4 financial resolutions for the new year

Amy Theisen, CFP®, CPA

Senior Strategist, Estate and Legacy

Each year brings its share of changes: 2024 brought inflationary adjustments, geopolitical concerns, market movements and an election. In the past year, you also may have experienced personal changes, such as a new job, a move to a new state, or a new child or grandchild.

Amid all these changes, it’s important to focus on what you can control. A new year is a great time to check in on your financial strategy to confirm you’re on track to reach your goals.

Here are four financial resolutions to help you stay on the path to meet your goals.

1. Perform a financial checkup

Budget — Make sure your budget is in line with your expenses. Inflation has moderated for some items, but others remain elevated, so it’s important to evaluate your total expenses. If overall expenses have increased, look for opportunities to adjust your spending to help ensure you don’t jeopardize your long-term plans.

Emergency cash fund — While we may have expectations for what the new year will bring, we also know there will be surprises. Check to make sure your emergency fund is in line with your needs. We recommend having three to six months’ worth of total expenses in cash or cash equivalents set aside for emergencies.

Debt — Years of relatively higher interest rates may have impacted the interest rate on your debt. As rates moderate, you may want to explore opportunities to refinance debt. Also, consider making extra payments to pay down any high-interest debt you have.

Property/casualty and life insurance coverage — Increasing home prices and improvements to your property can cause you to become underinsured. If you can’t afford the coverage you need, look for ways to lower your premiums (e.g., bundling policies or comparison shopping) without compromising on coverage.

Life changes may mean you need to update your overall life insurance coverage. And if you have a large amount of assets, you may want to consider umbrella insurance.

2. Reassess your retirement accounts

RMDs for inherited IRAs — The IRS finalized rules in 2024 for distribution requirements from individual retirement accounts (IRAs) inherited from individuals who died in 2020 or later. If you inherited an IRA after 2019, you may have to begin taking annual required minimum distributions (RMDs) in 2025. Talk to your financial advisor and tax professional to understand how this may impact you.

Expanded access to 401(k) plans — Beginning in 2024, some part-time employees gained additional access to 401(k) plans. For 2025, coverage is further expanded. If you’re a part-time employee who is at least 21 years old and has at least 500 hours of service for two consecutive years, you generally must be allowed to contribute to your employer’s 401(k) plan.

If you think you may qualify, contact your employer to learn how to get started. Also, consider contributing at least enough to earn the full employer match if one is offered.

