When should you take Social Security?

One of the biggest retirement-related decisions you’ll make is when to start collecting Social Security. This isn’t a choice to take lightly — Social Security is one of the most valuable retirement assets you have.

- Your Social Security benefit can provide a significant foundation for your retirement income. Social Security benefits replace about 40% of pre-retirement income for a median earner when claimed at full retirement age, according to the Social Security Administration (SSA). Additionally, since benefits are unaffected by market movements, they can provide a guaranteed source of income in retirement to help you meet your basic needs.

- Social Security benefits also address two key retirement risks — inflation and living longer than you expect. That’s because Social Security is a lifetime benefit that typically adjusts for inflation each year.

- And, since your spouse may be able to receive survivor benefits, it can also provide for them should they outlive you.

In fact, using the estimated 2024 average individual benefit of $1,907 per month, finding a similar benefit paying the same amount for as long as you live — with inflation adjustments and survivor benefits for your spouse — would cost about $500,000.*

So, before you claim, it's important to understand your options and how your choices may affect your and your spouse’s retirement.

Social Security basics

- Your Social Security retirement benefit is based on your highest 35 years of earnings, adjusted for inflation, as well as the age you begin taking Social Security.

- You can claim benefits as early as age 62 and as late as age 70. However, your benefits are reduced by up to 30% if you claim before your full retirement age (FRA) but can increase by up to 24% above your full-retirement benefit if you delay past your FRA (assuming FRA of 67).

- Your yearly statement from the Social Security Administration can provide you with an estimate of what your retirement benefit is, based on your FRA and work history. You can also find your statement and estimate your benefits online.

Monthly benefit amounts differ based on age you start receiving benefits

This chart shows how your monthly Social Security benefit differs based on the age you start receiving your benefits. Assuming a $1,000 monthly benefit at full retirement age of 67, you would receive $700 a month if you started receiving benefits at 62. But the benefit can increase incrementally to $1,240 a month – or a 24% increase – if you wait until age 70.

This chart shows how your monthly Social Security benefit differs based on the age you start receiving your benefits. Assuming a $1,000 monthly benefit at full retirement age of 67, you would receive $700 a month if you started receiving benefits at 62. But the benefit can increase incrementally to $1,240 a month – or a 24% increase – if you wait until age 70.

What to focus on when deciding to take Social Security

When deciding when to claim your Social Security, there are four key factors to consider: your income needs, your employment, your life expectancy and your spouse.

Your income needs

If you have limited means to meet your income needs and are unable to defer retirement or reduce expenses, you may need to take Social Security early. After all, that’s what Social Security is for – to provide a safety net when you need it most. However, if you have flexibility over your retirement plans, delaying your Social Security benefit can improve the likelihood your money lasts and provide a larger safety net for you later in life (when you may need it more).

Your employment

If you haven’t reached FRA and are still working (with meaningful earned income), you should generally wait to take Social Security. If you take Social Security early and your earned income exceeds a certain amount, your Social Security benefits are temporarily lowered until you reach FRA. (Earned income doesn’t include income from investments, pensions or Social Security itself.) Even though your benefit will be adjusted at FRA if you have benefits withheld, depending on your life expectancy, you may not recover the full amount. Additionally, taking Social Security benefits while working could result in higher taxes on your benefit and add complexity to your income planning.

