Charitable stacking: A long-term strategy with tax benefits

Although your main reason for charitable giving may be to support a specific cause or organization, there are critical tax strategies to consider. If you’re looking to enhance your tax benefits, a "stacking" or “bunching” approach can provide benefits as part of a long-term strategy.

Periodic giving vs. stacking gifts

Periodic giving

The most common way to give to charity is through periodic, outright gifts during an individual’s life. This includes giving cash, appreciated securities or physical property — such as real estate — directly to a charity. It may not be the most tax-efficient way to give, however, as you might not itemize your tax deductions and it doesn't present you with any control over the investment of your gift. Alternative giving solutions, such as stacking gifts and/or use of a donor-advised fund (DAF), may be worth considering.

Stacking gifts

If you have a multiyear giving plan but don’t expect to be over the standard deduction amount ($29,200 in 2024 for married filing jointly, $14,600 for single filers), you could consider “stacking” several years’ worth of giving into a single year. By doing this, you may be able to realize greater tax savings by itemizing this year and then taking the standard deduction in subsequent years as needed.

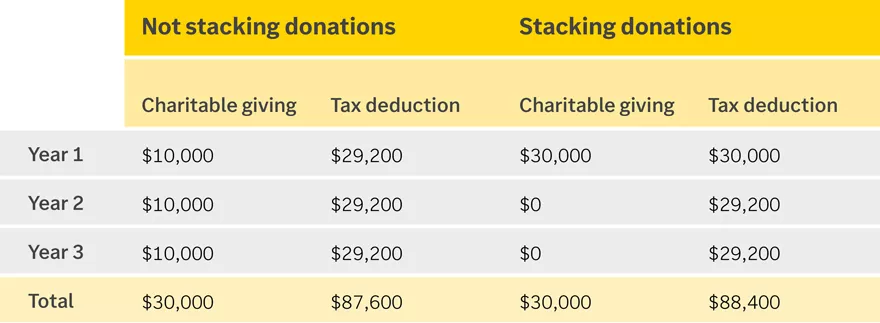

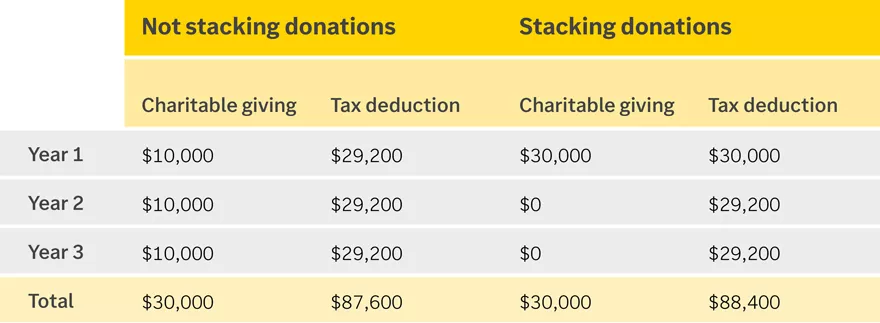

For example, someone who plans to give $10,000 in each of the next three years may not realize the benefits of itemizing. However, by stacking these gifts into a single year, they will be over the threshold to itemize deductions in that year and can still take the standard deduction in the next two years.

This table shows the difference between stacking your charitable donations into a single year versus not stacking the same donations in each of three years. Stacking enables the giver to be over the threshold to itemize deductions and can therefore realize greater tax savings.

This table shows the difference between stacking your charitable donations into a single year versus not stacking the same donations in each of three years. Stacking enables the giver to be over the threshold to itemize deductions and can therefore realize greater tax savings.

Assumes married filing jointly, the standard deduction is claimed if total itemized deductions are less than the standard deduction amount, and the 2024 standard deduction amount is held constant for the three-year period.

This strategy could be especially useful in years when your income may be higher than expected (e.g., if you sold a business, executed a Roth conversion or are approaching retirement). Typically, in high-income years, your marginal tax rate is also higher, so the benefits from charitable giving in those years would be greater than in subsequent, lower-income years. In these higher-earning years, you may also have an opportunity to increase your tax benefits and impact on charitable organizations.

What are donor-advised funds?

A DAF is a charitable giving tool that allows you to make an irrevocable contribution to the fund and gain an immediate tax deduction.

Under a DAF, you can:

- Make a tax-deductible gift to the DAF and subsequently make grants from the account to an IRS-approved charity.

- Have the DAF account invested based on your preferences, giving it the potential to grow tax free and expand your charitable impact.

- Choose which charities to support, when to support them and how much to give.

One example of a DAF is the Edward Jones Charitable Gift Fund, which has a minimum initial contribution of $10,000 when donating cash and marketable securities. When donating unique assets or tangible personal property for this fund, the value of the asset(s) must be at least $500,000.

Who should consider a DAF?

A DAF can be a powerful tool for maximizing your charitable impact in certain situations. This includes the following scenarios:

- You want your charitable giving to be tax-deductible, but you don’t give enough each year to itemize your deductions.

- You own investments or other assets that have significantly increased in value.

- You have experienced an unusually high-income year.

How a DAF can support your stacking strategy

A DAF allows you to make an immediate tax-deductible transfer of your stacked gift while allowing you time to decide where and when to direct those gifts in the future. You may be able to realize greater tax benefits while still meeting your annual giving goals.

With a DAF, your contributions will be invested, providing an opportunity for your charitable gifts to grow over time, tax free. This growth is not taxable to you, the DAF or the charity that receives the grant. When determining the investment allocation in your DAF, consider the appropriate amount of investment risk for the DAF and how long you expect to make distributions or grants from it.

How Edward Jones can help

Giving back looks different for everyone. At Edward Jones, we’re here to help you find the appropriate charitable path for your financial strategy — no matter where you are in life. Your financial advisor can help create a strategy for your unique needs that may also help provide a tax benefit.

Important information:

Edward Jones, its employees and financial advisors are not tax professionals and cannot provide tax advice. Before making any decisions affecting your tax situation, always consult your tax professional for guidance on the most appropriate actions to take.