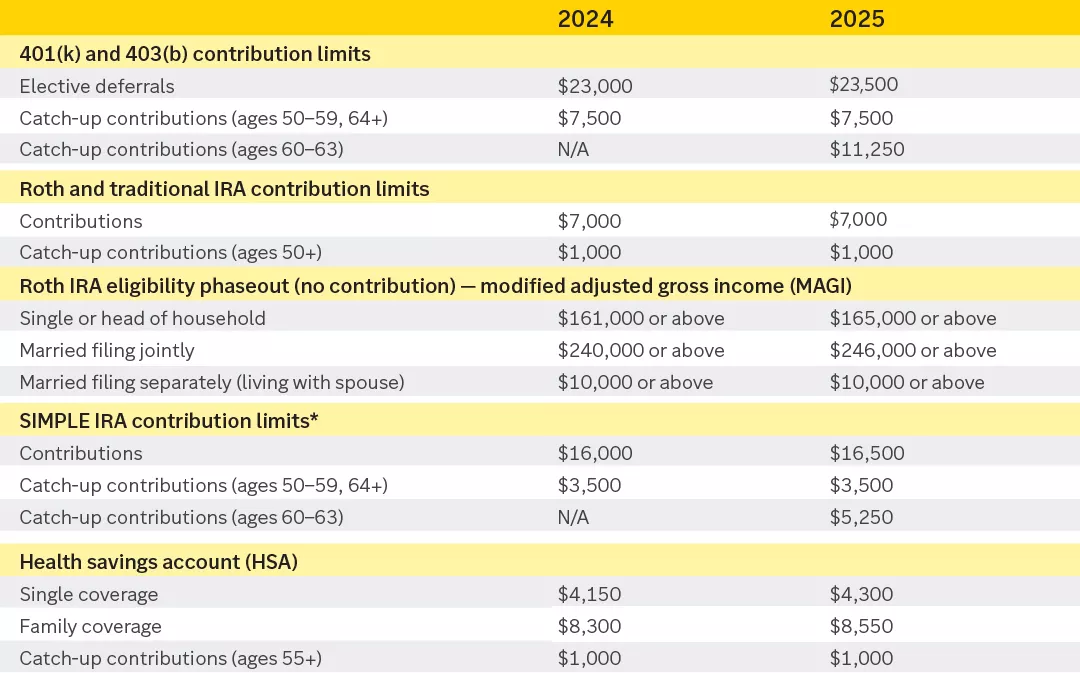

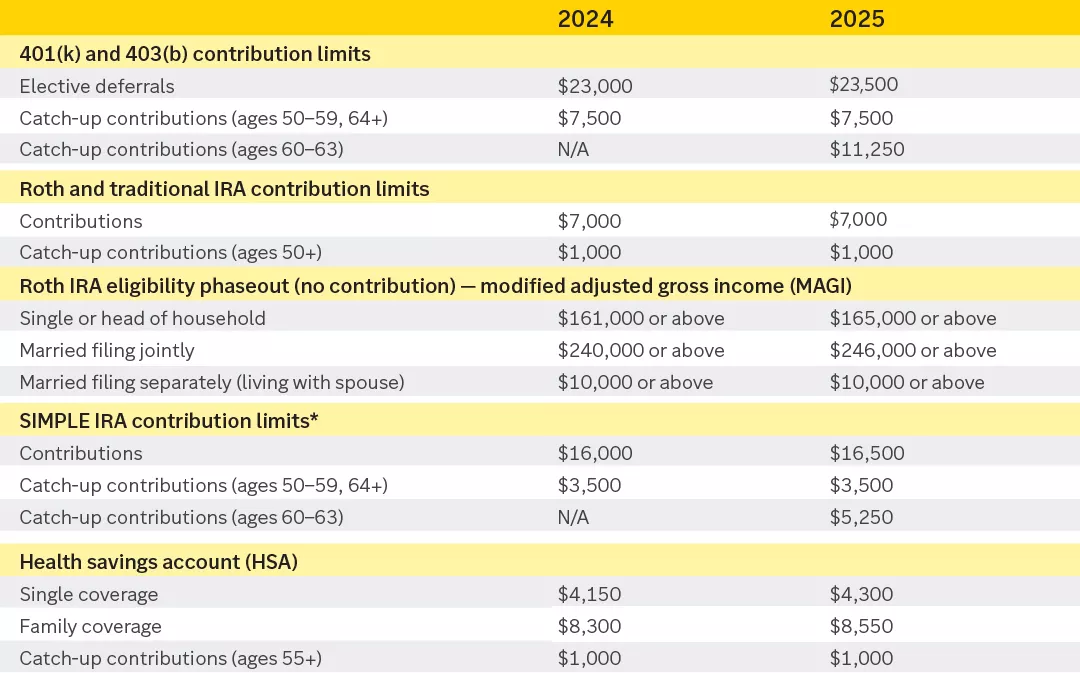

Higher contribution limits — As you review your financial situation and potential investment and savings opportunities, check your budget to determine whether you can take advantage of any increased limits:

- If your goal is to maximize your retirement contributions, be sure to adjust your contribution amounts to take advantage of this year’s higher limits. Additionally, if you’re aged 60 to 63, you may be able to make an even higher catch-up contribution to your employer plan this year as a result of SECURE 2.0.

- If you aren’t maxing out, consider increasing your contribution rate by at least 1% each year to progress toward the next savings milestone. Some plans even offer a feature that will automatically do this for you.

*Participants of eligible SIMPLE plans can contribute 110% of normal contribution limits, including catch-up contributions.

3. Review your investments

Cash and cash equivalents — As interest rates have declined, some short-term investments may not be as compelling at their new rates. It’s a good time to make sure you have enough, but not too much, in cash and cash equivalents.

But how much is too much? We recommend holding no more than 5% of your investment portfolio in cash for longer-term goals such as retirement.

Portfolio — Many areas of the market experienced significant gains in 2024. Review your portfolio with your financial advisor to determine whether your investments are still in line with your target asset allocation. This can help ensure you’re positioned to benefit from diversification and aligned with your risk and return objectives.

You may also want to discuss programs that provide automatic rebalancing to avoid allocations drifting from their targets.

4. Revisit your gifting and estate plan

Asset titling and beneficiary designations — Review how your assets are titled and how you’ve completed any beneficiary designations to ensure they’re up-to-date and aligned with your estate plan.

If you don’t have an estate plan in place, work with an attorney to draft and execute a plan that includes a will (or will and revocable trust), a health care power of attorney, a financial power of attorney and a medical directive.

Annual gifting — In 2025, the amount you can gift to any individual without using any of your lifetime exemption (the annual exclusion) increases to $19,000. If you and your spouse are eligible to gift-split, together you can gift up to $38,000 per recipient.

You can also make payments for tuition and medical expenses directly to providers on someone’s behalf without using your annual exclusion or lifetime exemption.

Qualified charitable distribution (QCD) — If you are interested in making charitable gifts and have an IRA, you might want to explore making gifts from your retirement account as a QCD. Individuals 70½ or older can exclude up to $108,000 of QCDs from taxable income in 2025. And if you’re at least 73, QCDs count toward your RMD for the year.

Lifetime estate and gift tax exemption — This exemption — the combined amount you can pass during your life and at death before paying any federal estate or gift tax — increases to $13.99 million in 2025.

If you plan to make a large lifetime gift, speak with your tax and legal advisors to determine whether you should use a portion of your lifetime exemption. The exemption is scheduled to be reduced by roughly half (to just under $7 million) at the end of 2025 if the Tax Cuts and Jobs Act (TCJA) is allowed to sunset.

Making these financial resolutions can help you start off your year on the right foot. You might not be able to address everything at one time, but working through them could help brighten your financial outlook for 2025 and beyond.

Important information:

Edward Jones, its employees and financial advisors cannot provide tax or legal advice. You should consult your attorney or qualified tax advisor regarding your situation.