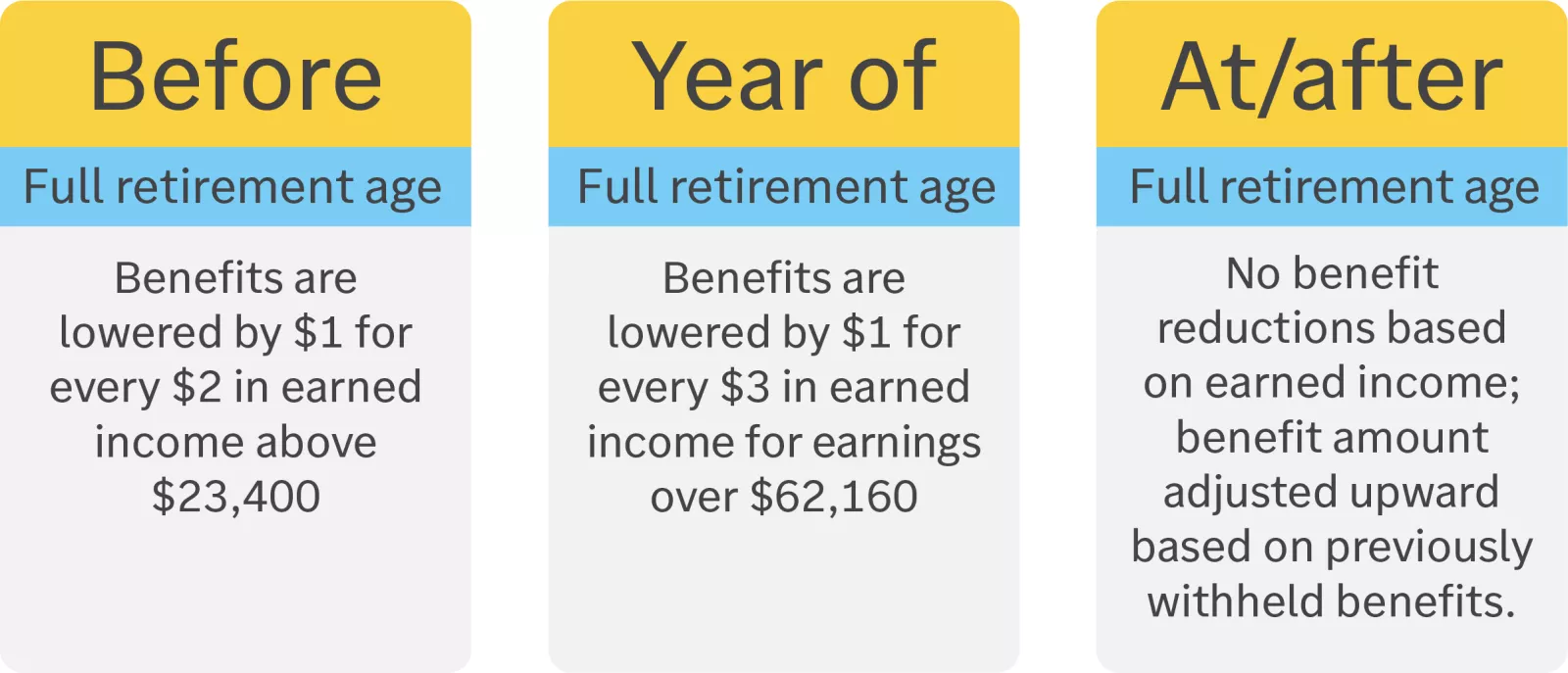

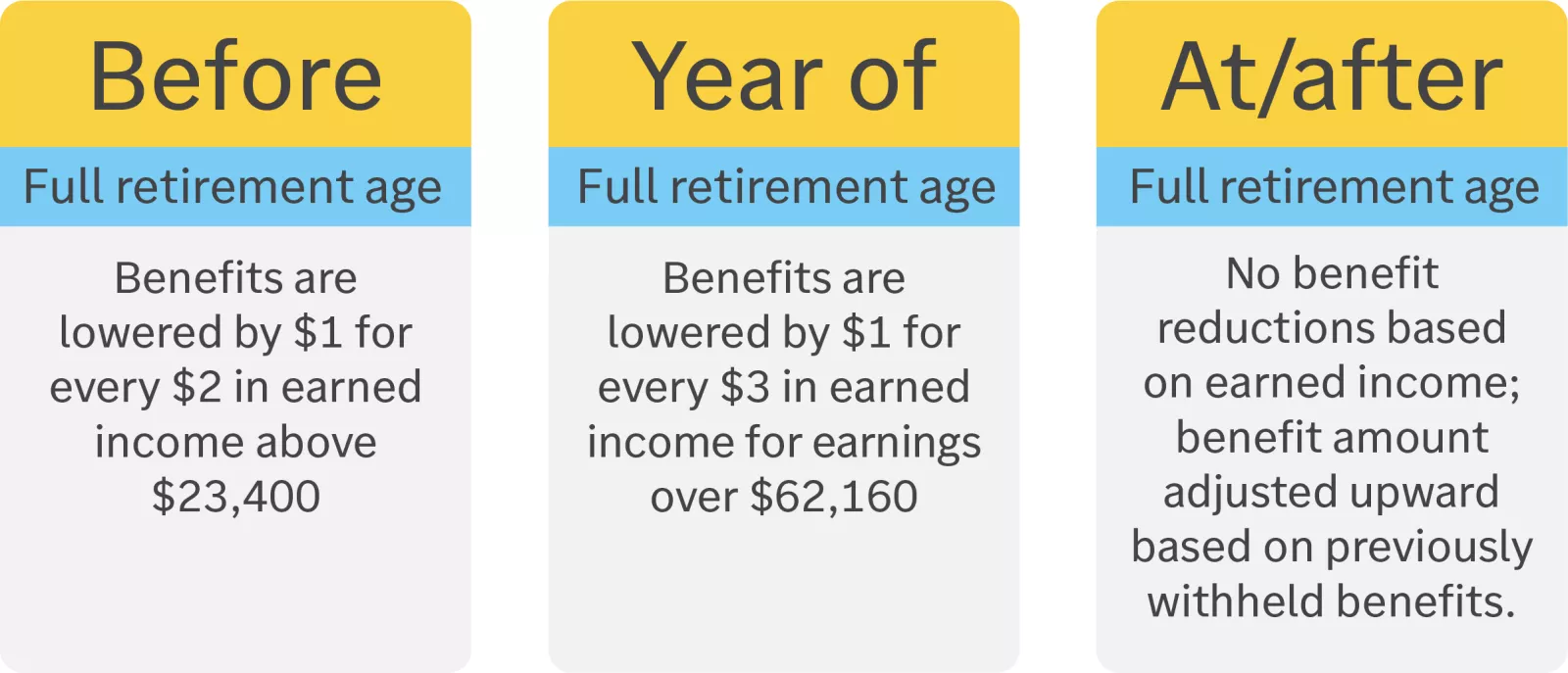

Earnings limitations (for 2025)

Before your full retirement age, your benefits are lowered by $1 for every $2 in earned income above $23,400. In the year of full retirement age, your benefits are lowered by $1 for every $3 in earned income for earnings over $62,160. At and/or after full retirement age, there's no earning limit but your benefits can still be taxed.

Before your full retirement age, your benefits are lowered by $1 for every $2 in earned income above $23,400. In the year of full retirement age, your benefits are lowered by $1 for every $3 in earned income for earnings over $62,160. At and/or after full retirement age, there's no earning limit but your benefits can still be taxed.

Your life expectancy

The better your health and the longer you expect to live, the more it may make sense to take Social Security later. Your Social Security benefit acts as longevity insurance — it ensures you’ll receive a minimum income amount (with cost-of-living-adjustments) no matter how long you live. The longer you live, the greater your lifetime benefit and the greater the likelihood you break even on your decision to defer.

Your spouse

There are two potential benefits for spouses: a spousal benefit (paid while both spouses are living) and a survivor benefit (paid after one spouse passes). The greater the difference in earnings history between you and your spouse, the more relevant these two benefits become to your and your spouse’s claiming decisions. Other important considerations for married couples are differences in age and life expectancy.

Taxes and your benefits

Taxes shouldn’t be a key driver of when you decide to take Social Security. However, it’s important to understand how your benefits could be taxed when determining your after-tax income in retirement:

