects of your decision before you begin taking Social Security.

Source: Social Security Administration.

Example does not include any potential cost-of-living adjustments (COLAs).

3. Consider outside savings.

You shouldn’t rely solely on Social Security for your retirement security. Social Security on average is likely to make up only about 30% of your income in retirement.4

The rest of your income will need to come from outside sources, such as your investments. And any proposed changes to the program could increase the amount you need to save to provide for your retirement.

4. Develop a backup plan.

If you’re concerned about Social Security being cut, consider identifying expenses you could reduce or eliminate in a worst-case scenario. We don’t believe such a plan is necessary, but it may help you worry less knowing you’ve done your homework on it.

3 actions you can take today

- Evaluate all your options and their effects on your income before deciding to take Social Security. This would include potential benefit reductions for you and your spouse as well as possible benefit reductions in other programs such as Medicare, which doesn’t begin until you turn 65.

- Work with your financial advisor to incorporate different scenarios into your investment strategy, including possible benefit reductions and changes to the age you can receive benefits — particularly if you don’t plan to retire for a long time.

- Review your investment and savings strategy to help achieve the lifestyle you desire in retirement.

How Edward Jones can help

While challenges exist, we believe Social Security can remain a dependable source of income in retirement. But you still share a major responsibility in securing a retirement that aligns with your goals. Your financial advisor can review your retirement strategy and help ensure it remains on solid ground.

Important information:

1 Board of Trustees Report, Social Security and Medicare trust funds (2024).

2 COLA adjustments are based on the CPI-W, a measure of inflation that tracks the price changes of a broad basket of goods and services covering all wage earners and clerical workers. One proposal is to switch to the Chained CPI-W, or C-CPI-W, which is a separate measure of inflation that allows for a redistribution of goods and services in the basket by assuming that consumers tend to decrease the amount of purchases for goods and services that have the highest increase in prices.

3 Source: Social Security Administration.

4 Social Security estimates originally suggested that, on average, Social Security provides about 30% of income in retirement. But new government research suggests this share might be lower. Social Security is currently reviewing these figures. Source: Social Security Administration.