- If your provisional income is $25,000 to $34,000 if single or $32,000 to $44,000 if married, up to 50% of your Social Security benefits will be taxed at your income tax rate.

- If your provisional income is above $34,000 if single or above $44,000 if married, up to 85% of your benefits will be taxed at your income tax rate.

Learn more about Social Security taxes.

Social Security and your retirement

With all this in mind, it's important to remember that Social Security was never intended to cover everything. That's why it's so important to work with your Edward Jones financial advisor to position your investments to help provide for your income needs throughout retirement.

Before making any decisions, be sure to check with the Social Security Administration and consult with your qualified tax advisor.

Important information:

*Edward Jones estimates based on CANNEX Immediate Annuity Quote System – 4/25/2024. Example assumes a joint life annuity, 67-year-old male and female, 3% inflation rate and the 2024 average benefit level from the Social Security Administration.

It's important to work with the Social Security Administration for a full discussion of your benefits and options as these strategies can be complex. Investors should rely on information from the Social Security Administration before deciding when to take Social Security benefits. Final decisions about Social Security filing strategies rest with you and should be based on your specific needs and health considerations For more information, visit the Social Security Administration at ssa.gov.

Edward Jones, its employees and financial advisors cannot provide tax or legal advice. You should consult your attorney or qualified tax advisor regarding your situation.